- Software Development

- Legacy System Modernization

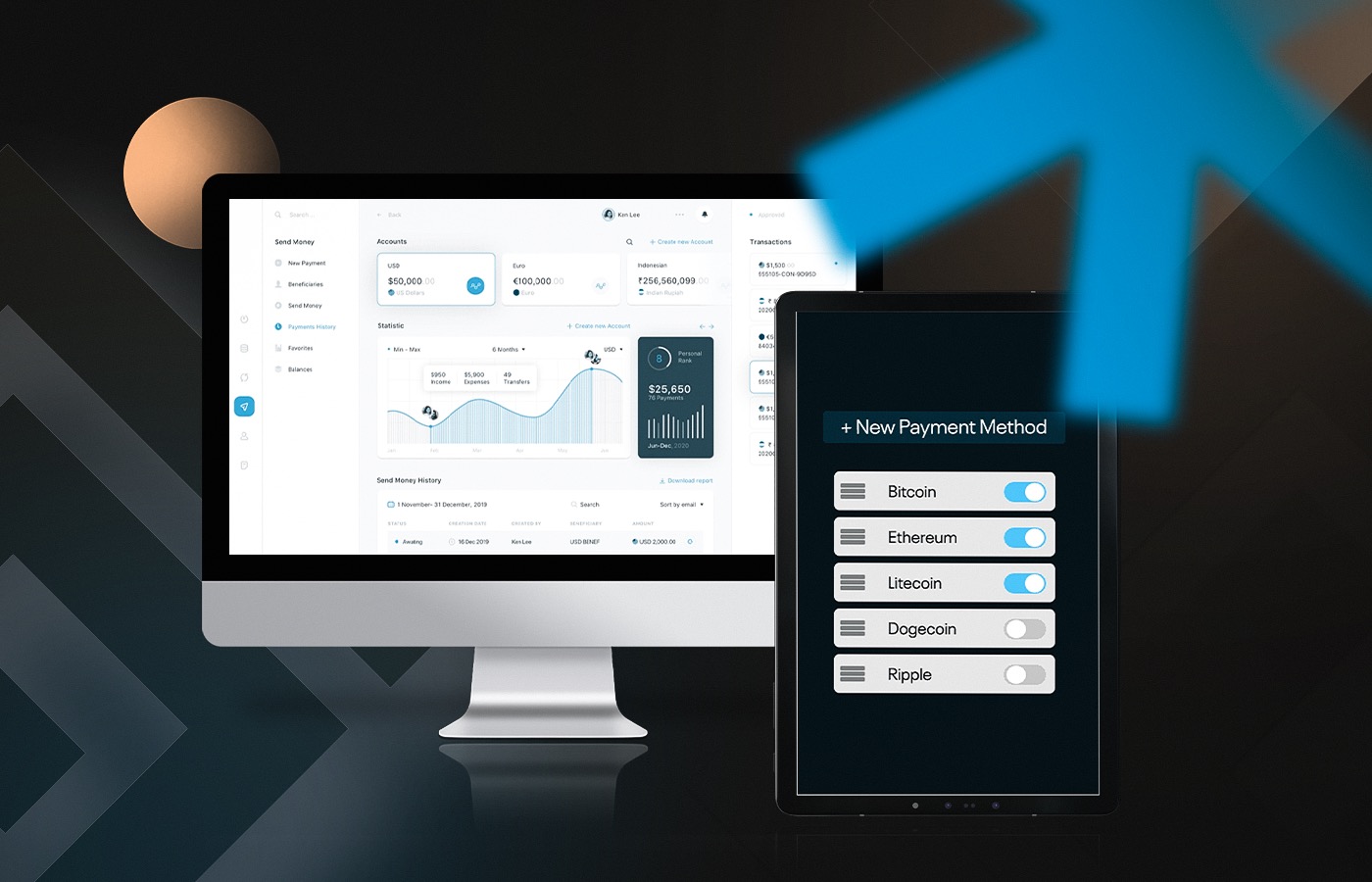

- Payment Systems

Architecture enhancement that unites distributed systems. Improvement of payment software solutions security through the development of anti fraud protection. Crypto payment platform integration.

client

NDA Protected

United States of America

1000+ employees

This leading real time payments system helps businesses securely accept, manage and process payments, as well as manage risk and fraud. The enterprise operates in 30+ countries and constantly expands its portfolio of services and industries it works in. It operates on all continents, creating effective international and local solutions.

request background

Fintech software development to improve reliability, security, and performance

The main responsibility of any FinTech company is to provide a high-quality, fast, uninterrupted service regardless of traffic volume. The client asked us to upgrade the architecture in order to improve transaction processing reliability. The digital payments platform had to be scalable and accommodate the growing stream of data.

Another crucial aspect concerns transaction security, which should not decrease with time and new fraud schemes. So, the company also required an ML-based anti-fraud solution to automate transaction screening and instantly detect suspicious activity.

And since a modern FinTech partner cannot stay away from market trends, they decided to improve its payment processing system software with cryptocurrency connectors. It would help the company stay competitive, enriching the experience of existing clients and attracting new ones.

challenge

Custom software development for payment platform with distributed systems

Thorough diagnostics helped us to identify two main issues to fix through payment platform development.

The first issue was the distributed system architecture. A modern backend is impossible without it, as it is a common way to maintain productivity in spite of scaling challenges and possible system failures. However, as with any open system, it comes with security risks.

Also, distributed systems are challenging to maintain and troubleshoot and require reliable digital payment software. The primary task was to choose a convenient framework and technology for data exchange and then build a unified infrastructure.

The second problem was the client's use of third-party anti-fraud verification tools. The company did not have complete control over the process, which made it more vulnerable to certain types of cyber threats. Also, outsourcing anti-fraud solutions could not guarantee complete data confidentiality in digital payment gateways, which is a crucial requirement for a FinTech vendor with a good reputation.

solution

The complex approach in payment software development

Next.js, .NET, Azure, DockerHub, Kubernetes

Ongoing

6 specialists

The client asked us to improve the reliability and performance of the real time payment management software. To begin with, we migrated the client software to the Microsoft Azure cloud platform to ensure easy access to the essential services.

As for the architecture improvement, we unified distributed systems based on ASP.NET Core 7 and apply gRPC as the communication protocol between internal services. It helped speed up data transfer and secure the API using HTTP / 2. For the digital payment application front-end, we used Next.js. It improves user experience by pre-rendering pages and helps company attract more users by offering enhanced SEO capabilities.

To identify, monitor, and prevent fraud, we developed a flexible algorithm and trained predictive models using available data. We operated Azure Event Hubs and Stream Analytics for our digital payment system project.

As a result, we got a real-time transaction monitoring program. It allows the company to identify hidden correlations between customer data and behaviour, make decisions faster, and reduce the amount of manual work as well as the number of verification steps for the users.

Also, we added cryptocurrency connectors to the client's digital payment processing system. To ensure the security of the process, we developed them ourselves.

- Built a technological framework based on .NET. Our dedicated team created an infrastructure to support distributed application development and execution.

- Developed and trained an anti-fraud system based on ML to make digital payment solutions safer.

- Created a cryptocurrency component of the real time payment processing system. Developed connectors for such cryptocurrency exchanges as Binance, Coinbase, and others.

outcome

Reliable and convenient platform for digital payments solutions

- More storage and processing power with a smart architecture using Microsoft Azure cloud services. Today the real time payment system serves about 5,000 corporate clients.

- Convenient UX and accelerated data processing helped the company improve customer engagement by 28%.

- The number of new digital payments software users increased by 36%.

- Proprietary ML-based anti-fraud system correctly detects over 96% of fraud across all transactions.

- Digital payment processing solutions with the ability to use popular cryptocurrencies in line with market trends.