AI agents are being deployed faster than organizations know how to value them. Teams see dramatic jumps in throughput and speed, yet financial outcomes are often reported vaguely or retroactively. The core challenge is: AI agents don’t behave like software or like people. Their output scales elastically, their cost curves move with usage, and their contribution varies based on workflow design, data quality, and how much autonomy they’re given.

AI agents change the unit economics of work. They adjust who performs tasks, how work is sequenced, and where cost concentrates in the operating model. AI sales agents with the highest ROI reduce the marginal cost of execution toward near-zero in some workflows, while introducing new recurring costs in model inference, monitoring, and governance.

When organizations understand that, when they model the economics at the level of the unit of work rather than the job role, ROI becomes measurable and defensible. If AI agents are to move from pilot to production, the economics must be clear. The following sections show how to make them clear.

How to define and measure work, cost, and impact of AI agents

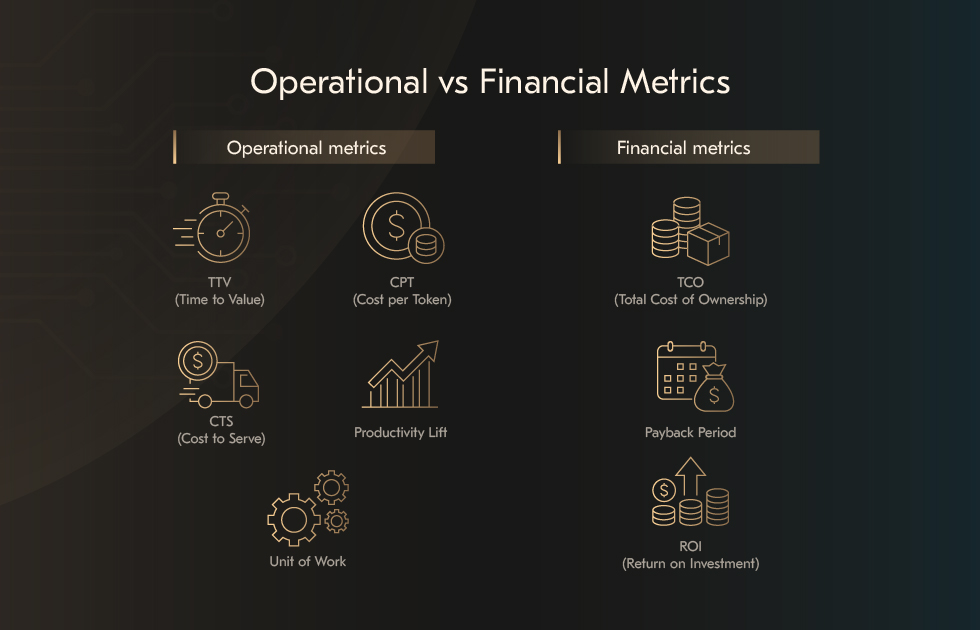

A defensible financial model depends on having precise operational definitions. Without clear units and value anchors, it becomes difficult to calculate TCO, forecast savings, or demonstrate ROI to finance stakeholders. The metrics below form the basis of an auditable and repeatable economic model for AI agents.

Operational metrics

A unit of work is the smallest discrete outcome the agent is expected to complete end-to-end. It is not a click, prompt, or chat turn; it is completing a task with a defined outcome, such as resolving a ticket, qualifying a lead, processing a transaction, or generating a contract draft.

CPT (Cost per Token)

For models priced on usage, CPT represents the cost associated with each token processed during inference. It forms the basis of the variable model consumption cost. CPT must be tied to the number of tokens required to complete a unit of work.

CPT = TCO / tasks per period

CTS (Cost to Serve)

Cost to serve represents the total cost required to complete one unit of work, regardless of whether a human, an agent, or a hybrid workflow performs it. CTS is the anchor for cross-comparing human and agent efficiency and is the primary denominator for demonstrating economic value.

Productivity Lift

Productivity lift measures the additional capacity unlocked when routine tasks are shifted from humans to agents. It is expressed as increased throughput, reduced task duration, or percentage of workload absorbed. Productivity lift should be tied directly to units of work completed, not broad time-savings assumptions.

Time to Value (TTV)

Time to value measures how quickly the first measurable business impact appears after deployment. It reflects the maturity of workflows, data availability, and the ability to integrate agents into existing operational systems. Faster TTV is achieved when the unit of work is well-defined and can be automated without redesigning the entire process first.

Financial metrics

A financial evaluation of agent performance should use standard investment metrics that can be reviewed with finance teams, audited, and compared against alternative automation strategies.

Total Cost of Ownership (TCO)

TCO represents the full cost of owning and operating the agent system over a defined period, typically 12–36 months. It includes implementation, platform and model usage, cloud computing, personnel oversight, retraining, and governance. The shift toward consumption-based AI means a greater portion of cost moves into OpEx, which must be forecasted based on workload volume.

TCO = Implementation costs+operational costs+training and change costs+maintenance and monitoring costs

Return on Investment (ROI)

ROI quantifies the net economic benefit generated relative to the cost of the deployment. For AI agents marketing ROI effectiveness USA, value must be calculated across cost reduction, revenue enablement, productivity lift, and risk mitigation.

ROI = (Benefits − TCO) / TCO

Payback period

The payback period measures how long accumulated benefits will equal the total initial investment. It is a time-based measure that reflects real operational traction.

Payback = Initial outlay / Monthly net benefit

A system that generates a positive payback within 12–18 months is generally considered strong for operational automation programs; revenue-linked agent deployments may justify shorter or longer windows depending on deal cycles.

The financial modeling approach reflects Acropolium’s experience delivering and scaling AI agent systems across retail, hospitality, transportation, and financial operations enterprise environments. The calculations and benchmarks are based on internal delivery data and public research.

How to model the Total Cost of Ownership for AI agents

AI agents typically introduce a consumption-driven cost structure, where value and cost scale with usage. That’s why we need to explain the difference between one-time investments and recurring operational spending.

How to distinguish a one-time investment from recurring cost

Capital expenditure (CapEx) reflects the initial outlay required to establish the agentic environment. It is generally incurred when organizations pursue proprietary development, build custom orchestration logic, or establish dedicated data and integration systems. CapEx increases when differentiation or regulatory control is a priority.

When operating expenditure (OpEx) reflects the ongoing cost of running and improving the system. That consists of model inference, platform subscriptions, cloud infrastructure, and continuous monitoring. This category represents the majority of long-term spend and will be the primary component influencing cost curves as usage scales.

The evaluation of CapEx vs OpEx shapes how quickly the organization can scale, how flexible the system can become, and how cost predictability will evolve.

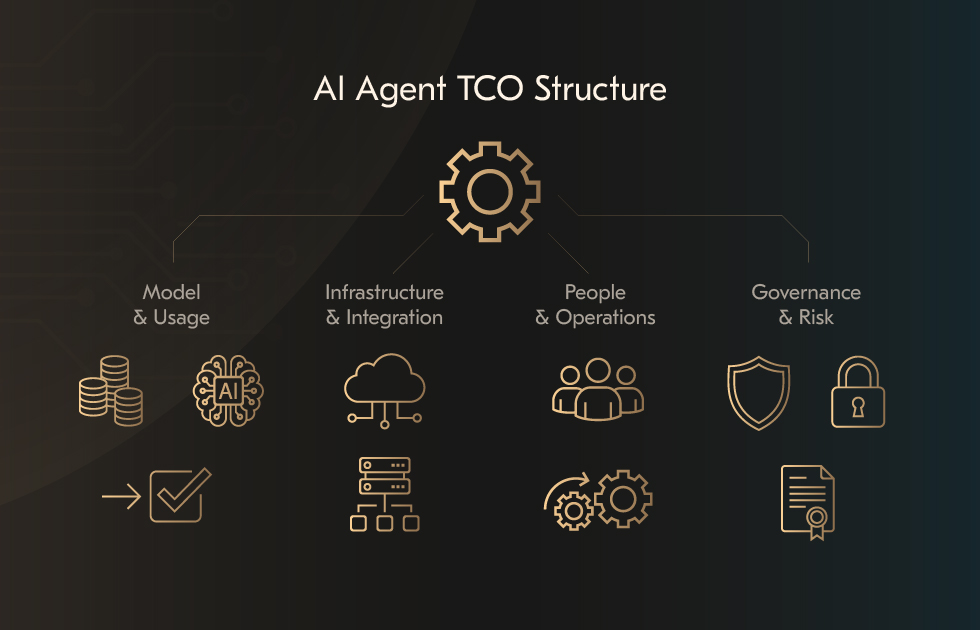

The structure behind an AI agent operating economics

The first dimension is model and usage costs, including inference fees tied to token consumption or per-resolution pricing and subscription or licensing charges for agent orchestration platforms.

The second dimension is infrastructure and integration. This encompasses cloud compute, data transfer, and storage needed to support real-time execution and the API- and event-driven integrations that connect agents to CRM, ERP, finance, ticketing, and knowledge systems.

The third dimension is people and operations. While AI agents absorb repetitive transactional work, they shift organizational effort toward supervision, orchestration, and continuous improvement.

The fourth dimension is governance and risk controls, covering security enforcement, access management, audit logging, compliance tooling, and the observability frameworks required to trace decisions and detect anomalies.

Sample 12-month TCO estimate

This table illustrates a representative 12-month TCO range for a medium-scale AI agent deployment, where agents are integrated into existing workflows and operate in production. Actual costs will vary based on interaction volume, system complexity, and the required depth of governance and observability.

| Cost item | One-off | Monthly | 12-Month Total |

|---|---|---|---|

| Initial setup & integration | $30,000–$75,000 | – | $30,000–$75,000 |

| Platform licensing | – | $6,700–$16,700 | $80,000–$200,000 |

| Model inference | – | $4,200–$12,500 | $50,000–$150,000 |

| Cloud compute & storage | – | $800–$3,300 | $10,000–$40,000 |

| Training & change management | – | $1,700–$4,200 | $20,000–$50,000 |

| Continuous improvement & MLOps | – | $5,000–$10,000 | $60,000–$120,000 |

| Governance, auditability, observability | – | $400–$1,200 | $5,000–$15,000 |

| Total | $30,000–$75,000 | $18,000–$48,000 / month | $255,000–$650,000 |

The typical ROI from AI agents for companies varies with automation depth and volume scale, which is why sensitivity testing is essential. Even small shifts in either dimension can materially change the economic outcome. To illustrate this, the table below shows how the base case ROI changes when we adjust automation depth by ±10 percentage points and interaction volume by ±20%.

| Scenario | Automation rate | Annual automated cases | Net savings | ROI impact |

|---|---|---|---|---|

| Base Case | 50% | 3,000,000 | $13.5M | 575% ROI |

| +10pp automation | 60% | 3,600,000 | $16.2M | ≈680% ROI |

| –10pp automation | 40% | 2,400,000 | $10.8M | ≈440% ROI |

| +20pp volume | 50% | 3,600,000 | $16.2M | ≈680% ROI |

| –20% volume | 50% | 2,400,000 | $10.8M | ≈440% ROI |

What value do AI agents actually create?

Cost reduction and efficiency gains

AI agents change the cost structure of operations, compress cycle times, and release capacity that can be reallocated to higher-value activities. Labor-intensive functions see the most significant impact because their underlying workloads are process-driven and scale linearly when performed manually. AI agents break this linearity by introducing a near-zero marginal cost per additional task handled.

Key value levers include:

Lower cost per transaction or case due to automated task execution

Reduced average handling and processing times across workflows

Higher throughput without requiring proportional staffing increases

Sustained productivity lift as repetitive tasks are removed from human queues

Progressive reduction in operational overhead as inference optimization matures

Revenue growth and customer experience performance

Timeliness, consistency, and follow-through correlate directly with conversion and retention outcomes in sales and service environments. ROI benefits of AI sales agents USA improve these outcomes. When response latency drops and engagement becomes persistent and context-aware, pipelines expand and conversion rates improve, but through availability and relevance.

Key value levers include:

Accelerated lead qualification and outreach, improving conversion efficiency

Expanded pipeline coverage without adding headcount

More consistent follow-up and nurturing sequences

Increased cross-sell and upsell performance through data-driven personalization

Risk mitigation and quality improvement

AI agents improve process reliability where consistency, auditability, and policy compliance are critical. By performing validations, cross-referencing records, and documenting actions automatically, they reduce the likelihood of errors that carry financial, operational, or reputational cost. Reducing exception handling, rework, and compliance remediation creates measurable economic benefit and reduces volatility in cycle outcomes.

Key value levers include:

Higher accuracy and reduction in avoidable errors

More reliable adherence to regulatory and internal control frameworks

Automated traceability and audit-ready activity logs

Increased stability and predictability in process outcomes

Where does ROI actually materialize across AI agent use cases?

The following examples illustrate how ROI results in three distinct operational domains. For a detailed breakdown of how AI agents are applied across industries, from manufacturing to retail to finance, see our industry-specific analysis of AI use-cases in major industries.

Example 1: Support automation

In customer support, most Tier 1 inquiries consist of routine, information-retrieval and status-check tasks. These tasks scale poorly with human teams due to labor costs, training cycles, and scheduling constraints. The expected ROI of AI leasing agents in call centers is reducing cost per interaction, shortening resolution cycles, and eliminating queue latency.

A hospitality use-case of self-service check-in kiosks demonstrates how AI agents affect service workflows and cost structures: check our hotel self-check-in kiosk software.

When a significant share of Tier 1 contacts is automated, labor effort shifts from transactional work to complex case handling. The economic effect is driven by the difference between the cost per human-handled interaction and the cost per AI-handled interaction, multiplied by interaction volume. Primary ROI drivers:

Lower cost per case

Reduced backlog and wait times

More consistent response quality

Ability to serve demand without staffing expansion

Example 2: Sales acceleration

According to McKinsey, in revenue teams, the impact is already measurable: deployments of AI sales agents with the highest ROI and workflow automation report 3–15% revenue growth and 10–20% productivity gains.

During revenue operations, speed and follow-through determine conversion outcomes. Lead engagement falters when response times are long, sequencing is inconsistent, or follow-up cycles depend on individual discretion. AI sales agents highest ROI when they introduce standardized, immediate outreach and persistent follow-up, ensuring every qualified prospect is contacted and nurtured. A real-world application in a hospitality SaaS context can be seen in our SaaS-based AI hotel-management system modernization.

Primary ROI drivers:

Faster response times lead to higher qualification rates

Expanded pipeline coverage without additional sales team hiring

More reliable lead scoring and prioritization

Increased conversion-to-opportunity efficiency

Example 3: Back-office process transformation

Reconciliation, accrual preparation, and document matching often span multiple systems and require manual judgment. AI agents reduce reconciliation effort by extracting, classifying, validating, and aligning records across systems. The financial return comes from reduced close cycles, fewer manual review hours, and higher consistency in reporting quality. Primary ROI drivers:

Reduced cycle time in month-end and quarter-end workflows

Lower rework and correction overhead

Improved auditability and compliance traceability

Reallocation of specialist time to strategic analysis

This ROI model generalizes across formats, including the prospective ROI of AI video agents for businesses supporting multilingual or asynchronous service delivery.

Key operational sensitivities and best practices to manage them

Organizations that manage these sensitivities from the outset gain a decisive advantage: predictable cost performance, accelerated time-to-value, and higher confidence in their ROI models.

1. Data quality and readiness

AI agents amplify whatever data environment they are placed into. Inconsistent, fragmented, or outdated data introduces structural noise that undermines reasoning accuracy and inflates inference and retraining costs. The financial impact is immediate: higher cost per task, increased error correction cycles, and slower realization of benefits. When combined with domain-specific workflows, partnering with Big Data consulting specialists ensures that data pipelines, lineage, and metadata frameworks are production-ready.

2. Governance and autonomy control

Autonomous agents demand governance systems as rigorous as financial reporting. The recent McKinsey report states: despite rapid experimentation, 78% of companies report using AI, over 80% still see no material bottom-line impact. The absence of traceability or role-based accountability introduces risk at operational and compliance levels. Every decision must be logged, auditable, and reversible when agents interact with sensitive data or execute financial-impacting actions.

3. Task complexity and orchestration

Agentic performance declines when workflows exceed bounded reasoning limits. The challenge is structural: multi-step, branching tasks create cumulative error exposure that directly reduces ROI. High-performing programs manage this by decomposing processes into atomic, verifiable tasks connected through orchestration layers or APIs.

4. Workforce readiness and adoption

Human alignment remains the critical dependency in realizing AI value. Ambiguity or lack of engagement leads to underutilization, process friction, and slow adoption. Integrating AI agents into workflows requires role redesign, clear communication about purpose, and new performance indicators.

5. Financial visibility and cost discipline

ROI projections lose credibility when the total cost of ownership is underestimated or fragmented across departments. Token usage, retraining overhead, and monitoring costs often emerge after deployment, distorting financial outcomes. Establishing a unified financial visibility layer transforms AI economics from assumption-based to evidence-based.

How Acropolium recommends addressing these sensitivities for agentic AI

Invest in unified data pipelines, standardized schemas, and validation automation. Data should be treated as a product.

Develop oversight frameworks alongside technical deployment. Assign ownership for ethical, compliance, and financial monitoring.

Design agents for well-defined, repeatable tasks before expanding scope. Use orchestration tools to manage task dependencies.

Train teams on workflow integration, redefine job roles, and build confidence through transparency.

Use real-time dashboards that visualize financial flows, operational throughput, and system efficiency.

How to validate the performance of AI agents?

For any AI agent initiatives, establishing realistic performance benchmarks and managing the time-to-value trajectory are integral. Benchmarks and time-to-value analysis function as continuous validation loops that align financial outcomes with operational progress. The most effective benchmarks balance efficiency, cost control, and value generation.

Operational efficiency

The clearest economic signal of AI impact lies in process acceleration and capacity expansion. Automation reduces cycle times, increases the number of transactions handled per unit, and minimizes idle periods between workflows. These improvements must be captured through metrics such as time-to-resolution, average handle time, and automation rate per process.

Cost optimization

Effective optimization promises lower infrastructure utilization, reduced rework, fewer error corrections, and better load balancing across human and digital teams. Regular cost-per-task analyses allow financial teams to identify where automation produces durable savings versus where it temporarily displaces expense.

Revenue enablement

AI agents extend the commercial capacity of sales and service operations by sustaining 24/7 availability and enabling data-informed customer engagement. Impact of AI sales agents with the highest ROI should be benchmarked through improved conversion rates, shorter sales cycles, and increased pipeline velocity rather than pure volume growth.

Quality, accuracy, and compliance

Operational consistency and reduced variance directly affect margins, especially in regulated or service-intensive industries. Benchmarks in this category include error rate reduction, first-contact resolution, and compliance adherence.

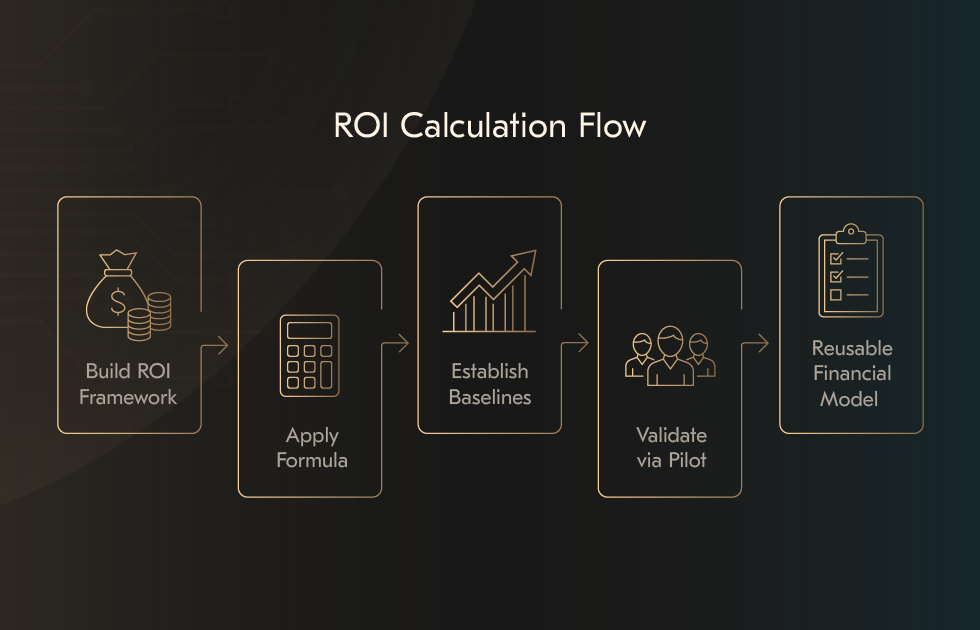

How to calculate ROI for your context: Checklist and practical model?

Accurately calculating the return on investment for AI agents is the beginning of a scalable automation strategy. Every deployment decision, from pilot scope to enterprise rollout, must be grounded in measurable evidence of value creation.

1. Build a complete ROI framework

Start with a holistic model that incorporates tangible and intangible sources of value.

Tangible benefits include measurable financial outcomes.

Intangible benefits include operational resilience, compliance improvements, and knowledge retention.

Total cost of ownership should include every layer of investment: licensing, infrastructure, data preparation, monitoring, retraining, and governance.

2. Apply a standardized formula

The most reliable ROI models for AI agents expand traditional financial equations to capture direct and derived gains. Organizations that use this model can reapply it across multiple business units, building comparability and governance discipline into their automation portfolio.

3. Establish baselines and measurement discipline

Before automation, measure the as-is process. Capture handling times, cycle duration, conversion rates, and defect rates to create a benchmark for all future gains. During the pilot phase, collect performance data continuously rather than retrospectively.

4. Use structured pilots to validate financial outcomes

ROI models are only credible when validated by empirical data. A controlled pilot provides this validation by isolating one process, measuring performance pre- and post-deployment, and quantifying differences in cost and throughput. In this stage, focus on precision: the goal is to test cost sensitivity, automation depth, and time-to-value before expansion.

5. Translate results into a reusable financial model

The final step is to embed ROI logic into the organization’s financial planning and automation governance. Create a standardized calculator that accepts small inputs (task volume, automation rate, human cost per task, AI cost per task, and investment level).

Example: Mini ROI calculator for contact center automation

The following simplified calculator outlines how to project the financial outcome of replacing a portion of manual interactions with automated handling.

Input parameters:

Monthly call volume: number of incoming calls handled per month

Automation eligibility rate: percentage of calls that can be automated without human intervention

Human cost per call: average cost per manual interaction

AI cost per call: operational cost of automated interaction

Annual investment: platform, integration, and maintenance expenditure

Procurement framework for AI agents with measurable ROI

Phase 1: Strategy and alignment

A successful implementation begins with business alignment and a clear understanding of where AI will generate measurable value.

Define objectives: Establish a precise vision for AI integration that supports business strategy and quantifiable outcomes.

Identify priority use cases: Select high-impact, repetitive processes where automation can show rapid time-to-value.

Set KPIs and baselines: Document the pre-automation state of each process. Key metrics may include cost per task, conversion rate, average handling time, or customer satisfaction.

Secure executive sponsorship: Assign ownership across business, IT, and finance. Sponsors ensure accountability, funding continuity, and organizational readiness for change.

Phase 2: Technical readiness

Once objectives are set, focus shifts to evaluating delivery models, technology fit, and data integrity.

Decide build vs. buy: Organizations that require tailored model tuning, domain-specific workflows, or integration into complex system landscapes typically partner with AI and ML consulting experts to ensure technical fit and long-term maintainability.

Assess vendor and architecture: Evaluate whether solutions are AI-native, platform-agnostic, and easily integrable with core CRM, ERP, or ticketing platforms.

Validate security and compliance: Confirm adherence to global standards, encryption protocols, and access controls.

Clarify cost structure: Ensure transparency in pricing models and estimate the total cost of ownership over the deployment horizon.

Prepare the data foundation: Consolidate, clean, and classify data needed for training and inference.

Phase 3: Implementation and governance

The pilot and launch phases test assumptions and operationalize governance.

Prototype and test: Build a working model, simulate real conditions, and measure KPI shifts against baselines.

Establish governance controls: Introduce human-in-the-loop supervision, version tracking, and performance drift monitoring.

Train and communicate: Prepare teams through structured onboarding and transparent communication about AI roles and responsibilities.

Ensure observability: Implement dashboards and logs that trace performance, decision flows, and costs in real time for continuous optimization.

To complement this financial model, you can also refer to our practical integration playbook on how to integrate AI into your business, which dives deeper into change management, workflow alignment, and scaling.

Phase 4: Continuous optimization

After proof of value, the focus moves from deployment to disciplined expansion and refinement. Organizations that treat agents as data-driven AI agents for ROI improvement maintain continuous monitoring loops to prevent drift.

Scale in stages: Extend rollout across business units or geographies through a controlled, metrics-driven roadmap.

Measure ROI and payback: Reassess cost-to-serve, time-to-value, and productivity lift periodically to validate business assumptions.

Iterate and retrain: Use feedback loops, usage data, and operational analytics to retrain models, fine-tune workflows, and improve accuracy.

Institutionalize learnings: Integrate pilots’ financial, operational, and compliance lessons into your enterprise AI governance framework.

Get a CFO-ready TCO/ROI model in 10 days

When all elements are quantified, AI agents stop being experimental add-ons and start operating as measurable profit centers. A transparent TCO model must account for every recurring cost and hidden dependency, while ROI projections should reflect efficiency and scale compounding gains. With a CFO-ready model in place, every discussion about AI shifts from “how much will it cost?” to “how fast will it pay back?”

At Acropolium, we help companies bridge that gap between strategy and execution. Within ten days, you can have a validated TCO and ROI framework tailored to your operations, enabling faster, data-backed decisions and measurable business impact. Start by mapping your automation economics with our experts - book discovery.

![6 AI Use Cases in Education in 2025: [Benefits & Applications]](/img/articles/6-ai-use-cases-in-education-transforming-the-learning-experience/img01.jpg)