Key Takeaways

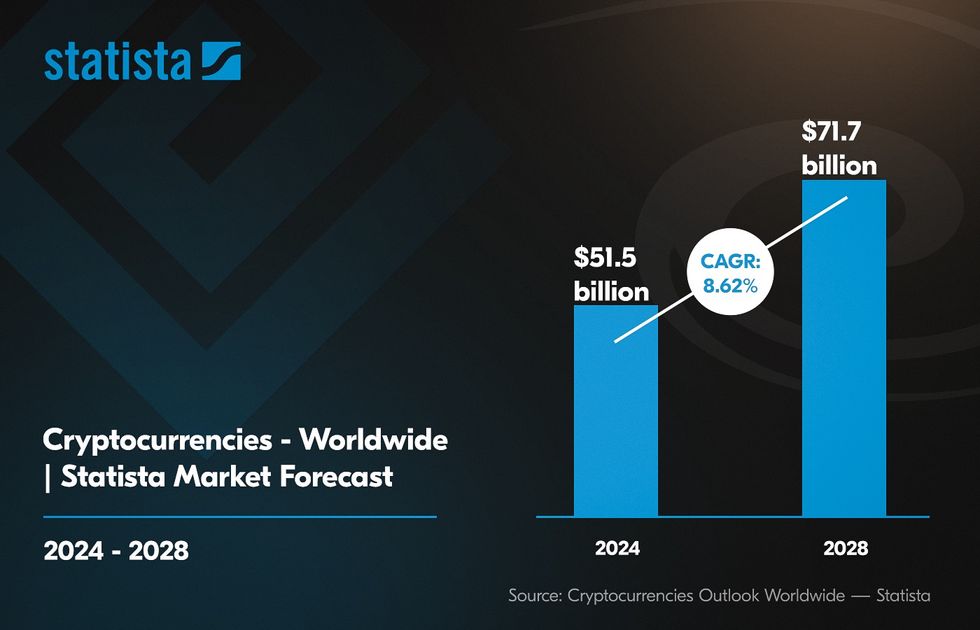

- Cryptocurrency operations have become vital tools for successful financial management, with global market revenue expected to reach $51.5B by 2024.

- Financial service providers explore crypto exchange development to leverage the increasing demand for digital asset trading platforms.

- Building your own exchange offers a competitive advantage, extends market outreach, and unlocks fresh revenue avenues.

Cryptocurrency operations have long been on everyone’s lips and become integral instruments for investors to manage financial operations successfully. With over 9600+ active coins in trade, the global cryptocurrency market’s revenue is projected to hit $51.5B in 2024.

The more people sell and buy crypto assets, the more intuitive and secure cryptocurrency exchange software solutions must be. For the past three years, Acropolium teams have been crafting unique fintech software to reimagine and digitize our clients’ financial operations.

Having several success stories of crypto and SaaS solutions, we will guide you through the essentials of building a custom platform. Read on to learn how to invest in functionality that pleases your users and grows your revenue.

What is Cryptocurrency Exchange Software?

Cryptocurrency exchange software enables users to buy, sell, and trade cryptocurrencies on a digital platform. It provides users with a marketplace where they can exchange digital assets like Bitcoin, Ethereum, or Litecoin, using other cryptocurrencies as a medium of exchange.

These platforms offer features like order matching, trading charts, wallet integration, and security measures to ensure secure and smooth trading experiences. They imply peer-to-peer transactions without the need for intermediaries like banking systems.

Since cryptocurrency transactions are decentralized and digital, they require unique accounting practices to comply with tax regulations. While there are many ready-to-use platforms to choose from, they differ in terms of features, ease of use, and overall integration opportunities.

When the functionality of off-the-shelf platforms is insufficient, financial businesses turn to custom development with a cryptocurrency exchange development company.

How Does It Work?

Using cryptocurrency exchange software, users register and deposit funds via various methods, place orders, and match, buy, and sell crypto orders. Executed trades, in turn, transfer cryptocurrencies between accounts.

The platform charges fees depending on trading volumes. Users can withdraw funds while built-in security measures protect assets and data.

Why Businesses Invest in Cryptocurrency Exchange Development

Modern financial service vendors consider cryptocurrency exchange development to benefit by satisfying the increasing demand for digital asset trading platforms. By creating your own exchange, you can sharpen your competitiveness, expand your market reach, and tap into new revenue streams.

The cryptocurrencies market is forecasted to reach US$51.5 billion by 2024. With an expected annual growth rate (CAGR 2024-2028) of 8.62%, leading to a projected total of US$71.7 billion by 2028.

The rise of businesses accepting cryptocurrency as payment and major corporations like Tesla and MasterCard adopting digital currency payment processing fuels industry growth. MasterCard’s move in November 2021, allowing its partners to facilitate digital currency transactions, exemplifies this trend.

Types of Cryptocurrency Exchanges

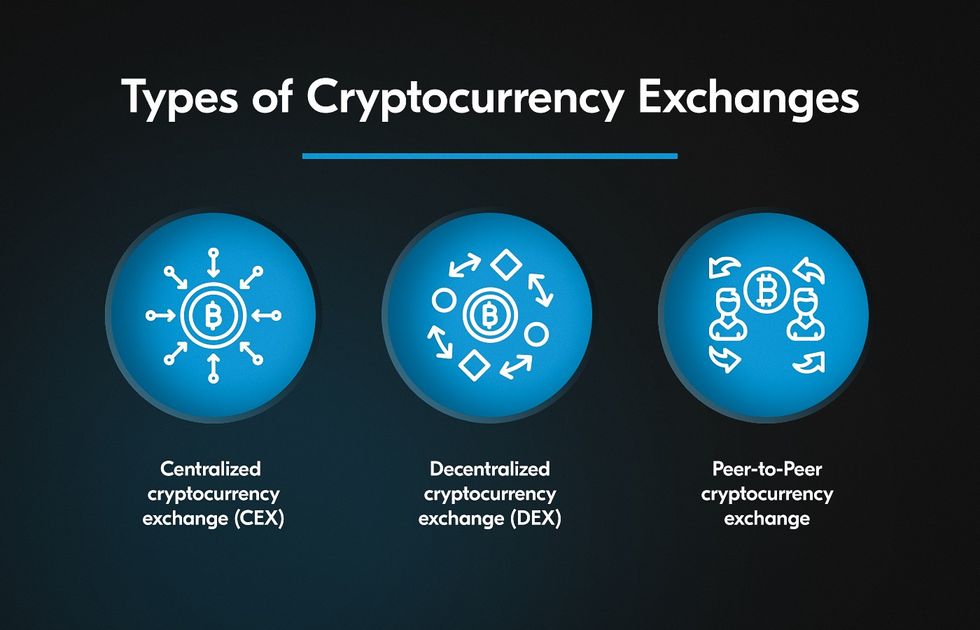

There are various types of cryptocurrency exchanges, each with its own characteristics and functionalities. Understanding the differences between centralized exchanges (CEX), decentralized exchanges (DEX), and peer-to-peer exchanges is essential for cryptocurrency traders and investors to choose the most suitable platform.

When initiating cryptocurrency exchange software development, keep in mind this brief comparison:

- CEXs offer high liquidity and advanced features, but it implies that users give complete trust with their funds to the platform.

- DEXs provide greater security and privacy by eliminating the need for intermediaries but may have lower liquidity and fewer trading options.

- Peer-to-peer exchanges offer flexibility and anonymity but may involve higher counterparty risk and lower liquidity compared to CEXs and DEXs.

Now, let’s take a closer look at each exchange type.

Centralized Crypto Exchange (CEX)

CEX is a digital, cloud-based platform operated by a central authority, which:

- Offers high liquidity, a wide range of trading pairs, and advanced trading features.

- Requires users to create accounts and undergo KYC/AML verification.

- Custodial in nature, meaning users deposit funds into the exchange’s wallets.

- It may be vulnerable to hacking or regulatory scrutiny due to centralization.

- Immune to censorship and regulatory intervention due to decentralization.

Decentralized Crypto Exchange (DEX)

Unlike the previous exchange type, (DEX) operates without a central authority or intermediary and:

- Facilitates peer-to-peer trading directly from users’ wallets.

- Provides greater privacy and security since users retain control of their funds.

- Typically offers lower liquidity and fewer trading pairs compared to CEXs.

- Immune to censorship and regulatory intervention due to decentralization.

Peer-to-peer Exchanges

In peer-to-peer exchanges, users can post buy or sell offers, and other users can choose to accept them without the need for an intermediary:

- Peer-to-peer-based cryptocurrency exchange software allows for various payment methods and flexible trading terms.

- Often facilitates trades through escrow services to mitigate counterparty risk.

- It may offer lower liquidity and fewer trading options than CEXs and DEXs.

- Provides greater anonymity and privacy since transactions occur directly between users.

Key Features of a Crypto Exchange Platform

When planning your crypto SaaS product, you start with the vision of the functionality your target user desires. While you can expand traditional usability patterns, experiment with web architecture and diversify the service scope, there are irreplaceable features every crypto product has to offer:

- Cryptocurrency exchange software development can’t do without two-factor authentication (2FA) and biometric authentication. This is crucial to protect user accounts from unauthorized access.

- Implementing robust security measures such as encryption, DDoS protection, cold storage for funds, automatic logouts, and regular security audits is imperative to safeguard user funds and data.

- Focus on compliance features such as Know Your Customer (KYC) verification, Anti-Money Laundering (AML) checks, and regulatory compliance tools to adhere to legal requirements and enhance user trust.

- To facilitate smooth operation and administration, a comprehensive admin dashboard with tools for managing users, transactions, trading pairs, and fees is a must.

- Enable a robust order-matching engine to efficiently match buy and sell orders in real-time, ensuring smooth trading operations.

- Your platform should support multiple cryptocurrency wallets and have a secure QR code generator, which lets users deposit, withdraw, and store their digital assets securely.

- Cryptocurrency exchange software should have an intuitive and user-friendly trading interface with advanced charting tools, order types, and trading pairs.

- Liquidity management tools on the platform will ensure sufficient liquidity across various trading pairs, minimizing slippage and providing better trading opportunities.

- Customer support with live chats and phone support is another worthy feature that will evoke trust and loyalty in your customers.

- API integration features will allow third-party developers to build trading bots, algorithmic trading strategies, and other applications on top of the exchange platform.

Estimated Cost to Build a Crypto Exchange Platform

The cryptocurrency exchange development cost can vary significantly depending on various factors. This includes the scope of features, complexity of functionality, development approach, technology stack, and geographic location of the dedicated team if you outsource.

Note that the more complex you want your app to be, the more developers and time it will take for it to reach the market.

A primary cryptocurrency exchange platform may cost tens and hundreds of thousands of dollars to develop, while more complex, scalable, and feature-rich platforms can cost over a million dollars.

To get more accurate estimates, it’s essential to evaluate your project requirements and consult with experienced vendors specializing in cryptocurrency exchange development services. Since crypto exchange development has quite a plethora of moving parts, you can get a general picture of platform development and estimate expenses:

| Platform Complexity | Average Cost | Approximate Timeframe |

|---|---|---|

| Basic | $50,000 — $100,000 | 3–6 months |

| Medium | $125,000 — $225,000 | 7–9 months |

| High | $250,000 + | 10+ months |

Why Choose Acropolium?

Acropolium is your trusted partner for cryptocurrency exchange software development. With our extensive expertise in the fintech industry, we craft cutting-edge solutions to address your unique needs.

We specialize in developing GDPR-compliant software, ensuring the highest standards of data protection. Our ISO-certified processes guarantee reliability and adherence to industry best practices throughout the development lifecycle.

As our valuable clients continue to trust us with financial software development outsourcing, we have amazing success cases in our portfolio.

Cryptocurrency Trading Platform

Acropolium was asked to create a MVP that would assist the client’s in-house developers in trading platform development. Our task was to optimize the product’s architecture and set up documentation to pass to the client’s developers.

Solution

- Our progress on this cryptocurrency trading platform development proceeded smoothly, as it was built from the ground up.

- We introduced numerous new features and chose appropriate backend frameworks for architecture and infrastructure optimization, embracing the Scrum methodology.

- Alongside development, we conducted a comprehensive audit, proposed architectural enhancements, and established project documentation.

Results

- The MVP was developed within a six-month timeframe, resulting in a 53% increase in client flow and a 30%reduction in time to market.

SaaS-based Cryptocurrency App Development

Another client of ours required a user-friendly SaaS crypto platform for beginners featuring a crypto robo-advisor to simplify digital investments. They aimed for a SaaS product that would facilitate platform exploration. The product also had to contain a risk assessment questionnaire, suggesting diversified trading strategies for established cryptocurrencies based on moderate risk tolerance.

Solution

- During cryptocurrency trading software development, our dedicated team provided various scalable scenarios to swiftly resolve technical issues, minimizing downtimes.

- Acropolium integrated diversification as the main feature, allowing users to distribute their investments across various trading strategies to reduce exposure to individual assets.

- Additionally, for informed decision-making, our developers provided comprehensive performance metrics for each trading strategy and portfolio, including historical returns, risk assessments, and other pertinent data.

Results

- User registrations surged 250%, while trading volumes increased by 119% as users actively managed their portfolios, driving revenue through transaction fees.

- The platform is nurturing a vibrant community of traders and investors.

Final Thoughts

With abundant cryptocurrencies and a global market continuously rising, the demand for robust and innovative exchange platforms has never been greater. That’s why you’d want to build a crypto trading platform tailored to your vision.

Standing at the forefront of this dynamic field, Acropolium combines expertise, innovation, and dedication to craft advanced solutions that redefine how users engage with digital assets.

Our commitment to excellence and security ensures that every platform we develop is intuitive, user-friendly, and equipped to meet the evolving market needs. From financial tools integrations to fintech legacy system modernization and platform development from scratch, we are here to give life to your perfect product.

Contact us today — we offer flexible, subscription-based cooperation where your goals get realized with your budget in mind

![8 Risks of Software Development Outsourcing [Their Solutions]](/img/articles/software-development-outsourcing-risks/img01.jpg)

![In-House vs Outsourcing [What to Choose in 2024]](/img/articles/in-house-vs-outsourcing-software-development-what-to-choose/img01.jpg)

![Outsourcing vs. Outstaffing Comparison [Which to Choose in 2024?]](/img/articles/outsourcing-vs-outstaffing/img01.jpg)