Key Takeaways

- Blockchain in finance cuts costs by eliminating intermediaries and automating financial processes.

- $100B+ in revenue is currently generated by 5,000+ payments-focused fintechs, projected to reach $520B by 2030.

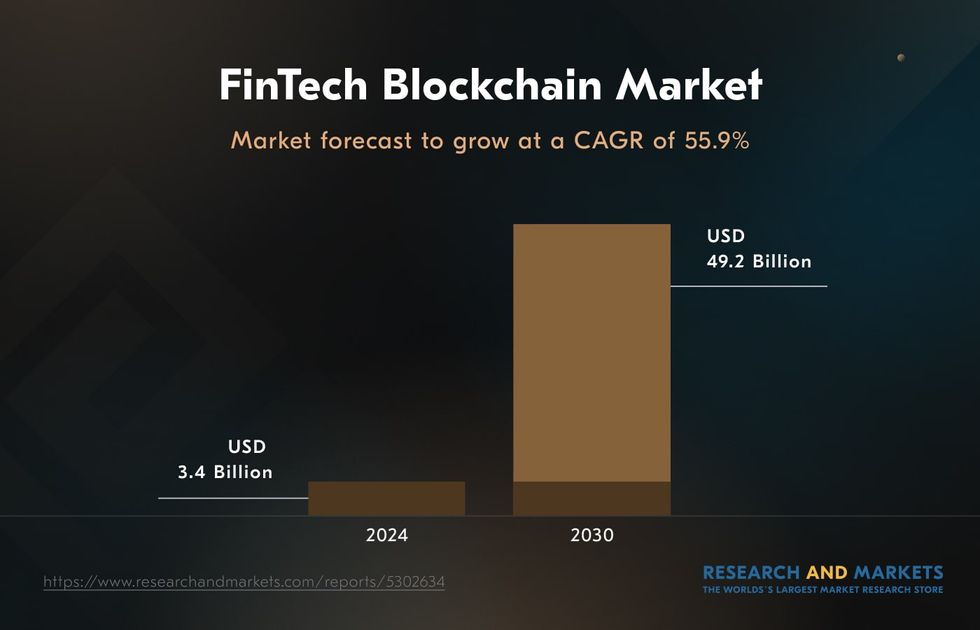

- The global fintech blockchain market is forecasted to grow from $3.4B in 2024 to $49.2B by 2030.

- Acropolium’s blockchain-powered SaaS crypto platform led to a 22% client growth and 15% revenue increase within 6 months.

The growing use of blockchain in fintech is redefining the foundations of the financial sector by introducing alternative systems rather than simply improving existing ones. It opens up new opportunities for people previously excluded from traditional banking, offering faster, more affordable, and more secure financial services.

By eliminating intermediaries, strengthening data protection, and increasing transparency, blockchain lowers the barriers to entry and creates a more inclusive financial environment. What was once dismissed by many industry players is now being actively explored and integrated.

Today, fintech companies are competing to build blockchain-based platforms capable of handling diverse financial needs across various use cases.

As a fintech software developer with robust experience in blockchain, Acropolium has collected actionable insights on how it can work for your finance operations. Let’s see what the technology has to offer with relevant applications and real success stories!

What is Blockchain in Finance?

Blockchain technology in fintech is a public ledger that tracks the origin, movement, and transfer of anything valuable. Instead of depending on a central authority like a bank, it uses agreements from multiple network nodes to approve transactions.

Smart contracts are a key application of blockchain in finance, allowing agreements to be automatically carried out when certain conditions are met. This removes the need for manual handling, reducing delays and mistakes.

The role of blockchain in fintech is getting more and more significant because it helps solve major issues like security risks in online payments and slow, inefficient data processes. In payment systems, it enables quick, low-cost transactions across borders.

In fact, over 5,000 payments-focused fintechs currently generate around $100 billion in revenue, which is projected to rise to $520 billion by 2030.

Thus, it has become one of the hottest financial tech trends, with the global fintech blockchain market expected to hit $49.2B in 2030 from $3.4B in 2024.

Benefits of Blockchain in Finance

Customary banks are unlikely to disappear anytime soon. They remain the most reliable option for fraud protection and secure storage of funds in stable currencies — areas where cryptocurrencies fall short due to volatility. Many users also continue to distrust digital assets.

However, blockchain financial technology offers banks a way to significantly reduce operational costs, enabling them to deliver more efficient and accessible services to a broader range of clients.

Enhanced Security

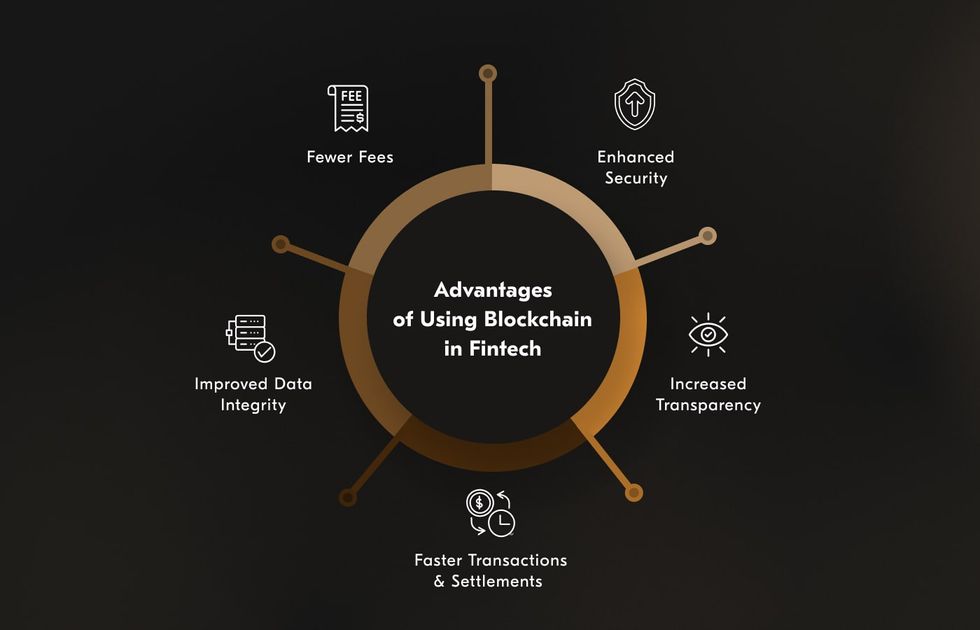

Blockchain uses advanced cryptographic methods to protect every transaction. This makes unauthorized access, data manipulation, or fraud extremely difficult. As a result, financial institutions can operate with a much higher level of security and confidence. Furthermore, 47% of companies report reducing the number of international payments they send due to issues with cross-border transactions, with 41% marking fraud as a top risk.

Increased Transparency

Blockchain in fintech ensures that every transaction is recorded in a way that can be viewed by all participants in the network. Once added, these records can’t be changed, which helps prevent disputes and builds trust. This level of openness makes it easier to track activity and confirm that financial data is accurate and complete, especially in accounting operations.

Faster Transactions & Reduced Settlement Time

Traditional banking systems often involve multiple checks and third parties, causing delays in processing payments, notably across borders. The adoption of blockchain in finance industry operations removes many of these steps, allowing transactions to be settled much faster. What once took days can now be completed in minutes or even seconds.

As for digital banking, wallets, and crypto exchange platforms they also can’t do without a secure and efficient ledger that automatically processes transactions while maintaining data integrity.

Lower Operational Costs & Fewer Fees

By cutting out intermediaries and automating processes with AI, blockchain for finance significantly reduces the costs of running operations. There are fewer processing fees and less administrative overhead, which can lead to more affordable services for both businesses and end users.

As a matter of fact, blockchain is set to play an important role in managing AI business applications by using smart contracts. It defines and enforces rules for automated actions, helping ensure transparency and accountability.

Improved Data Integrity and Access Control

All blockchain data is securely stored and resistant to tampering. This ensures that records remain accurate and trustworthy, even within AI-based systems that still have issues with data bias. At the same time, access can be restricted to approved users, helping organizations protect sensitive blockchain and finance data and maintain control over who sees what.

Use Cases of Blockchain in Finance

Blockchain technology is widely adopted across industries for a broad range of purposes, and its impact on fintech is quite powerful. From improving security and transparency to reducing expenses and delays, blockchain for finance operations helps companies rethink their workflows.

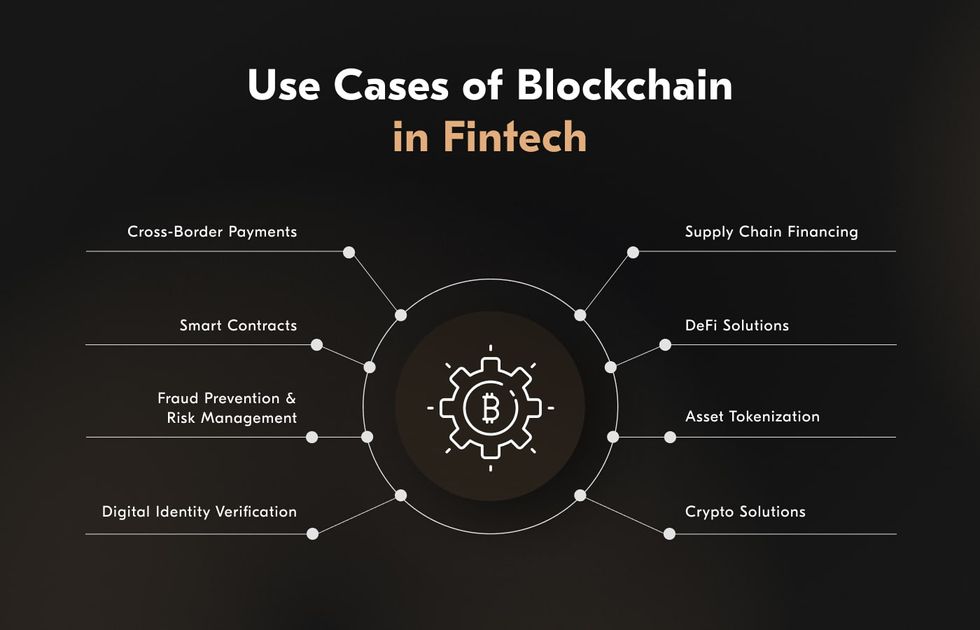

Cross-Border Payments and Remittances

Sending money internationally has long been expensive and slow. Blockchain in finance simplifies this by enabling direct, peer-to-peer transfers without banks acting as intermediaries. You can reduce fees, while the transfers that once took days now take minutes.

Fintech companies like Ripple have built blockchain-based payment networks that allow real-time settlements across currencies and borders. Additionally, stablecoins like USDC and PYUSD are being integrated into platforms such as Coinbase and PayPal, offering faster and more affordable cross-border transactions.

Smart Contracts in Lending and Insurance

As the most widely employed blockchain applications in finance, smart contracts are automating financial agreements, reducing the need for manual intervention. In the insurance sector, platforms like Ensuro utilize smart contracts to autonomously manage risk pools, collect premiums, and process claims, enhancing efficiency and reducing overhead.

In lending, portfolio management and decentralized tools like Aave help users to borrow and lend assets without traditional intermediaries, streamlining operations and lowering costs.

Fraud Prevention and Risk Management

Blockchain’s immutable ledger provides a secure method for tracking transactions, making it an effective tool for fraud prevention. Financial institutions are leveraging blockchain to enhance real-time risk monitoring and improve fraud detection systems, ensuring transaction histories cannot be tampered with.

For example, ING Bank has explored zero-knowledge proofs on blockchain to enhance security and confidentiality in risk assessments.

Digital Identity Verification

Blockchain-based identity solutions offer secure identity management, lowering dependence on centralized databases. These blockchain finance applications enhance privacy and security, supporting Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance.

Sovrin and uPort, for instance, are pioneering in this space, providing users with control over their personal data.

Supply Chain Financing

Blockchain technology is enhancing supply chain financing by providing verifiable tracking of goods. This ensures that financing is released only when specific milestones are met, reducing risk and enabling faster access to capital for businesses.

Walmart, in collaboration with IBM’s Food Trust Network, utilizes blockchain for finance to trace food products from farm to table, ensuring safety and authenticity.

Decentralized Finance (DeFi) Solutions

DeFi platforms run entirely on blockchain, allowing users to borrow, lend, or trade without banks. This blockchain financial technology opens up access to financial services like lending, borrowing, and trading without regular intermediaries.

Platforms such as Compound and Uniswap have gained prominence by allowing users to earn interest, access loans, and trade assets directly.

Tokenization of Assets

Blockchain makes it possible to turn physical assets into digital tokens that users can trade effortlessly. Such fintech blockchain use cases allow for fractional ownership and unleash investment opportunities to a greater audience. In 2024, State Street partnered with a Swiss crypto firm Taurus to offer tokenized versions of traditional assets. These include bonds and real estate, catering to institutional investors seeking diversified portfolios.

Cryptocurrency

Stablecoins like Bitcoin and Ethereum provide faster and less costly alternatives to standard currencies for payments, savings, and investment. For example, Coinbase has waived transaction fees for PayPal’s stablecoin PYUSD. This way, they promote its adoption for everyday transactions as a faster and more cost-effective alternative.

Implementing Blockchain in Finance: Challenges & Tips

As impressive as the benefits of blockchain in finance might seem, its implementation comes with several hurdles. These include regulatory uncertainty, technical complexity, integration with legacy systems, and concerns around scalability.

Let’s see how to get the most out of your use of blockchain in fintech and overcome common challenges.

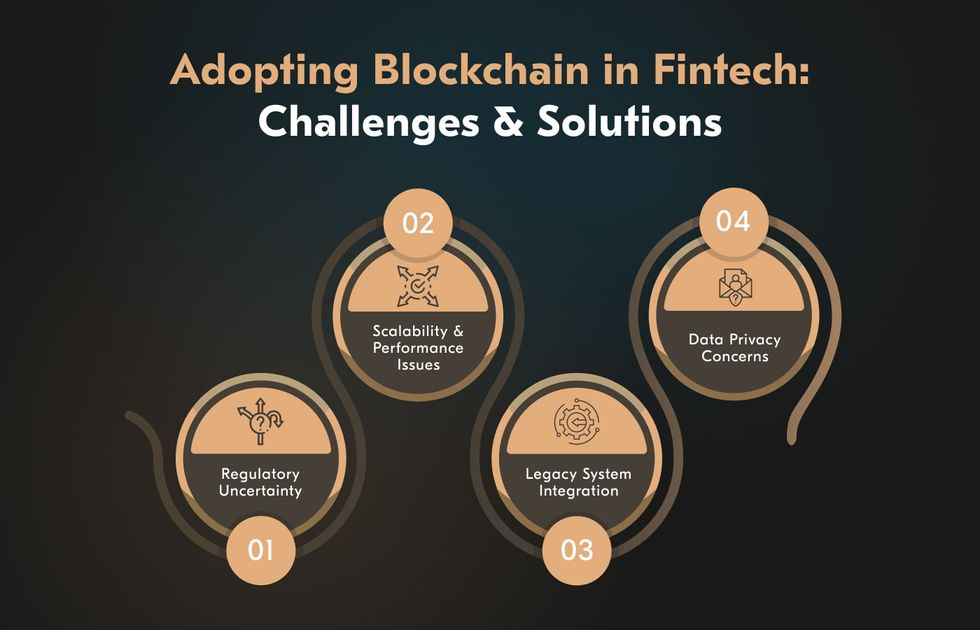

Regulatory Uncertainty Across Regions

The lack of consistent regulatory frameworks creates hesitation among fintechs, especially those operating across multiple jurisdictions. Varying legal interpretations and compliance requirements can slow adoption. Fintech companies must adhere to regulatory sanctions, including those from the US and EU, to avoid facilitating illicit activities.

Engaging with regulators and developers who are aware of the fintech development standards helps shape clearer policies while ensuring compliance.

Scalability and Performance Issues

Early blockchain and financial services networks often struggle with transaction speed and throughput, making them difficult to scale for high-volume or time-sensitive financial operations.

Transitioning to a more efficient tech stack and consensus mechanisms like proof of stake can significantly improve scalability and reduce latency.

Integration with Legacy Systems

Existing financial infrastructures are often incompatible with decentralized technologies, making integration complex and costly.

Middleware and tailored APIs can bridge blockchain with traditional systems, allowing for phased implementation without disrupting operations.

Data Privacy Concerns

Blockchain’s transparency can conflict with privacy requirements in finance, particularly regarding customer data and regulatory adherence.

Privacy-enhancing tools such as zero-knowledge proofs or private ledgers can strike the right balance between transparency and confidentiality.

Why choose Acropolium? Acropolium Case Study

Recognized as a leading blockchain developer, Acropolium brings over 20 years of experience in custom software development, specializing in fintech solutions. With ISO-certified processes and a focus on compliance, we ensure secure, scalable, and legally sound blockchain applications.

Acropolium’s deep expertise in navigating complex regulatory landscapes allows us to craft solutions that meet global standards. We combine the power of blockchain and finance, helping businesses innovate and grow with confidence. Our dedicated teams deliver measurable results in each project, and here’s one of the most prominent outcomes.

SaaS-based Crypto Asset Management Platform

Our client, a leading cryptocurrency portfolio management firm, aimed to develop a platform that would simplify asset management and improve user experience. The goal was to implement blockchain in finance for streamlined asset monitoring, transaction tracking, and trading.

Solution

We focused on enhancing user interaction by designing an intuitive interface tailored to traders and investors. The platform features customizable dashboards, real-time data analytics, and easy-to-navigate tools for a seamless user experience:

- A centralized hub for managing diverse digital portfolios

- Customizable dashboards for a personalized experience

- Live analytics to aid decision-making

- Encryption and multi-factor authentication for robust security

- Scalable architecture to handle increasing trading volumes

Results

- 22% increase in clients within six months

- 15% rise in revenue during the same period

- Improved client retention and a growing customer base

- Significant cost savings on infrastructure maintenance

Final Thoughts

Blockchain is a working technology with clear, practical use in fintech. It reduces transaction costs, strengthens data security, and enables instant cross-border transfers — benefits already leveraged by financial institutions aiming for efficiency and resilience.

Realizing these gains, however, requires more than technical implementation. It demands a precise understanding of compliance requirements, security protocols, and financial user behavior.

Acropolium brings a two-decade expertise to employ blockchain in finance in a way it addresses unique needs. Our subscription-based cooperation model ensures predictable costs, technical continuity, and operational flexibility — all while we manage the infrastructure.

![Learn how [Online Payment Processing Software] works and how to process online payments on website](/img/articles/how-to-process-online-payments/img01.jpg)

![Cryptocurrency Exchange Software Development [2025 Guide]](/img/articles/why-you-need-custom-cryptocurrency-exchange-software-and-how-to-get-it-right/img01.jpg)

![Why Invest in Cryptocurrency Wallet Development [2025 Guide]](/img/articles/investing-in-cryptocurrency-wallet-development-cost-and-benefits/img01.jpg)

![Top AI Applications in Finance for 2025: [Benefits & Success Stories]](/img/articles/artificial-intelligence-applications-in-finance/img01.jpg)