Oil and gas companies face persistent challenges: lengthy project cycles, fragmented OT/IT systems, and the burden of maintaining legacy infrastructure. In 2025, many technology trends in oil and gas industry revolve around shortening this cycle from reduced-code platforms to AI-driven analytics.

Reduced-code approaches enable production-ready workflows in 90 days. Pre-configured components replace bespoke development, integrations with SCADA, historians, and ERP systems are delivered through secure connectors, and governance frameworks ensure compliance with standards.

By adopting reduced-code in 2025, oil and gas firms can shorten delivery timelines, reduce technical debt, provide measurable returns in the first quarter of deployment, and scale more advanced initiatives in AI. If you want to explore how these approaches can be applied in your operations, you can book a 30-minute discovery call with our experts to review potential use cases.

For a practical way to evaluate the financial outcomes, you can also download the ROI calculator (XLSX) and model the impact of a 90-day deployment in your environment.

Why reduced code software oil gas in 2025

The momentum behind reduced code software oil gas adoption is not accidental. It reflects the intersection of persistent industry challenges (long project cycles, legacy technical debt, and the OT/IT divide) with a maturing technology landscape that now makes rapid, governed digitalisation possible.

First, the challenges have reached a breaking point. Traditional Information Technology in oil and gas industry projects in the sector are capital-intensive and slow to deliver, leaving many companies trapped in pilot purgatory. Legacy systems, from SCADA to custom-built databases, continue to anchor operations but resist integration, creating silos that weaken decision-making. The gap between OT and IT remains a structural barrier. These realities slow progress, increase operational risk, and erode the business case for transformation.

Second, the new technology in oil and gas industry environment has shifted in ways that make reduced-code a practical solution. Three oil and gas software developments stand out:

Cheaper and more accessible integration connectors. What once required custom integration projects can now be achieved in weeks, allowing reduced-code platforms to plug into ERP, EAM, and historian data without disrupting core operations.

The maturity of data fabric architectures. Reduced-code applications can standardise and feed clean, structured data into these fabrics for downstream analytics and AI models.

Advances in mobile clients for field teams. Reduced-code platforms now deliver field-ready applications: workover approvals, safety workflows, maintenance forms optimised for tablets, smart glasses, and low-connectivity environments.

The renewable sector has already demonstrated how modular digital platforms can accelerate transformation. AI-driven renewable energy platforms are built with flexible connectors, cloud-native architecture, and mobile-first interfaces; the same traits now define reduced code software oil gas.

Among the most defining technology trends in oil and gas industry is the pivot from large monolithic IT projects to reduced-code delivery models that integrate securely with OT and enterprise systems while accelerating ROI.

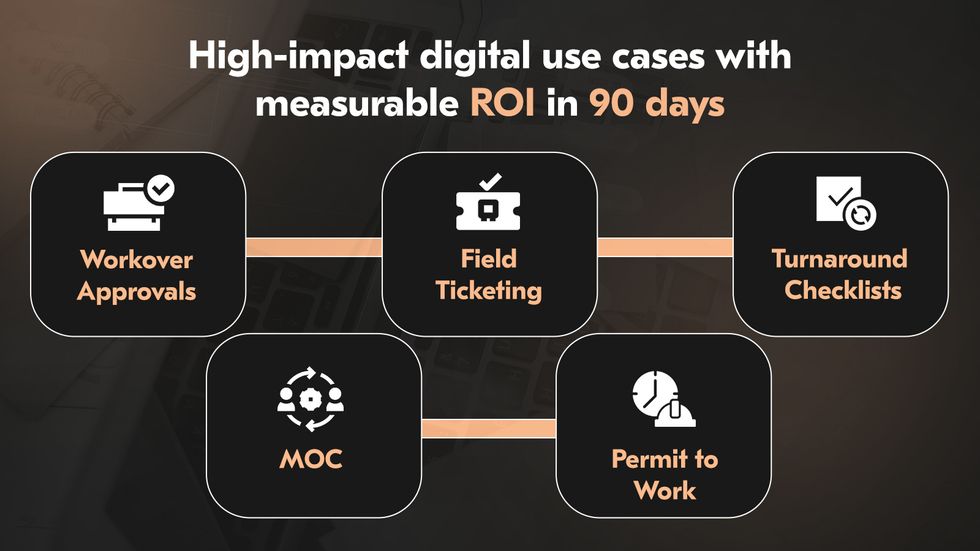

Top 5 use cases of digital transformation in energy with 90-day time-to-value

Digital transformation for oil & gas companies often spans years, but not every initiative requires a long horizon. Specific workflows can be digitalised rapidly and deliver measurable value within 90 days. These early wins matter: they reduce costs, improve safety, and build organisational momentum for broader transformation. The following five use cases stand out as the most impactful in digital transformation in energy industry for short-term return.

1. Workover approvals

Workover operations depend on multiple sign-offs across engineering, finance, and regulatory functions. In paper-based or email-driven processes, delays are inevitable and costly. By digitising approvals with structured forms, automated routing, and integrated audit trails, companies can cut approval cycles from weeks to days. The immediate effect is reduced downtime and faster redeployment of capital, with the added benefit of full traceability for regulators and auditors.

2. Field ticketing & production accounting

Field tickets remain one of the most persistent sources of inefficiency in upstream operations. Manual entry into spreadsheets creates errors, slows reconciliation, and weakens financial visibility. Automated ticketing platforms replace paper with mobile forms that synchronise directly with production accounting and ERP systems. Within 90 days, organisations typically see shorter reconciliation cycles, fewer disputes with service providers, and faster reporting to finance teams.

3. Management of Change (MOC)

Change in assets, equipment, or processes must be controlled and auditable, but paper-driven MOC workflows often lack speed and transparency. A digital MOC system provides structured workflows, approvals, and centralised records. Technology trends in oil and gas industry help enterprises to reduce compliance risk while accelerating implementation. Within the first three months, organisations establish a faster turnaround for changes and a demonstrable compliance framework.

4. Permit to work & safety workflows

Permits to work and related safety workflows are among the most compliance-sensitive processes in the industry. Digital transformation for oil & gas companies provides real-time visibility into active permits, automated alerts for conflicts, and mobile access for field supervisors. The result is fewer delays, stronger assurance of compliance, and improved safety oversight. By the 90-day mark, organisations typically achieve measurable reductions in permit-related delays and a stronger safety record supported by digital evidence.

5. Turnaround/shutdown checklists

Paper checklists and manual validation slow down execution and create blind spots. Predictive maintenance has demonstrated 12% lower maintenance costs and extended asset lifecycles by 20%. Moving checklists to mobile platforms with embedded validation rules ensures that tasks are completed, logged, and escalated in real time. Within a single shutdown cycle, digital transformation for oil & gas companies enables documenting compliance more effectively, reducing rework, and shortening critical path activities.

| Use case | Segment | Time-to-value | Key KPIs |

| Workover approvals | Upstream | 60–90 days | Cycle time reduction, NPT hours avoided |

| Permit to work | Upstream/Midstream | 30–60 days | Safety incidents prevented, compliance rate |

| Field ticketing & accounting | Midstream | 60–90 days | Days-to-cash reduced, error rate lowered |

| Asset maintenance workflow | Downstream | 60–90 days | MTBF, MTTR, maintenance cost per unit |

| Turnaround/shutdown checklist | All segments | 90 days | Downtime hours avoided, schedule adherence |

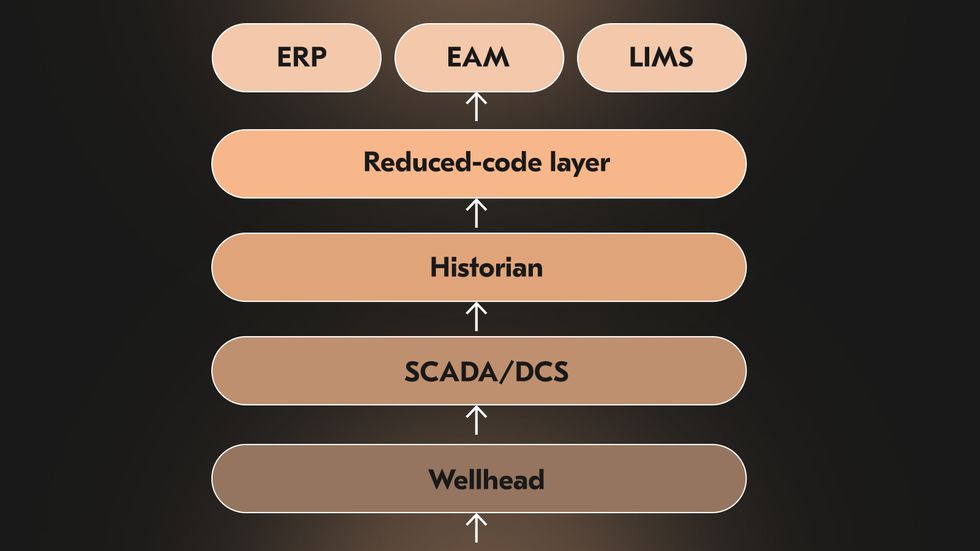

What a secure reference architecture for the oil and gas sector looks like

A modern oil and gas digital architecture must span the entire value chain from the wellhead and production systems to enterprise resource planning platforms. To begin with, operational technology remains the foundation of production. SCADA and DCS systems control assets and safety functions, while historians capture the high-volume time-series data generated across upstream and midstream environments. However, to realise value at the enterprise level, this operational data must converge with Information Technology in oil and gas industry systems.

Convergence is critical to unlock enterprise-wide visibility, but must be implemented with strict safeguards. Data diodes and demilitarised zones (DMZs) provide controlled conduits between OT and IT. This data can flow into analytics platforms without exposing control systems to external threats.

Building on this foundation, a reduced-code layer accelerates digitalisation by providing pre-configured forms, rules, and workflow automation components. Mobile applications extend these workflows to the field, enabling technicians to capture, access, and act on data in real time, even in remote or low-connectivity environments. Equally important, guardrails for citizen development ensure that flexibility does not come at the cost of governance.

The whole efficient impact of digital transformation comes when operational and reduced-code layers integrate with enterprise systems to create a single operational backbone where field data, maintenance planning, financials, and compliance reporting work:

EAM/CMMS for asset integrity, predictive maintenance, and work order execution.

ERP for finance, procurement, supply chain, and production planning.

LIMS for laboratory data management and quality assurance.

DMS for managing technical documentation, drawings, and compliance records.

Industry cases already highlight the value of integrated analytics in oil and gas. Purpose-built analytics platforms have been deployed to unify SCADA, historian, and ERP data, enabling operators to track production, optimise logistics, and strengthen compliance reporting.

Step-by-step guide on how to design an oil and gas digital transformation with security and compliance

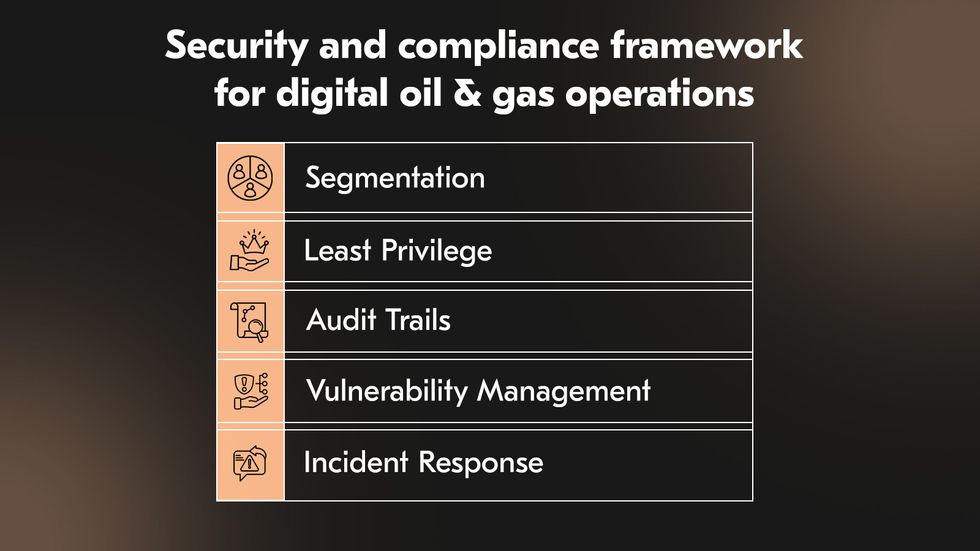

The following steps outline how to build security and compliance into architecture, governance, and daily operations.

Isolate SCADA, historians, and safety instrumented systems within defined OT zones, with only tightly controlled conduits transferring data into Information Technology in oil and gas industry environments. Segmentation ensures production-critical systems remain protected from lateral cyber movement.

Every user, contractor, and application service account must operate under the minimum rights required for their role. Access must be reviewed periodically and revoked immediately when no longer needed. This principle limits the blast radius of insider errors or credential compromise and enforces discipline across the supply chain.

Maintain comprehensive audit trails that record system events and user activity across workflows. Whether through workflow automation tools, OT-specific MLOps platforms, or blockchain-based ledgers, these digital trends in oil and gas industry create transparency, reinforce accountability, and provide evidence for regulators and auditors.

Use IEC 62443 as the structured pathway for industrial cybersecurity maturity. Begin with asset identification, zone definition, and hardened baseline configurations. Progress to continuous vulnerability management and integrated intrusion detection.

Prepare for inevitable incidents with tested runbooks that define escalation paths, decision authority, and recovery timelines for ransomware or anomalous SCADA behaviour scenarios. Support these with a RACI framework that assigns clear responsibility and accountability to operators, engineers, IT, compliance, and executives.

Embed governance into design. By embedding segmentation, least privilege, audit trails, IEC 62443 maturity, and incident preparedness into the design phase, organisations shift from reactive defence to proactive resilience.

How to build a KPI dashboard and ROI model for oil and gas transformation

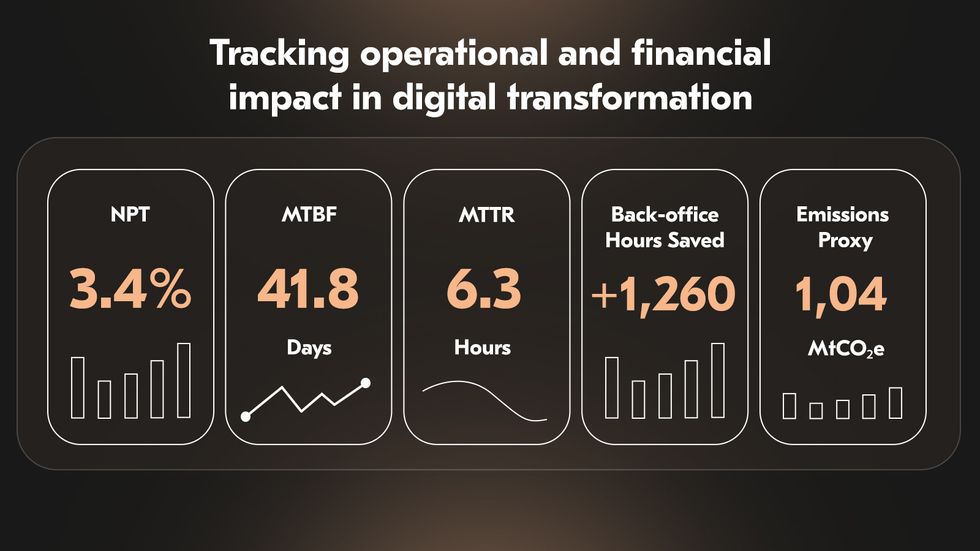

Without a well-structured KPI dashboard and ROI model, even successful projects risk being dismissed as experiments rather than proven value drivers. The dashboard should concentrate on metrics directly affecting operational performance, cost efficiency, and sustainability. The following measures are critical:

Non-Productive Time (NPT): Quantifies avoided delays in drilling, maintenance, and compliance approvals, directly linked to production continuity.

Mean Time Between Failures (MTBF): Tracks asset reliability and demonstrates whether digital solutions extend uptime between incidents.

Mean Time to Repair (MTTR): Measures the speed of recovery when failures occur, highlighting efficiency gains in maintenance workflows.

Back-office hours saved: Shows the reduction of manual work in reporting, approvals, and compliance processes, translating time into cost savings.

Emissions proxy: Captures environmental performance through flaring volume, compressor efficiency, or energy intensity indicators.

Measure results across 30/60/90 days

Impact should be visible early and structured into three checkpoints. In the first 30 days, the priority is to establish baselines and demonstrate fast wins in approval times and workflow efficiency. By 60 days, reliability improvements and measurable efficiency gains in operations and back-office work emerge. At 90 days, the ROI model links these operational data points to financial outcomes for turning downtime avoided into deferred production recovered, labour hours saved into direct cost reductions, and emissions proxies into compliance or carbon value.

How to construct a defensible ROI model

An ROI model only creates credibility if its calculations withstand audit and board-level scrutiny. Each KPI must be linked to financial proxies with transparent formulas: NPT reductions converted into production value, MTTR improvements into avoided service costs, back-office time saved into labour cost equivalents, and emissions proxies into compliance or carbon-pricing scenarios.

An embedded Excel calculator can standardise ROI tracking across sites and programs. It should contain:

Input sheets for baseline values and actuals, with units and update frequency defined.

Formula sheets converting KPI deltas into financial impact using pre-agreed cost multipliers.

Dashboard sheets visualising 30/60/90-day progress with trends, baselines, and cumulative ROI.

Instruction notes clarifying editable versus protected fields, version control, and validation steps.

How to embed change management into digital transformation in energy

Effective change management during digital transformation in energy must be embedded from the outset, with as much disci pline as technical execution. Senior executives must formally endorse the initiative, while operational champions bridge the gap between business requirements and new technology in oil and gas industry delivery. A structured communication plan ensures that everyone understands what is changing and why. Messaging must be adapted to each audience: engineers need clarity on data reliability, field technicians on safety and ease of use, and managers on scheduling and cost control.

The next step of digital transformation for oil & gas companies is to equip field teams with the right knowledge. Training cannot stop at introductions to new applications; it must build confidence to use digital workflows under real operational pressures. Don’t forget to reduce friction and uncertainty during adoption with standardised artefacts. Standard Operating Procedures define how work is done, User Acceptance Testing confirms that solutions meet operational reality, and hypercare support during the first two weeks rapidly responds to issues before confidence erodes. Reinforcement sustains change by embedding new performance metrics into reviews and maintaining refresher sessions.

How to secure procurement wins in digital transformation in energy industry

Procurement is often where oil and gas digital initiatives either gain momentum or stall. A clear strategy for pilots, contracting, and supplier evaluation can shorten decision cycles, reduce risk, and ensure that reduced code software oil gas investments deliver measurable value.

Zero-based pilots and contracting discipline

Starting with a zero-based pilot allows a team to test one workflow under tightly controlled conditions, without carrying forward assumptions from legacy projects. The pilot should be framed by a skeleton Statement of Work that defines scope, deliverables, and integration boundaries while leaving space to refine based on operational feedback. Pricing at this stage should be transparent and modular, with early clarity on whether the model is licence-based (CAPEX-heavy) or credit-based (OPEX and outcome-linked).

Licences versus platform credits

The industry is steadily shifting from perpetual licences to flexible, consumption-based models. Traditional licences lock capital upfront but often slow down scaling when priorities shift or oil prices fluctuate. Platform credits or “as-a-service” pricing provide a more adaptable route, aligning expenditure with usage and allowing projects to be expanded or paused without long renegotiations. For operators, the right choice depends on their cash flow strategy, appetite for OPEX versus CAPEX, and the degree of certainty around the workloads they intend to run.

When evaluating vendors, four attributes should be mandatory:

Operational technology expertise: Ability to integrate with SCADA and DCS safely, and proven understanding of digital trends in oil and gas industry and regulatory requirements.

Security maturity: Compliance with IEC 62443, proactive vulnerability management, and robust audit trails that do not rely on ad-hoc patching.

Reliable SLAs: Outcome-based commitments tied to metrics such as downtime reduction or throughput gains, not just generic uptime percentages.

Offline and remote support: Systems and mobile apps that work in offshore or remote desert conditions with poor connectivity.

The difference between stalled pilots and scaled transformation often comes down to how procurement is structured. Clear SoWs, well-chosen pricing models, and vendors who understand the operational realities of oil and gas reduce cost and risk.

What are the pilot packages, budgets, and timelines for digital transformation initiative oil and gas industry?

Digital transformation in oil and gas must be structured in clear, manageable phases. Industry research shows that large-scale adoption of AI can deliver 10–20% cost savings.

Reduced code software oil gas accelerate delivery, but each step still requires careful budget allocation, risk management, and disciplined execution. The three pilot packages below illustrate how digital transformation initiative oil and gas industry can progress from single-workflow pilots to enterprise-scale rollouts.

1. Starter package

The Starter package focuses on a single high-value workflow, such as workover approvals or permit-to-work automation. Delivery typically spans 8–12 weeks, with most effort centred on integrating with historians, SCADA, or ERP systems and validating offline mobility for field staff. Budgets usually sit in the low six-figure range, covering licences, connectors, and a brief hypercare cycle.

2. Standard package

The Standard package extends to 2–3 workflows, such as field ticketing tied to production accounting or MOC approvals, and introduces formal governance through artefacts like RACI charts and incident response runbooks. Timelines average 16–20 weeks, with additional capacity reserved for structured training and change management. Budgets move into the mid-to-high six figures, driven mainly by ERP and CMMS integrations.

3. Multi-site package

The multi-site package scales adoption across several assets, such as multiple upstream fields or an integrated refinery and pipeline network. Implementation requires 9–12 months, with staggered rollouts to minimise operational disruption. Budgets reach the low seven figures, justified by measurable returns such as up to 30% maintenance cost reduction, 15–25% fewer unplanned shutdowns, and substantial back-office efficiency gains.

Investment at each stage is significant, but returns are equally tangible. Predictive maintenance and remote monitoring can cut maintenance costs by nearly a third, while automation of workflows reduces cycle times and back-office overheads. The main risks stem from high upfront CAPEX, ROI uncertainty, and the persistent challenge of legacy integration.

![Low-Code in Healthcare [5 Use Cases]](/img/articles/low-code-healthcare/img01.jpg)

![ᐉ Low-Code MVP Development: [Pros, Cons, Guide]](/img/articles/low-code-mvp/img01.jpg)

![Low-Code App Development [2026 Guide] — Acropolium](/img/articles/low-code-app-development/img01.jpg)