- Software Development

- Consulting (technology stack and cloud selection, architecture)

- Data Analytics

- Legacy System Modernization

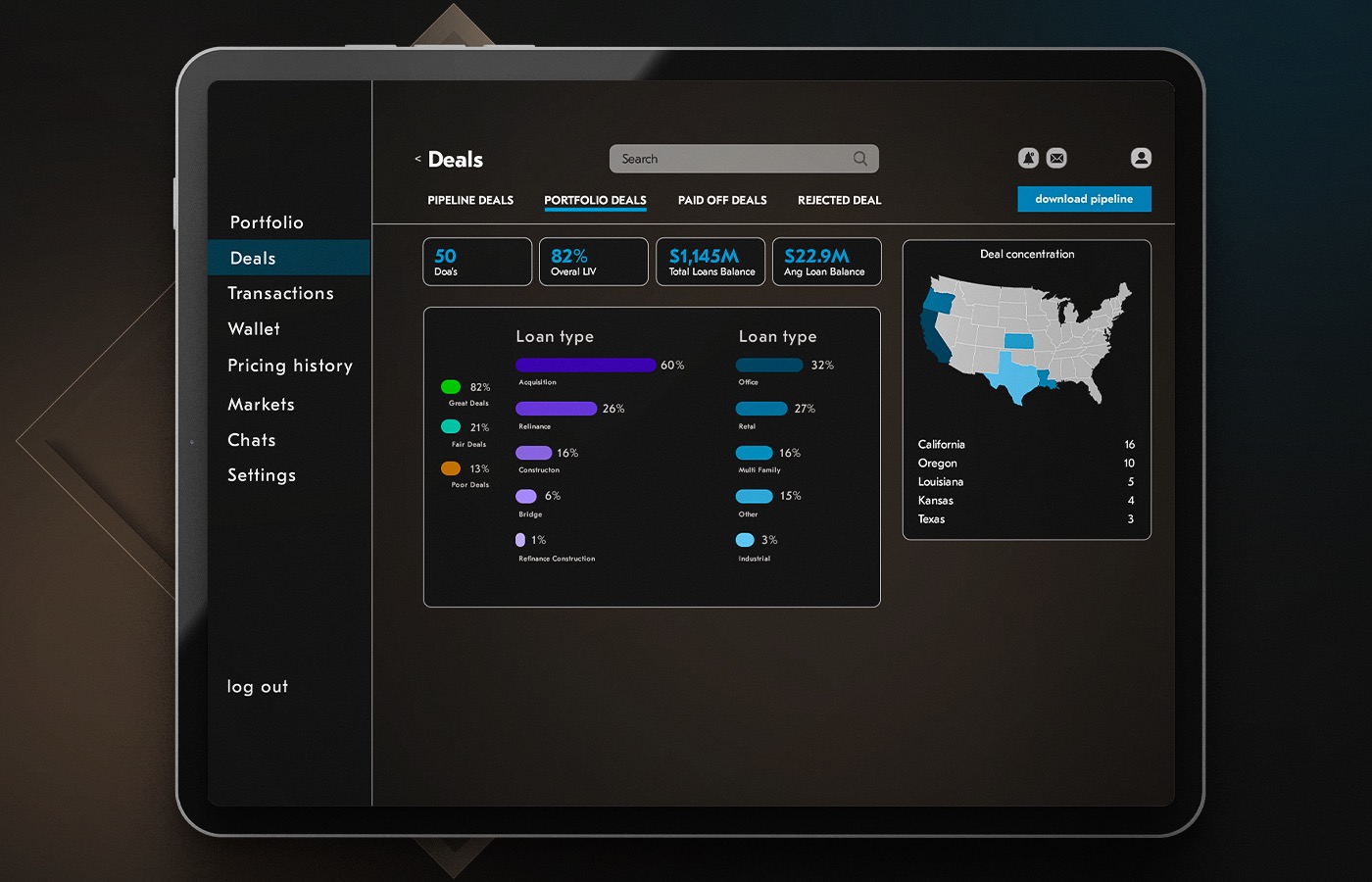

Building portfolio asset management software with robust project management tools. Creating a user-friendly dashboard for better project visibility. Developing a resource allocation module to enhance the management of budget and personnel. Implementing risk assessment and mitigation capabilities for a systematic approach.

client

NDA

Austria

74 employees

Our client is a financial services firm serving companies across international borders. It offers diverse solutions to various customer segments, including individuals, businesses, and institutional clients. Key services include investment management, wealth advisory, insurance, and lending.

request background

Portfolio Intelligence Tool for Advanced Project Management Capabilities

As the company expands operations and services, its portfolio of projects naturally grows in size and complexity. The rising difficulty of portfolio management requires more sophisticated strategies to ensure successful execution and delivery.

The financial industry is characterized by rapid changes in regulations, market conditions, technology, and customer preferences. The company operates in this dynamic environment where unforeseen events affect project priorities, timelines, and resource allocation. Managing projects demands flexibility, adaptability, and proactive risk management strategies.

Efficient project management is crucial for the client to deliver projects on time, within budget, and according to quality standards. The company needed to adopt modern project management methodologies, tools, and best practices.

By having real-time visibility into project progress, performance metrics, and resource allocation, decision-makers could prioritize projects based on strategic importance, risk factors, and potential returns.

Also, optimizing the overall performance of the project portfolio was important. This involved maximizing project success rates and return on investment, minimizing risks, and ensuring alignment with organizational goals and client expectations.

challenge

Scalability, Resource Optimization, and Risk Management Challenges of Portfolio Asset Management System Development

The client faced several challenges with its existing project management processes.

The project management processes in the company were manual, meaning they heavily relied on human intervention and traditional methods. This led to inefficiencies, errors, and delays in project execution. Resources spent on project scheduling, task assignment, progress tracking, and reporting could be better utilized elsewhere.

At the same time, current project management processes lacked the necessary tools for effective decision-making, resource optimization, and risk management.

Another challenge was decentralized project management — different teams or departments had their own ways of handling projects. As a result, the company dealt with inconsistencies, duplication of efforts, and difficulties aligning project objectives with overall business goals. To prioritize projects effectively, the client required a unified approach.

Due to limited real-time access, the firm struggled with tracking project progress, identifying issues, and assessing overall health. Resources like budget and workforce were not allocated optimally across projects. It was important to balance competing priorities and maximize the utilization of available resources.

Without scalable project management practices in place, our client faced constraints in its ability to take on new projects or expand its business operations effectively. Effective risk management was also essential for mitigating cost overruns, schedule delays, scope creep, or external factors.

goals

- Implementing a real-time, centralized visibility system for the entire portfolio asset allocation software.

- Creating an investment portfolio management system with a user-friendly dashboard highlighting key metrics, project statuses, and financial data.

- Developing a resource allocation module to tackle inefficiencies in resource management based on project priorities, skill sets, and timelines.

- Designing the investment asset management software with a scalable architecture.

- Integrating a robust risk assessment and mitigation tool providing a systematic approach.

solution

Investment Analysis and Portfolio Management Software with Intuitive Interface and Modules for Process Automation

.NET 6, Angular 13, Material Angular 12.2.13, Azure services (Frontdoor, App Services, App Configuration, Blob storage etc)

14 months

5 specialists

Our developers successfully addressed the client's challenges and delivered efficient wealth management investment software.

The investment portfolio management tools required creating a centralized and user-friendly dashboard with simple navigation and intuitive design. Now, stakeholders access key metrics, project statuses, and financial data with ease. Through customizable features and real-time updates, users monitor project progress, identify trends, and make informed decisions promptly.

Additionally, our team integrated a resource allocation module considering project priorities, skill sets, and timelines. The module optimizes resource utilization through automated processes and intelligent algorithms, mitigates conflicts, and minimizes wastage.

Furthermore, the portfolio allocation software was designed with a scalable architecture. The architecture is flexible and adaptable, scaling seamlessly to support a growing number of projects, users, and data volumes.

Scalability ensures that the investment portfolio analysis software remains responsive, reliable, and efficient, even as the organization expands its operations and undertakes larger projects. At the same time, future enhancements and updates can be implemented without disrupting existing functionalities.

Also, we embedded robust risk assessment and mitigation capabilities within the investment portfolio analysis tool. They employ advanced analytics, algorithms, and scenario modeling techniques to identify, assess, and prioritize risks across the project portfolio. Now stakeholders can track risk exposure, assess potential impacts, and develop mitigation strategies.

- Investment allocation software with a scalable architecture to support the growing client needs.

- A centralized and user-friendly dashboard with real-time updates, customizable features, and easy navigation.

- Resource allocation module with intelligent algorithms and visualization tools for process automation.

- Investment risk management tools employing advanced analytics, algorithms, and scenario modeling techniques.

outcome

Wealth Portfolio Management Software for Better Project Visibility and Risk Mitigation

- Improved visibility into project statuses and timelines by 30%.

- Centralized access to financial metrics increased by 25%.

- Achieved a 30% reduction in the time required for real-time portfolio monitoring.

- A 17% increase in overall workforce efficiency and productivity.

- A 25% increase in the accuracy of strategic decisions.

- Proactively identified and addressed 80% of potential risks.