Key Takeaways

88% of enterprises have integrated AI in portfolio management and accounting.

Companies using AI in finance have an average of six use cases, nearly twice as many as others.

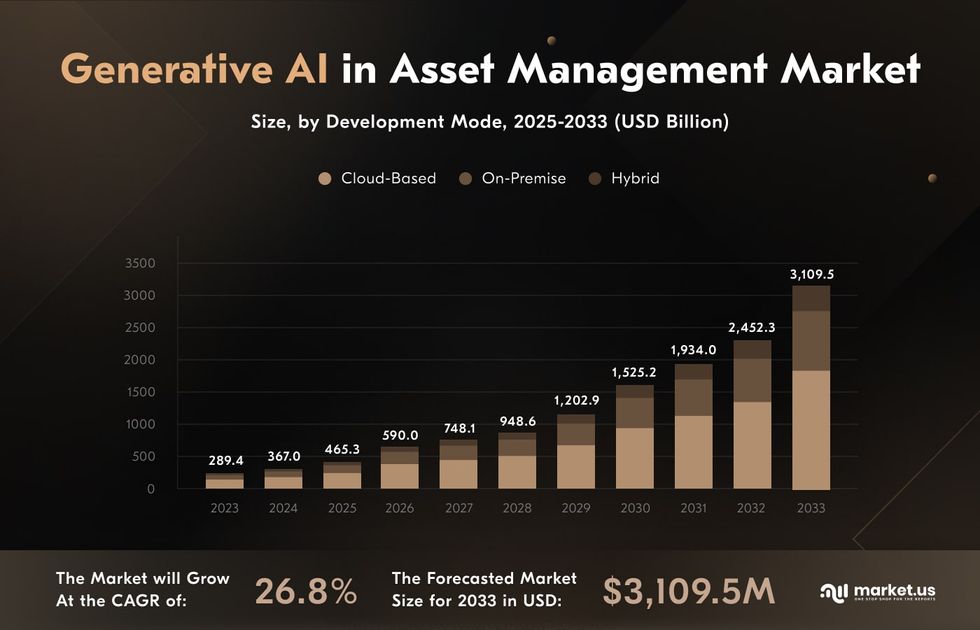

The GenAI market in asset management is projected to grow from $465.3 million in 2025 to $3.1 billion by 2033.

AI-driven portfolio management represented over 31.6% of the GenAI market in 2023.

Acropolium’s AI-powered compliance solutions reduce regulatory reporting time by 20%.

Investors and financial institutions use AI-managed portfolio tools to better analyze market data, spot trends, and make trades more efficiently. In fact, 71% of surveyed companies use AI in their finance operations, with 41% relying on it significantly.

AI’s ability to process real-time information helps portfolio managers make smarter investment decisions while reducing inefficiencies. However, incorporating AI in portfolio management goes beyond keeping up with technology. It serves as an instrumental strategy for improving financial results in the constantly changing market.

Today, we want to explore the full potential of advanced algorithms in the context of protected, well-managed financial assets.

With Acropolium’s 6-year expertise in AI/ML consulting and fintech software development, we’ve highlighted the most impressive benefits and use cases. Let’s see what challenges you may come across when integrating AI and how our clients overcome them with our dedicated teams!

What is AI in Portfolio Management?

AI in portfolio management functions based on advanced algorithms, machine learning, and real-time analytics to optimize investments, reduce risk, and enhance returns. As a response to traditional methods relying on human analysts and historical patterns, AI has become a key fintech trend for its ability to adjust portfolios with greater precision.

Using predictive modeling, sentiment analysis, and quantitative finance, AI in asset management evaluates financial indicators, economic trends, and market sentiment in real-time. With many use cases across industries, it also automates portfolio rebalancing to keep investments aligned with goals and risk tolerance.

The GenAI market in asset management is on the rise, projected to hit $3.1 billion by 2033, up from $465.3 million in 2025. A big part of this growth comes from the use of AI for portfolio management, which made up over 31.6% of the market in 2023.

Benefits of AI Portfolio Management Solutions

Artificial Intelligence is making its way into every corner of finance, and accounting and financial planning are leading the charge. Right now, nearly two-thirds of companies are already piloting or actively using AI portfolio management tools in areas of planning due to its accurate insights.

Other finance functions aren’t far behind — almost half of companies are now testing or using AI for treasury and risk management. From improving debt management and cash-flow forecasting to fraud detection and credit risk assessment, AI is helping businesses make smarter, more strategic financial decisions.

Intelligent Decision-Making

AI-based portfolio management analytics process vast amounts of market data in a live format, identifying trends and opportunities that human analysts might miss. SaaS-based AI solutions provide seamless access to these insights, helping investors make data-driven decisions without the need for complex infrastructure.

Automated Trade Execution

Trading systems powered by AI execute orders with precision, optimizing trade timing and reducing manual effort. This automation is particularly valuable in cryptocurrency markets, where volatility demands split-second decision-making to maximize returns and minimize losses.

Adaptive, Strategic Portfolios

Artificial intelligence portfolio management solutions continuously refine portfolio strategies based on live market data, improving asset allocation according to the investment goals. For digital and traditional assets alike, AI ensures portfolios stay optimized, even in rapidly changing conditions.

Advanced Risk Mitigation

Machine learning models analyze financial indicators, economic patterns, and market sentiment to detect potential risks in the early stages. AI-powered platforms help investors proactively manage exposure, whether in stocks, bonds, or crypto exchanges, safeguarding assets from unexpected downturns.

Finance Applications & AI Use Cases in Portfolio Management

Financial leaders are outpacing others in AI adoption, using the technology more than three times as often. The gap is striking across all finance areas — 88% of big companies have adopted AI in portfolio management and accounting.

Businesses are looking for solutions to automate routine activities, empowering finance teams to focus on strategic objectives. On average, they have six AI use cases — nearly twice as many as others.

Now, let’s take a look at some portfolio management AI use cases found in both small and large businesses.

AI-Powered Asset Allocation

AI optimizes asset allocation by analyzing historical data, market trends, and risk factors. At the same time, machine learning models dynamically suggest the ratio of equity, bonds, and other assets to maximize returns while maintaining risk exposure.

For example, Wealthfront’s algorithms craft individualized asset allocation strategies for its customers, balancing their investments based on risk profiles and future goals.

Risk Assessment and Management

AI in portfolio management for businesses reliant on sensitive data identifies and responds to market, credit, and liquidity risks with unmatched accuracy. ML modules predict potential crises through historical patterns, while stress testing detects vulnerabilities in portfolios ahead of time.

BlackRock’s AI tool, Aladdin, helps asset managers globally detect early-stage financial risks and assess portfolio resilience under various economic scenarios.

Predictive Analytics for Early Risk Detection

As a valuable subset of AI, machine learning refines predictive models for stock prices and asset performance over time. AI continually adapts as new data is introduced, ensuring forecasts remain accurate and actionable.

For instance, Kensho Technologies creates predictive analytics models to project asset trends, aiding investment firms in their decision-making processes.

Automated Trading and Robo-Advisors

Advanced AI-managed portfolios within trading systems execute trades based on predefined conditions, outperforming human limitations in speed and efficiency. Robo-advisors use data to develop custom recommendations tailored to individual investors.

Providers like Betterment and Wealthsimple provide robo-advisory services, guiding investors with personalized strategies based on their financial goals and risk tolerances.

Sentiment Analysis for Market Trends

Portfolio management AI analysis parses news articles, social media platforms, and financial reports to assess market sentiment. This insight helps managers predict potential price fluctuations driven by public perception.

Dataminr is used by financial firms to spot breaking news and identify market-moving trends in real-time.

Predictive Analytics for Investment Decisions

Many companies employ AI in portfolio management to refine predictive models for stock prices and asset performance. Artificial intelligence gradually adapts as new data is introduced, ensuring forecasts remain relevant and actionable.

Goldman Sachs creates predictive analytics models within their Marcus Invest platform to project asset trends. This lets investors stay on track with their financial vision while minimizing risk and maximizing returns.

Fraud Detection and Compliance

Artificial intelligence portfolio management systems monitor transactions to detect anomalies, flag potential fraud, and ensure regulatory compliance. By leveraging ML, these systems recognize suspicious patterns — such as unusual transaction volumes, rapid fund transfers, or deviations from a customer’s typical behavior — before they escalate into financial loss.

PayPal uses AI-powered fraud detection systems to process millions of transactions daily while ensuring security and compliance. This mitigates financial crime by identifying irregular activities before they result in loss.

ESG (Environmental, Social, Governance) Investment Optimization

The rising demand for sustainability and responsible investing has led to the rise of ESG investments. AI evaluates companies against environmental, social, and governance criteria, optimizing portfolios to align with investors’ ethical goals.

Fact Set has adopted AI for portfolio management to additionally analyze ESG data, helping firms incorporate sustainability metrics into their investment strategies.

Implementing AI in Portfolio Management: Challenges & Tips

AI is changing the game in asset management, offering speed, accuracy, and data-driven insights that can enhance investment strategies.

Still, integrating AI in portfolio management isn’t without its hurdles. Financial professionals need to be mindful of key challenges to ensure a smooth and responsible adoption.

Data Privacy and Security Concerns

AI thrives on data, but when that data includes sensitive financial information, security is a top concern. With the financial sector being the third-most targeted after public administrations, the risk of breaches, cyberattacks, and regulatory violations is real.

To counter this, you need to work with developers that implement strong encryption, access controls, and continuous monitoring. Cybersecurity training for staff and strict compliance with financial regulations are also essential to protect both investors and institutions.

Over-Reliance on AI Models and Potential for Errors

The fact that AI-managed portfolios process market data in seconds doesn’t mean they’re infallible. Relying too much on automated decision-making can backfire, especially in unpredictable market conditions or black swan events.

Transparency is key — investment managers should understand how the models work and maintain human oversight to catch errors, biases, or gaps in the data.

Ethical Considerations in AI-driven Financial Decisions

AI can sometimes unintentionally favor certain investors or create market imbalances. Biased algorithms, unfair risk assessments, or opaque trading strategies can lead to ethical dilemmas.

To mitigate this, prioritize fairness in AI app development, ensuring their models don’t disadvantage specific groups or manipulate market dynamics.

Why Choose Acropolium?

Recognized as one of the best AI development companies, we know how crucial trust and reliability are in the financial world. With years of experience, Acropolium specializes in delivering secure, high-quality solutions tailored to the needs of the fintech industry.

We prioritize data protection at every step, ensuring all our software meets GDPR requirements and aligns with the strictest industry standards. Whether it’s building custom scalable tools or migrating your financial systems to the cloud, our ISO-certified practices guarantee performance you can count on.

Acropolium Case Studies

In the last 6 years, we have been trusted by over 30 clients with projects ranging from AI-powered portfolio management to financial analytics tools. Having delivered measurable results, we’d like to share some of our clients’ success stories.

AI-based Portfolio Management Software

A financial services company sought a portfolio asset management tool with features for improved project visibility, budget and resource management, and risk mitigation.

Solution

We developed a tailored AI portfolio management platform designed to breathe transparency into workflows and enhance decision-making for the client:

Centralized access to key metrics, project statuses, and financial data for real-time visibility.

Automated features improved efficiency by optimizing resource use.

Built to support growth with additional projects, users, and datasets.

Analytics and scenario modeling identified and mitigated potential risks.

Results

30% improvement in project visibility and monitoring efficiency.

25% better access to financial metrics.

17% boost in workforce productivity.

80% of risks proactively addressed with advanced tools.

Anti-money Laundering Tool

A growing digital bank required advanced anti-money laundering (AML) software to ensure compliance and secure transactions as it expanded its services.

Solution

We implemented a cutting-edge AML system powered by AI and machine learning to elevate security and digitize operations:

Leveraged AI to improve accuracy and minimize manual oversight in identifying illicit activities.

Strengthened risk management with early threat detection and prevention of potential losses.

Developed to auto-generate reports and accelerate regulatory response.

Automated processes to reduce costs and allow staff to focus on high-priority cases.

Results

Improved reporting efficiency by 20%.

Enhanced fraud detection accuracy by 45% with fewer false positives.

Reduced fraud-related losses by 75%.

Final Thoughts

AI-driven portfolio management shapes the new ways how the financial sector operates with its exceptional automation and risk-assessment capabilities. From optimizing asset allocation to improving fraud detection and compliance, AI tools foster smarter decisions and streamline workflows. However, challenges like data security and ethical concerns highlight the need for experienced partners in implementation.

Acropolium is here to make this journey easier for you. We cooperate with businesses that require financial transparency and efficiency, be it healthcare, transportation, hospitality, or fintech.

Strengthening compliance, we empower companies to embrace AI for long-term success. Contact us and explore our subscription-based cooperation format to discover new opportunities for your growth!

![4 Benefits of Custom Accounting Software [+Case study]](/img/articles/custom-accounting-software/img01.jpg)

![Learn how [Online Payment Processing Software] works and how to process online payments on website](/img/articles/how-to-process-online-payments/img01.jpg)

![Why Invest in Cryptocurrency Wallet Development [2025 Guide]](/img/articles/investing-in-cryptocurrency-wallet-development-cost-and-benefits/img01.jpg)

![Top AI Applications in Finance for 2025: [Benefits & Success Stories]](/img/articles/artificial-intelligence-applications-in-finance/img01.jpg)

![Conversational AI for Banking: [Use Cases for 2025]](/img/articles/conversational-ai-in-banking/img01.jpg)