Key Takeaways

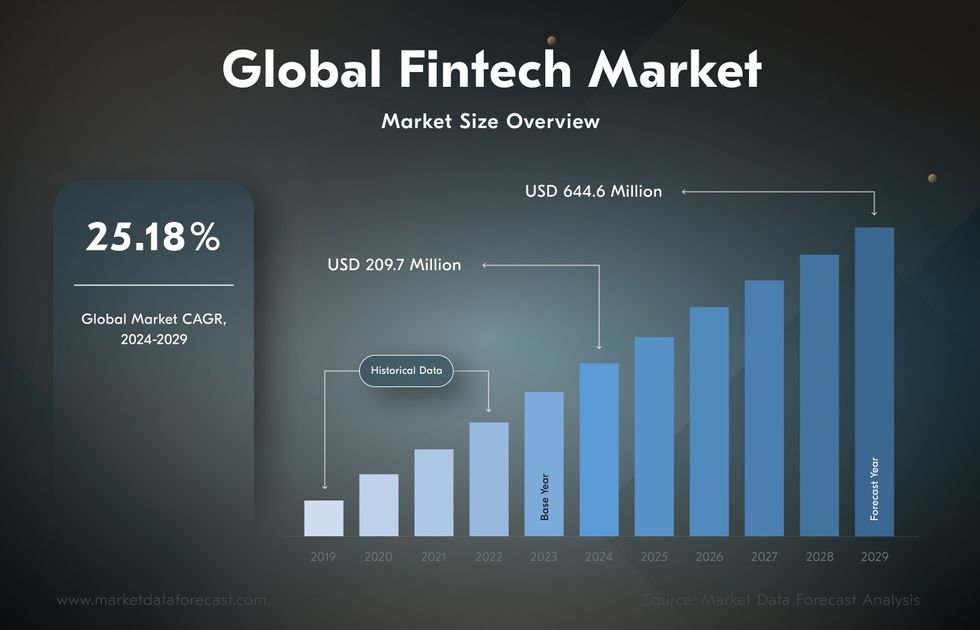

- The rapid adoption of advanced fintech technology trends has made a significant impact. From $280B in 2025, the global fintech market is projected to grow to $1,382B in 2034.

- Key fintech trends encompass embedded and decentralized finance, digital and open banking, AI and machine learning, blockchain and cryptocurrencies, and cybersecurity and compliance.

- Implementing blockchain with financial services could reduce banks’ infrastructure costs by 30%, saving more than $10 billion annually.

- By investing in modern technology in finance industry operations, Acropolium’s clients improved financial data accuracy by 95%.

The finance sector is increasingly digital, with technology and financial services now closely linked. Fintech leads global investment, boasting over 30,000 startups worldwide. Emerging technologies are transforming areas from retail banking and education to investment management and fundraising, driving innovation and fueling strong growth across the market.

The growing adoption of advanced technologies in finance operations has shown an impressive impact. Valued at $280B in 2025, the global fintech market is estimated to reach $1,382B in 2034. Today, we want to shed more light on the trends that contribute to such market dynamics.

Delivering high-end fintech software solutions for 5+ years, Acropolium has explored and implemented numerous financial technology trends to elevate our clients’ operations. Dive in for an expert trend overview with real-world examples, benefits, and our own success cases!

The Top 10 Financial Technology Trends

Some tech practices are well-established, while others are emerging, and they still have fresh statistics on their implementation record. To identify those shaping 2024, we researched and evaluated many disruptive finance technology trends.

According to our findings, top trends in fintech include embedded and decentralized finance, digital and open banking, AI & ML, blockchain and cryptocurrency, and cybersecurity and compliance.

Now, let’s delve deeper into each of them.

Artificial Intelligence (AI) and Chatbots: Personalized Financial Services

The popularity of AI has spread across various industries, having become an irreplaceable technology trend in logistics, hospitality, and healthcare operations. As for its role in the fintech sector, it has hit a value of $115.4B in 2025 and is expected to reach $250.98B in 2029.

In 2025, chatbots and AI-powered virtual assistants have become game-changing tools for efficient management of balance inquiries, payment processing, and account updates. AI’s algorithms are also trained to provide fraud detection, credit risk assessment, customer service automation, and personalized financial advice.

Speaking of customer service: advanced solutions like robo-advisors and bots examine user behavior and turn the derived insights into tailored investment strategies. That’s why data quality and integrity are the primary business focus of one of our partners.

Having implemented AI technology in fintech operations contracting software, the large enterprise reduced contract review times by 75%, lowering operational costs.

Embedded Finance: Smooth Financial Integrations

Embedded finance refers to integrating financial services or tools directly into the products and services of non-financial companies. It’s used by companies for payment processing, lending, insurance, or investment operations.

This technology in finance allows different businesses to provide fiscal services seamlessly within their existing user experiences, improving customer engagement and creating new revenue streams. Thus, the embedded finance market is expected to grow by 148% by 2028.

That’s how Amazon, a global e-commerce leader, offers product insurance options directly at the point of purchase and simplifies the process for customers.

Digital Banking and Neobanks: Secure and Personalized Experiences

The digital banking sector has seen significant growth and transformation. With the adoption of banking industry technology trends, the neobanking market is projected to reach 386.30 million users by 2028.

Neobanks leverage technology to streamline operations and improve customer experiences. They offer swift account onboarding through mobile applications, secure transactions with robust encryption, and personalized banking experiences using data analytics and AI.

These innovations attract tech-savvy customers and those seeking more efficient banking options compared to traditional banks.

For example, Ally Bank stands among the most successful adopters of financial services technology trends. As an online-only bank known for its high-interest savings accounts, it provides users with competitive loan rates on a user-friendly digital platform.

Sustainability in Finance: Ethical Investments

This year, financial institutions will face growing pressure to support green initiatives like renewable energy projects, recycling programs, and carbon footprint reduction. Customers are increasingly aware of the environmental impact of their financial decisions, prompting banks to prioritize sustainable practices and transparency.

Therefore, the sustainable finance market is set to soar, reaching $18.8 trillion by 2029 with a 22.8% CAGR.

This trend drives partnerships with sustainable products, such as ESG-focused funds and renewable energy investments. Institutions must disclose transaction-related energy usage and carbon emissions, enabling informed customer choices.

For instance, Yayzy, a London-based startup, developed a mobile app that calculates users’ carbon footprints by analyzing their spending habits. It connects to bank accounts via Open Banking to generate personalized carbon emission data and suggests eco-friendly alternatives.

Cybersecurity and Data Protection: Protected Assets & Customer Trust

Despite the major impact of technology on financial services, the further businesses go with digitization, the more risks they’re exposed to. Fintech companies face various cyber threats and prioritize securing networks, systems, and data against unauthorized access, attacks, and breaches.

AI introduces growing cyber risks, with increasingly complex threats demanding robust risk management. In 2025, investments in advanced tools, infrastructure, and fraud detection will be vital as financial institutions explore generative AI.

According to a 2024 cybersecurity benchmarking survey, fintech businesses highlight payment fraud and email compromise (70%), ransomware attacks (67%), and client data threats (52%) as the biggest risks.

To address such threats, companies increasingly align with standards like DORA (Digital Operational Resilience Act). The protocols set stringent requirements for risk management, incident reporting, and operational resilience across the financial.

This framework helps ensure that fintech organizations can withstand and recover from cyberattacks without compromising operations.

That’s why Square, a fintech platform, encrypts payment data from the point of transaction through its secure infrastructure, ensuring data remains protected. Also, by using encryption technology in finance industry services, Robinhood monitors user accounts in real time for suspicious activities and sends alerts for unusual activities.

Open Banking and APIs: New Revenue Streams through Innovation

As one of the biggest technology trends in banking, open banking has seen substantial growth in 2024, with over 100 billion APIs accessed globally. Open banking allows third-party financial service providers access to consumer transactions, and other economic data from banks and financial institutions through APIs.

Facilitating greater financial transparency and providing more control over their financial data, such systems can integrate with other finance-oriented and accounting tools.

Moreover, APIs in open banking are designed with high-security standards to ensure that data sharing is secure and compliant with GDPR and other regulations. Tink, a European open banking, offers account aggregation, payment initiation, and data enrichment services to over 3,400 banks via APIs. Among their clients, you can see giants like PayPal, BNP Paribas, and Klarna.

Green Banking: Attracting Eco-conscious Customers & Investors

The term green banking refers to environmentally friendly banking practices that aim to reduce the ecological footprint of financial institutions and promote sustainable development.

Embracing emerging technologies in fintech, banks encourage paperless banking to reduce paper consumption through digital banking services, online banking, electronic statements, and mobile apps with guiding chatbots.

For instance, the British HSBC bank has committed to providing $100 billion in sustainable financing and investment this year. They offer green loans for projects that support renewable energy, energy efficiency, and other environmentally sustainable initiatives.

Blockchain and Cryptocurrencies: Safe & Transparent Transactions

Fintech companies implement cryptocurrencies through various methods and applications, leveraging blockchain technology for financial services, including crypto exchange, e-wallet solutions, and payment processing.

Blockchain, also known as a distributed ledger, records each transaction in a unique block that links to previous blocks in the network. It’s accessible to all parties and ensures transparency and security in financial operations.

In fact, the blend of blockchain technology and financial services has the power to cut banks’ infrastructure costs by 30%, saving over $10 billion annually.

However, banks aren’t the only businesses that can benefit from this digital innovation. After adopting blockchain for a crypto-asset platform, our client saw a 15% revenue increase and a 22% growth in their customer base.

Decentralized Finance (DeFi): Financial Inclusivity

Also known as DeFi, decentralized finance represents a significant shift towards a more open, transparent, and inclusive financial system. It’s an umbrella term for financial applications and services built on blockchain technology. Particularly operating on the Ethereum blockchain, this technology in finance aims to recreate and improve upon lending, borrowing, investing, and trading.

Such platforms offer open access to anyone with an internet connection and a cryptocurrency wallet, breaking down traditional financial barriers. Transactions are recorded on public blockchains for transparency and auditability, allowing verification of smart contract execution and fund movements.

Additionally, many DeFi protocols are interoperable, enabling users to combine services and create complex financial products. And crypto exchange platforms like Uniswap and Sushiswap get the most out of it, offering users direct trading, with no intermediaries.

Machine Learning (ML): Improved Predictive Analytics

Going hand in hand with AI as its subset, machine learning algorithms also offer a staggering number of use cases across global sectors. The ML technology and financial services meet when businesses need to analyze extensive data to make informed decisions and improve operational efficiencies.

Businesses apply machine learning to ensure consistent data processing and maintenance of its quality. Thus, our client who has been breathing technology in the finance industry operations approached us to develop a data monitoring tool. As a result, the company achieved a data accuracy rate of 95%, improving business scalability by 200%.

RegTech (Regulatory Technology): Streamlined Compliance

The rise in fraudulent activities, particularly in the financial sector, is expected to drive the growth of the regulatory technology market. As financial crimes get more sophisticated, organizations require robust RegTech solutions to help risk and compliance teams manage regulatory challenges and mitigate breaches effectively.

Given the stringent and complex regulatory landscapes, automating compliance processes is becoming a top priority. RegTech solutions leverage the abovementioned financial technology trends like AI/ML and blockchain to streamline regulatory compliance and reduce legal risks.

Why Choose Acropolium?

Acropolium is an experienced software development partner with a proven record of delivering secure and innovative solutions to the fintech industry. We specialize in building compliance-ready platforms, adhering to regulations like GDPR and ISO-certified processes to ensure robust data security and regulatory compliance.

Whether it’s creating custom fintech applications, modernizing legacy systems, or implementing advanced algorithms, our dedicated teams enhance your operations with scalable, efficient, and intelligent solutions.

Acropolium Case Studies

With extensive expertise in delivering blockchain-powered solutions across global industries, including fintech, healthcare, hospitality, and logistics, we have a wealth of success stories to share. Let’s explore one of our most impactful fintech projects!

AI-based Data Quality & Data Profiling Tool

A top fintech firm sought automated data profiling, commissioning a new tool for data quality assurance and categorization. The tool was supposed to automatically gather, categorize, and allocate data while ensuring its integrity for valuable insights.

Solution

- The development team established standardized processes and frameworks for real-time data quality monitoring, identifying and tracking issues via dashboards and configuring alerts for immediate notification of changes.

- The system design was optimized for future growth and fluctuating data inflow and structured for horizontal scalability to manage increasing volumes without performance degradation.

- The real-time data quality monitoring tool promptly identifies and flags data quality issues.

- We used a proactive ML-based approach to ensure swift corrective actions to prevent inaccurate data spread.

- The scalable data quality tool and profiling software architecture include customizable features for modifying incorrect data detection settings.

Results

- Data errors decreased by 40%, achieving a final data quality rate of 95%.

- Additionally, data processing time was reduced by 30%.

- The client now processes up to 30 terabytes of data daily, showing a 200% improvement in scalability.

Final Thoughts

Whether growing or emerging, IT trends in the fintech industry broaden business horizons, presenting new disruptive opportunities to financial operations. When applied right, each of them can become a game-changer for your revenue and client experience — and Acropolium is here to make it real.

From MVP development for fintech startups to agile product deployment with microservices architecture, Acropolium prioritizes your business goals and compliance. As an ISO-certified vendor crafting GDPR-compliant solutions, we give life to software that maintains data integrity.

With your budget in mind, we offer flexible pricing models, including a subscription-based model with predictable costs and smooth workflow. Get in touch today, and let’s revolutionize your financial endeavors!

![Top AI Applications in Finance for 2025: [Benefits & Success Stories]](/img/articles/artificial-intelligence-applications-in-finance/img01.jpg)

![Blockchain in Finance: [Use Cases Revolutionizing Finance in 2025]](/img/articles/blockchain-in-finance-use-cases/img01.jpg)

![Conversational AI for Banking: [Use Cases for 2025]](/img/articles/conversational-ai-in-banking/img01.jpg)

![4 Benefits of Custom Accounting Software [+Case study]](/img/articles/custom-accounting-software/img01.jpg)

![AI in Portfolio Management: Use Cases & Benefits [2025 Guide]](/img/articles/ai-for-portfolio-management-use-cases/img01.jpg)