A customer transfers money abroad on their phone. The payment clears in seconds. She doesn’t see the silent battle behind the screen: algorithms comparing her behaviour with billions of past transactions, scanning for patterns that hint at fraud, weighing risks in real time. By the time her transfer is complete, the system has already decided it’s safe.

This is the reality of fintech in 2026. Digital transactions move faster than ever, and fraudsters move just as quickly. Old, rule-based systems struggle with the scale and sophistication of modern attacks. Artificial Intelligence has become central to that defence.

Instead of rigid rules that flag too late or too often, fintech fraud detection AI learns from live data, recognises hidden patterns, and responds in seconds. At the same time, risk management software integrates compliance, monitoring, and reporting into a single, transparent process that regulators and customers can trust.

The question is not about whether attacks happen, but whether systems can identify and stop them in time. If you’d like to explore how AI can strengthen your fintech operations, book a free consultation.

The rising need for AI in fintech security

Criminal activity is faster, more coordinated, and increasingly technology-driven. Traditional systems cannot absorb the complexity, so AI fintech fraud detection has moved from a differentiator to a necessity. Three forces are accelerating this shift: the vulnerabilities created by rapid digitization, the limits of legacy detection methods, and the sophistication of modern fraud tactics.

Increased fraudulent activity from digital transformation

Digital platforms have redefined how money moves. Trillions of transactions are processed each year, with a proportional rise in fraud attempts. The convenience of instant payments, peer-to-peer transfers, and mobile-first banking has become a double-edged sword.

More data in circulation means more entry points for attackers.

Larger transaction volumes create cover for fraudulent activity.

Financial losses are already enormous: according to Gartner, U.S. fraud losses alone may hit 40 billion USD annually by 2027, driven partly by generative AI scams.

The failure of traditional detection methods

Rule-based systems and manual reviews once provided a safety net. Today, they are brittle. Static thresholds trigger excessive false positives, sometimes exceeding 12–20% in industry benchmarks. They also lag in response: legacy platforms detect anomalies minutes after a transaction, when the damage is already done. In contrast, AI and ML services enable enterprises to generate insights in under two seconds.

Just as important, older systems lack adaptability. They cannot interpret user context, cannot evolve with fraud patterns, and leave wide gaps where emerging threats slip through.

The sophistication of fraud tactics

Financial crime has evolved into a professionalized industry. Fraud networks use synthetic identities, large mule networks, and automated account takeover schemes to bypass static rules. Deepfakes and AI-generated content now fuel social engineering, while Fraud-as-a-Service platforms let even unskilled actors launch complex attacks at scale. AI systems continuously retrain on fresh data to identify subtle shifts in behaviour and learn from new fraud scenarios without human intervention.

The case for AI rests on its ability to:

Detect and stop fraud in real time.

Process and analyse vast volumes of data streams.

Uncover complex, non-obvious patterns across channels.

Deliver decisions with explainability and accuracy.

| Aspect | Traditional fintech fraud detection | AI-powered fraud detection |

| Speed | Minutes or hours after transaction | Milliseconds, real-time |

| Adaptability | Static rules, fixed thresholds | Continuous learning from live data |

| Accuracy | High false positives | Reduced false positives, better precision |

| Coverage | Limited to known fraud patterns | Detects emerging, cross-channel threats |

| Scalability | Struggles with growing volumes | Handles billions of transactions seamlessly |

| Explainability | Manual reviews required | Transparent, explainable AI outputs |

How fintech risk management software works

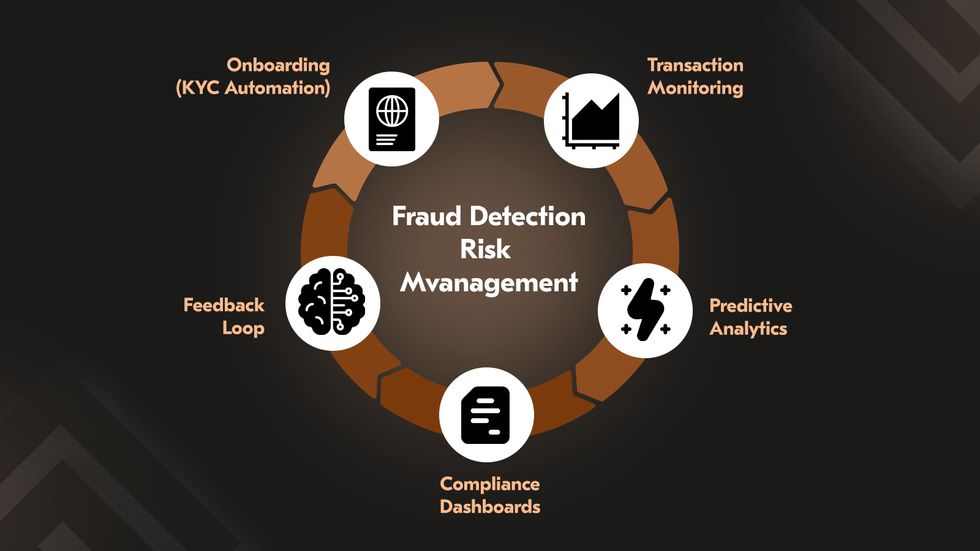

Step 1. KYC automation

The process begins at onboarding. Customer identities are verified using computer vision for document checks, biometric authentication for liveness, and NLP for extracting and validating details against global watchlists. Risk scoring engines run in the background through assigning each prospect a profile before accounts are approved. Graph-based techniques detect patterns that indicate synthetic identities or collusive applications.

Step 2. Transaction monitoring

Once customers are active, every payment, transfer, or withdrawal flows through continuous monitoring engines. AI models trained on millions of prior transactions evaluate them in milliseconds. Artificial Intelligence in finance flag velocity spikes, abnormal values, or geographic inconsistencies. Scenario-based typologies extend coverage and embed known laundering methods like remittance structuring. The software can pause, block, or escalate instantly when an anomaly is detected.

Step 3. Predictive analytics

The fintech fraud detection system does not wait for anomalies alone; itt forecasts them. Predictive analytics combines historical and real-time data to identify fraud hotspots and calculate dynamic risk scores. Behavioural profiling establishes baselines for each customer’s activity, raising alerts when deviations suggest account takeover or collusion. In credit, the same fintech fraud detection analytics combine bureau data with alternative signals like utility or digital behaviour, generating precise creditworthiness assessments within seconds.

Step 4. Compliance dashboards and explainability

Every action, whether onboarding or intervention, is logged into compliance dashboards. Investigators see consolidated alerts and case histories in one interface. Automated reporting prepares STRs or equivalent filings in regulator-ready formats. Alert prioritisation further streamlines workloads via ranking threats, reducing false positives, and focusing resources where the risk is greatest.

Newly verified identities feed into monitoring. Monitoring outcomes refines predictive models. Predictions and alerts populate compliance dashboards, which in turn provide feedback to improve the system. This closed-loop process makes fintech software adaptive and auditable, capable of protecting against fraud.

Key fraud detection use cases in fintech

Use case: Real-time transaction monitoring

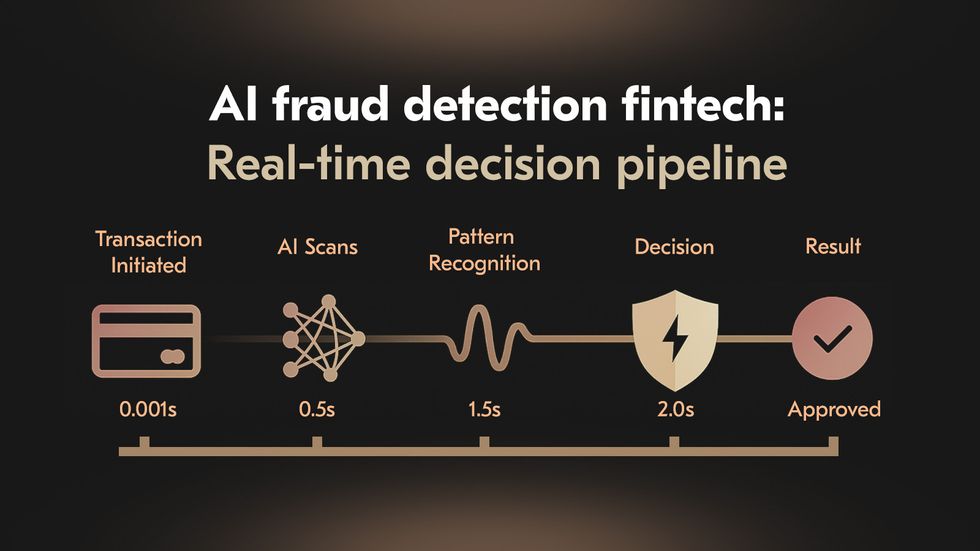

The first and most critical layer of defence is the ability to monitor transactions as they happen. With instant payment platforms and 24/7 digital services, delays in fintech fraud detection mean funds are lost before an investigation even begins. AI fraud detection fintech systems can process vast volumes of streaming data in milliseconds, identify patterns invisible to human review, and enforce decisions immediately.

The first and most critical layer of defence is the ability to monitor transactions as they happen. With instant payment platforms and 24/7 digital services, delays in fintech fraud detection mean funds are lost before an investigation even begins. AI fraud detection fintech systems can process vast volumes of streaming data in milliseconds, identify patterns invisible to human review, and enforce decisions immediately.

Functionality: AI-powered monitoring platforms ingest transaction data continuously, applying advanced models such as RNNs and CNNs to capture sequential and contextual signals.

Detection focus: Key indicators include transaction velocity anomalies, sudden spikes in transfer size, inconsistent merchant categories, or unusual geographic locations. The system aims to separate risks from legitimate variations in behaviour precisely.

Response: Once risk is detected, the system can block, hold, or escalate the transaction instantly. Some platforms integrate with authentication layers, prompting additional biometric or MFA checks. Others route cases to human analysts with contextual evidence for immediate resolution. The net effect is fewer successful fraud attempts and reduced loss exposure.

We partnered with a leading digital bank to design and implement a unified, real-time AI fraud monitoring platform spanning payments, accounts, lending, and crypto transactions. Within months of deployment, the client reported a 40% reduction in fraudulent activity and a 30% improvement in operational efficiency, driven by automated case triage and streamlined alert workflows.

Use case: Identity verification & KYC/AML automation

Traditional manual KYC checks and periodic AML audits cannot keep pace with the velocity of digital onboarding and global transaction flows. AI fraud detection fintech automation changes this approach by making identity verification and monitoring continuous, adaptive, and far more comprehensive.

Identity verification (KYC): AI enhances document checks through computer vision, validating passports, IDs, or utility bills while detecting tampering or forgery. Natural language processing validates structured and unstructured data.

Anti-money laundering (AML) detection: ML algorithms trace complex layering and integration patterns within transaction networks. By scoring behaviours against regulatory typologies, these systems detect laundering strategies that evade static rules. Automated suspicious activity reports are generated quickly.

Fraud network detection: Graph neural networks are increasingly applied to identify links between accounts, devices, and IPs. They uncover mule accounts, collusive rings, or shell company structures by mapping relational data, a task that manual teams could not feasibly perform.

Targeted fraud types: Beyond compliance, these systems counter identity theft, synthetic identities, and fraudulent onboarding practices. When detecting inconsistencies across applications and behavioural mismatches in usage, AI ensures fraudulent identities are flagged before they gain traction in the ecosystem.

We collaborated with a financial services provider to develop an AI-driven anti-money laundering platform. By embedding Machine Learning models into their compliance workflows, the client achieved a 20 % reduction in reporting time and a 45 % boost in fraud detection accuracy. The system now flags suspicious activity in real time while keeping false positives to a minimum.

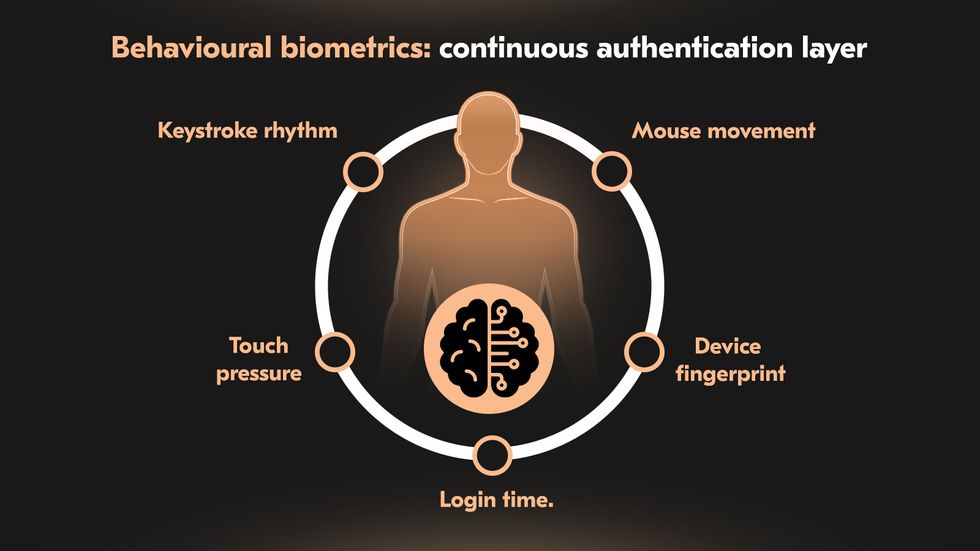

Use case: Behavioural biometrics & anomaly detection

Fraud often hides in the subtleties of how a user behaves. Traditional systems that only scan static attributes miss these signals. AI-driven behavioural biometrics and anomaly detection fill this gap, continuously profiling activity and surfacing deviations that suggest manipulation or compromise.

Fraud often hides in the subtleties of how a user behaves. Traditional systems that only scan static attributes miss these signals. AI-driven behavioural biometrics and anomaly detection fill this gap, continuously profiling activity and surfacing deviations that suggest manipulation or compromise.

Behavioral biometrics: Systems monitor keystroke cadence, typing speed, mouse trajectories, and touchscreen pressure. Over time, these micro-patterns form a unique behavioural signature.

Anomaly detection: Unsupervised learning techniques detect behaviours that diverge from established baselines. These methods excel at flagging novel fraud attempts, which cannot be captured through pre-defined rules.

Data inputs: Signals span login location, device fingerprinting, transaction times, and spending rhythm. A sudden geolocation mismatch, device switch, or irregular sequence of transactions triggers risk scoring and additional checks.

Use case: Account takeover fraud (ATO) prevention

Account takeover remains one of the most damaging threats, driven by credential theft, phishing, and large-scale data breaches. Once access is gained, attackers move quickly, often draining funds or laundering through mule networks before detection. AI defences focus on catching the earliest signs of compromise and stopping escalation.

Detection mechanisms: LSTM models are adept at sequential data analysis and trace login histories and transaction flows for irregular patterns. Suspicious sequences trigger heightened scrutiny even if stolen credentials appear valid.

Behavioral monitoring: Monitoring login frequency, device usage, and navigation patterns highlights anomalies. For example, a sudden increase in high-value transfers or repeated login failures across multiple devices may indicate compromise.

Pre-emptive measures: Risk-based authentication systems automatically enforce step-up checks, biometric re-verification, or temporary account locks when compromise is suspected.

Multi-channel defense: Modern ATO prevention integrates data across mobile, web, and call centre channels. For AI fraud detection fintech, this multi-surface approach closes the gaps that criminals exploit when switching between platforms.

Core functions of risk management in fintech

Risk management in fintech is designed to operate in real time, with advanced analytics and AI models embedded into daily workflows. What follows are the core areas risk management must deliver, and how technology has increasingly redefined them.

1. Regulatory compliance

Compliance is the first line of defence and also the most resource-intensive. Anti-money laundering and KYC checks must now operate, scan millions of transactions across multiple channels, screen customers against global watchlists, and generate timely suspicious activity reports. AI is central in cross-border fraud detection fintech solutions, mapping complex transaction networks and detecting laundering patterns invisible to static rules. Regulatory frameworks like GDPR and CCPA require strict data minimization, anonymization, and auditable storage practices, while PSD2 enforces strong customer authentication and real-time monitoring of payment flows.

2. Credit risk assessment

The next function within top fintech fraud detection services is credit risk. AI models have transformed this space by drawing on traditional credit bureau data and alternative signals such as utility payments, digital purchase histories, or device usage. Predictive models generate far more nuanced risk profiles, particularly for underbanked segments with sparse conventional data.

3. Operational risk monitoring

Liquidity and operational stability require constant monitoring. AI-driven monitoring tools analyse historical flows, market signals, and geopolitical news to forecast volatility. Stress testing and scenario modelling extend these capabilities further. With this approach, your team can simulate shocks and prepare mitigation strategies before they materialize. On the operational side, automation reduces manual overhead in processes.

4. Cyber risk management

The final core function addresses the threat surface created by digital platforms. Fraud, identity theft, synthetic accounts, and account takeovers exploit scale and speed, and defending against them requires equivalent sophistication. AI systems perform anomaly detection across user behaviour, device fingerprints, and transaction histories to stop fraud in flight. The shift is from reactive forensics to predictive defence − forecasting potential hotspots, testing adversarial scenarios, and adapting models against evolving threats. Beyond fraud, AI strengthens broader cybersecurity posture, automating intrusion detection, anomaly alerts, and response playbooks to reduce detection and remediation time.

Benefits of AI-powered fraud detection & risk management

Best fraud detection solutions for fintech 2026 focus on automation and measurable business value at scale. Institutions that invest in advanced systems already report tangible reductions in fraud losses, faster compliance cycles, and stronger customer trust. So where does the value show up most clearly?

You can reduce fraud losses

The direct impact of fintech fraud detection is shrinking where AI systems are deployed. Predictive analytics and Deep Learning models can identify complex typologies earlier and more precisely than rule-based engines. The difference is significant: the U.S. Treasury recovered over 4 billion USD in fraud and improper payments in 2024 through ML systems, the Commonwealth Bank of Australia cut scam losses nearly in half, and PayPal reported a 40 percent reduction in fraud losses.

You can improve compliance

Regulation is relentlessly growing more complex, yet AI can absorb much of the burden. By monitoring transactions at scale, mapping networks, and automating suspicious activity reporting, AI strengthens AML/KYC controls and reduces manual compliance overhead. Here is where explainable AI becomes critical. With clear reasoning behind each alert through fintech fraud detection, institutions can satisfy regulators that decisions are consistent, lawful, and defensible.

You can leverage real-time decision-making

AI enables risk decisions at the moment of transaction rather than after settlement. Models trained on streaming data now deliver alerts or block actions within two seconds on average, compared with several minutes for legacy systems. Those solutions from agentic fraud detection fintech companies translate into fewer losses, fewer manual interventions, and faster throughput across high-volume platforms. Only those who act in real time will keep pace with instant payments and global digital flows.

You can enhance customer trust

Customers stay with platforms that protect them and abandon those that cannot. AI lowers false positives after distinguishing genuine anomalies from normal behavior, reducing unnecessary declines and keeping legitimate transactions moving. DBS, for example, achieved a 90 percent reduction in false positives through AI-driven detection.

Challenges in adopting AI for fintech risk management

AI fraud detection fintech provides faster, cleaner risk decisions, yet execution is complex. Here is what typically stalls enterprise programs, and what leaders must design around.

Data privacy concerns

Financial data is sensitive by design, so lawful basis, data minimization, and purpose limitation are non-negotiable. GDPR, CCPA, and local banking rules restrict how customer attributes, device telemetry, and behavioral signals can be collected, combined, and retained, which limits the feature space available to models. Cross-border transfers, data residency, and Schrems-II style constraints complicate shared model training, even inside one group.

Two practical frictions follow: obtaining sufficient labeled fraud data at production quality, and addressing class imbalance without leaking identity or fabricating artifacts when using synthetic data. Privacy-preserving techniques help, but introduce engineering overhead: strong pseudonymization, encryption in transit/at rest, secure enclaves for sensitive features, differential privacy for analytics, and federated learning when raw data cannot move.

Integration with legacy systems

Most fintech fraud detection platforms must ingest from many sources in real time, including payments, onboarding, AML, chargebacks, support, device fingerprinting, velocity stores, and then decide on an authorize/deny/step-up path in milliseconds. Legacy cores and point tools were not built for that cadence. Schemas drift, identifiers don’t align, batch ETL collides with streaming pipelines, and critical systems expose limited APIs or brittle message buses.

Balancing automation with human oversight

Executives set risk appetite; models operationalize it. Regulators now expect explainability, consistent adverse-action rationales, and accountable decision governance. That demands model documentation, challenger/benchmark strategies, calibrated thresholds, and accessible case-level explanations. Human-in-the-loop is a design choice: clear escalation paths, reviewer tooling, feedback loops that retrain models on confirmed outcomes, and guardrails that pause or roll back models when drift or fairness monitors breach limits.

Cost and implementation complexity

Enterprise-grade AI is a program, not a procurement. Budget lines span data contracts, event streaming, storage, feature computation, model training and serving, monitoring, case management, and vendor licenses where applicable. Compute costs rise with real-time inference and experimentation; TCO rises again with resiliency requirements across regions.

Skills are scarce: you need risk domain experts, data engineers, ML engineers, MLOps, model validators, and security architects working from a shared runbook. Adversarial pressure adds more work. Red-teaming models against evasion and poisoning attacks, hardening input validation, building canaries and shadow deployments, and running continuous robustness tests.

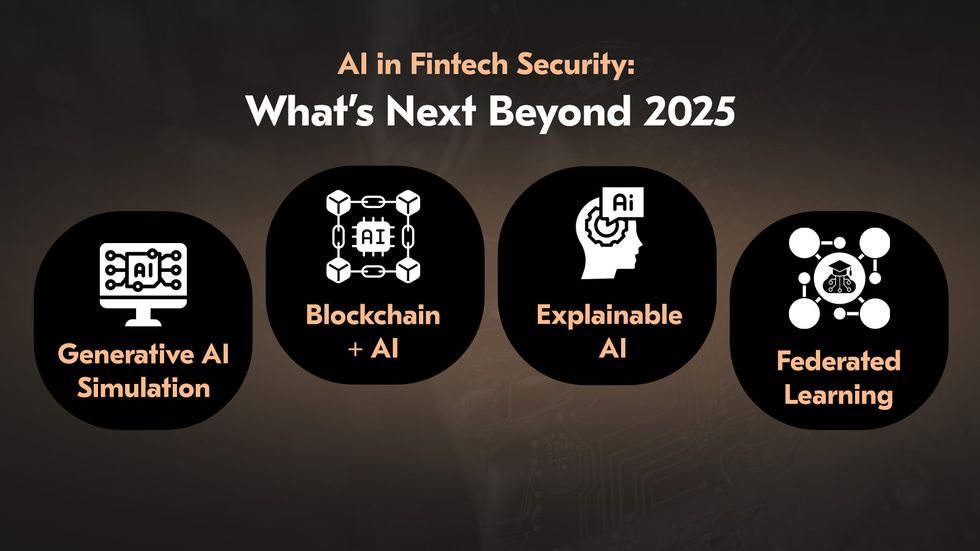

Future trends of AI in fintech security beyond 2025

As AI reshapes the way fintechs defend their systems, the next wave of innovation will not simply block attacks, it will anticipate them, adapt in real time, and enable industry-wide collaboration. So, what comes next? Let’s look at the key trends to define fintech security beyond 2025.

Generative AI for fraud pattern simulation

If today’s fraud detection models are reactive, tomorrow’s will be predictive. Generative AI is already being used to create synthetic data that mimics real-world financial activity, exposing fraud models to scenarios they rarely encounter in production. AI fraud detection fintech allows institutions to simulate attacks before they happen, making detection systems smarter and more adaptive.

Blockchain and AI for secure transactions

Now consider what happens when immutable transparency meets predictive intelligence. Blockchain has long been valued for its tamper-proof ledgers, but its true potential emerges when paired with AI. Together, they enable systems to analyse them instantly for signs of fraud. Smart contracts, enhanced by AI, can verify and enforce compliance in real time to reduce human error and close gaps that fraudsters exploit. Transactions that are faster, safer, and auditable at a level regulators and customers can trust.

Explainable AI for compliance audits

But fraud detection in fintech alone is insufficient; regulators now demand clarity. The rise of explainable AI means financial institutions can finally open the “black box” of machine learning. SHAP and LIME allow executives to justify why a payment was blocked or an account was flagged to regulators and customers. This shift does more than meet compliance requirements; it strengthens credibility.

Federated learning for cross-institution risk sharing

One of the biggest dilemmas in fintech has always been how to share intelligence without sharing data. Federated learning now allowes institutions to train shared fraud detection models without exposing sensitive records. Imagine banks across continents strengthening their defenses collectively while fully compliant with GDPR or PSD2. Early pilots with SWIFT and leading global banks have already demonstrated significant improvements in catching money laundering networks. Beyond 2025, federated learning will make fraud prevention a collective industry effort rather than a siloed fight.

As these trends reshape the future of fintech security, the real question is how fast your organisation can adopt them without disrupting trust or compliance. If you want to explore how these capabilities translate into practical solutions for your business, contact a fintech fraud prevention and detection company to request a demo or book a free consultation.

![4 Benefits of Custom Accounting Software [+Case study]](/img/articles/custom-accounting-software/img01.jpg)

![AI in Portfolio Management: Use Cases & Benefits [2025 Guide]](/img/articles/ai-for-portfolio-management-use-cases/img01.jpg)

![Cryptocurrency Exchange Software Development [2025 Guide]](/img/articles/why-you-need-custom-cryptocurrency-exchange-software-and-how-to-get-it-right/img01.jpg)

![Blockchain in Finance: [Use Cases Revolutionizing Finance in 2025]](/img/articles/blockchain-in-finance-use-cases/img01.jpg)

![Learn how [Online Payment Processing Software] works and how to process online payments on website](/img/articles/how-to-process-online-payments/img01.jpg)

![Conversational AI for Banking: [Use Cases for 2025]](/img/articles/conversational-ai-in-banking/img01.jpg)