Key Takeaways

Financial institutions increasingly rely on AI for automation, data-driven decision-making, fraud detection, and customer service enhancements.

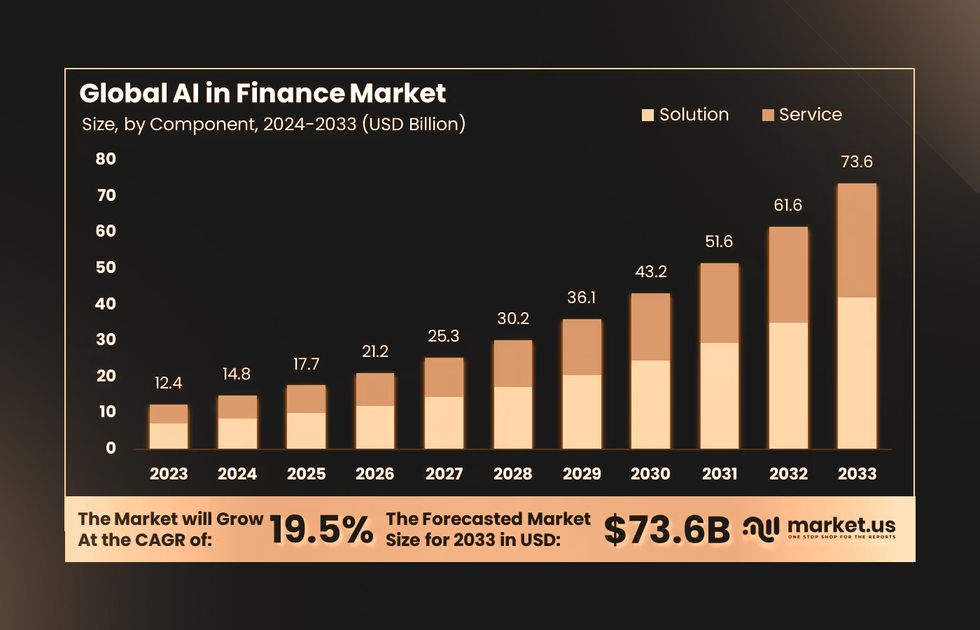

The AI in fintech market is projected to reach $73.9 billion by 2033, with a 19.5% CAGR, driven by improved accessibility and technological advancements.

Nearly 50% of financial firms leverage AI for risk management, fraud monitoring, and credit risk assessment, improving decision accuracy and reducing financial losses.

Acropolium’s AI automation resulted in a 40% reduction in data errors, significantly improving efficiency in financial data handling.

Even though banks have relied on technology and data for years, AI in the finance industry is taking things to the next level by making transactions faster and more efficient. It’s no secret that AI’s automation and data-driven insights can boost productivity, drive growth, improve risk management, and enhance the overall customer experience.

Not long ago, advanced AI-powered finance systems were costly to develop, making them accessible only to a few major players. But, with advancements in AI, machine learning, and better data processing techniques, 58% of financial institutions of all sizes already integrate AI into their systems easily.

Named a leading AI development company, Acropolium applies our 6-year expertise in AI/ML consulting to guide you on the power of intelligent algorithms in fintech software creation. Today, we will share our expert insights and AI applications in finance with you. Explore how sophisticated technology can breathe smoothness and authenticity into your financial business.

What is AI in Finance?

AI in fintech is all about using smart technologies — especially machine learning — to make financial services faster, more accurate, and more efficient. Similar to healthcare, the finance industry also manages sensitive data. And AI helps with everything from data analysis and forecasting to risk management, fraud detection, and customer support.

By automating manual processes and offering deeper insights into financial markets, AI is one of the leading fintech trends that create more intuitive ways for businesses to connect with customers.

AI adoption is accelerating across financial functions. Thus, the global AI in finance market is projected to hit $73.9 billion by 2033, growing at a 19.5% CAGR, up from $17.7 billion in 2025.

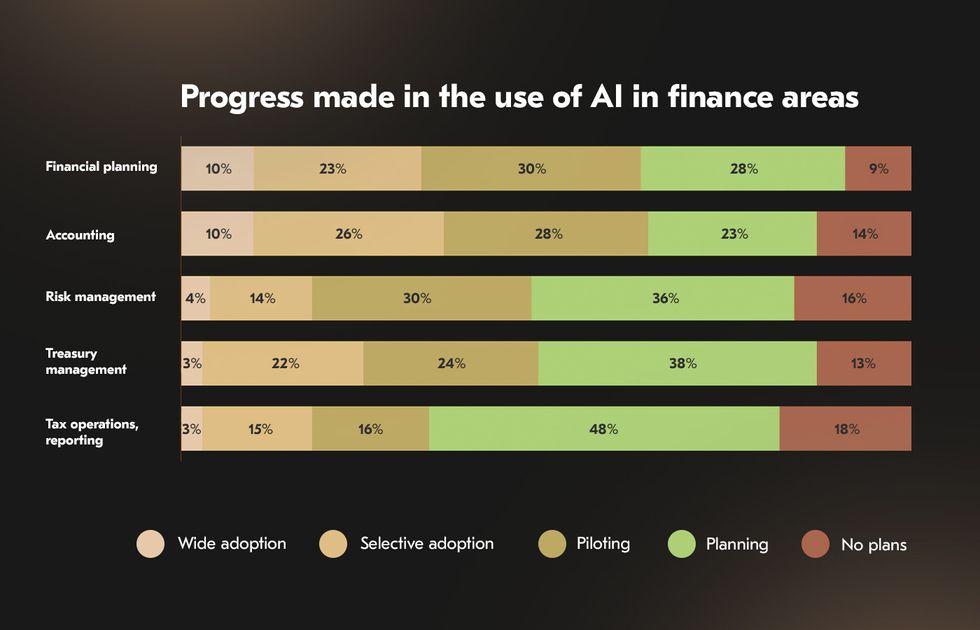

AI applications in finance, like accounting and financial planning, lead the way, with nearly two-thirds of companies already using or testing AI for improved reporting, prompt insights, and predictive analytics. Treasury and risk management are close behind, with almost half of firms integrating AI for cash-flow predictions, fraud monitoring, and credit risk assessment.

Benefits of Artificial Intelligence in Finance

As AI adoption in different industries and finance expands, so do the benefits. Early adopters see a few key advantages, but as they integrate AI more deeply, the list grows significantly.

The biggest impact comes from AI’s ability to enhance data, improve accuracy, spot errors, and generate deeper insights. Other major benefits of artificial intelligence in finance include faster access to insights, lower costs, greater efficiency, and a more skilled workforce.

Together, they make AI a game-changer for finance teams, but there’s something more.

Advanced Customer Service

Banks and digital banking providers use AI to handle high call volumes, reducing wait times and improving customer interactions. Virtual assistants and chatbots personalize conversations by analyzing transaction history and market trends while being sustainable alternatives to report paperwork.

Automating responses to common inquiries cuts expenses, enhances efficiency, and fosters customer satisfaction.

AI-Powered Debt Collection

Predicting delinquency risks, AI for fintech allows tailoring outreach strategies for more effective debt recovery. Machine learning detects warning signs, sends timely reminders, and suggests personalized repayment options. This approach streamlines the process while maintaining a customer-friendly experience.

Enhanced Risk Assessment & Compliance

With the ability to process large datasets, AI integration improves risk evaluation, offering lenders and insurers deeper insights. Compliance efforts also benefit from automation, as the technology tracks regulatory updates, simplifies reporting, and minimizes manual labor costs.

Faster Underwriting

Loan approvals speed up with AI analyzing transaction history and alternative credit indicators. Automated document processing eliminates delays, significantly reducing the time required for underwriting decisions.

Personalized Banking Experience

Customer loyalty strengthens when the use of artificial intelligence in financial sector operations delivers tailored services. Predictive analytics anticipate individual needs, while virtual assistants enhance interactions with live, empathetic support. The result is a more engaging and responsive banking experience.

AI Applications in Finance: Use Cases to Look Up to

Financial leaders are rapidly exploring AI to automate workflows and focus on more strategic tasks. On average, industry leaders have implemented six AI use cases in financial services — nearly twice as many as others. They’re also leading the way in using generative AI for document creation and summarization.

Beyond that, businesses are finding value in AI in web solutions for everyday tasks like administrative work, performance evaluation, training, and data entry, making processes more efficient across the board.

Fraud Detection and Prevention

With 65% of financial companies reporting cyberattacks, fraud detection remains a top priority. AI steps in as the ultimate watchdog, spotting suspicious transactions before they cause damage. By analyzing customer behavior, AI detects anomalies, whether it’s an unusual purchase location or a sudden spike in transfers, and flags them instantly.

Live fraud prevention is already making an impact. Mastercard, for example, partners with banks to track transactions and block fraudulent ones before they go through. With AI constantly learning and adapting, financial institutions can stay ahead of even the most sophisticated fraudsters.

AI-Driven Risk Management

Credit risk assessment used to be a slow, manual process. AI in fintech comes in to analyze massive datasets in seconds, giving lenders a clearer picture of an applicant’s creditworthiness. From transaction history to social media behavior, AI takes a holistic approach, making smarter lending decisions and reducing default risks.

Companies like Equifax use AI-powered models to generate more accurate credit scores while offering insights into how borrowers can improve them. With fewer errors and faster approvals, AI-driven risk strategy benefits both financial institutions and their customers.

Personalized Banking & AI Chatbots

Customers want instant support, and AI-powered chatbots deliver it. Apart from answering FAQs, they help customers apply for loans, manage accounts, and even offer financial advice, all in real-time.

ICICI uses digital assistants like iPal — which stands among popular examples of AI in finance — to guide customers through transactions. Such solutions handle multiple conversations at once, ensuring no one is left waiting. By mimicking natural conversations, they create a seamless and engaging experience.

Algorithmic Trading and Investment Management

Crypto trading isn’t just for Wall Street pros anymore, as AI is making it more accessible. By analyzing relevant market data, AI identifies trends, predicts stock movements, and even automates trades at lightning speed.

High-frequency trading, once impossible for humans, is now a reality. Such AI applications in financial services help investors make data-driven decisions by scanning news, social media, and financial reports for sentiment analysis. Wealth management firms like JP Morgan Chase and individual traders combine financial services and AI to optimize portfolios, maximize returns, and minimize risks.

AI in Loan and Credit Underwriting

Getting a loan used to mean endless paperwork and long approval times. SaaS platforms and AI applications in fintech simplify the process by automating document verification and analyzing credit risk in minutes. Banks can now assess borrowers based on a broader range of factors, including spending habits and income patterns, rather than just credit scores.

Some lenders use AI to offer instant loan approvals by evaluating transaction data. For example, Mercado Libre recently introduced AI-powered credit lines for sellers, reducing approval times from a week to just two days. Faster underwriting means more opportunities for borrowers and better efficiency for lenders.

AI-Powered Regulatory Compliance & AML

Regulatory compliance can be overwhelming for financial institutions, but AI technology in finance makes it manageable. With continuous transaction monitoring, AI detects potential money laundering activities and flags risks before they escalate.

It also helps banks keep up with evolving regulations, automatically updating compliance frameworks and streamlining reporting.

AI-powered tools reduce the risk of penalties by ensuring all requirements are met efficiently. HSBC already uses deep learning models to scan for suspicious patterns, helping compliance teams focus on critical cases rather than manual checks.

AI for Insurance and Claims Processing

Filing insurance claims can be a frustrating experience, but AI is changing that. Insurers now use AI to assess claims faster, detect fraudulent activities, and automate payouts. With AI analyzing accident reports, medical records, and policy details immediately, legitimate claims are processed almost instantly.

Allstate leverages AI-powered virtual adjusters to assess auto damage from customer-submitted photos. The AI estimates repair costs and approves settlements quickly, expediting the claims process while reducing operational costs.

Adopting AI in the Finance Industry: Challenges and Solutions

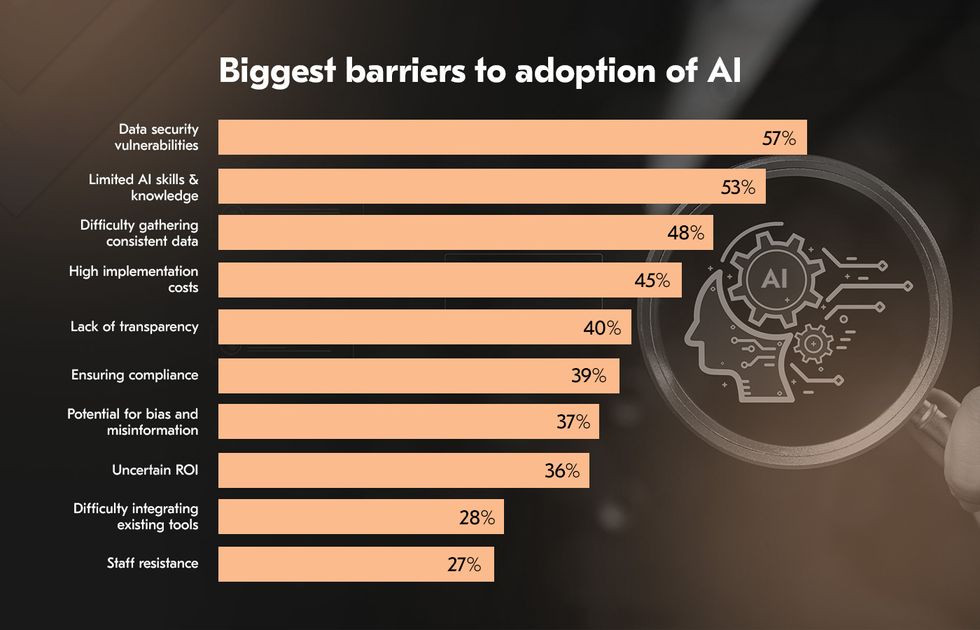

Embracing artificial intelligence in fintech comes with hurdles, from data security risks to integration challenges and high costs. Over half of executives cite a lack of AI skills as a major barrier, while concerns about bias, misinformation, and compliance also weigh heavily.

As companies expand AI use, issues shift — ensuring data consistency, overcoming staff resistance, and integrating AI with existing systems become key struggles. Gen AI raises additional concerns, especially around cybersecurity, intellectual property, and accuracy. To navigate these risks, firms must invest in both AI infrastructure and workforce upskilling, ensuring teams can effectively leverage AI while mitigating its challenges.

Data Privacy & Security Risks

AI-based banking solutions tons of sensitive customer data, making privacy and security quite vulnerable. The risk of data breaches grows as AI models process personally identifiable information (PII) and financial records.

To mitigate these threats, banks must adopt robust encryption, access controls, and automated anomaly detection.

Bias in AI Decision-Making

The use of AI in the finance industry can inadvertently reflect biases present in historical data, leading to unfair credit scoring, loan approvals, cryptocurrency exchanges, and fraud detection outcomes. This lack of fairness not only impacts customers but also exposes banks to reputational and regulatory risks.

To counteract bias, financial institutions must ensure diverse and representative training data, regularly audit AI outputs, and implement explainable AI (XAI) techniques. Human oversight is also essential, and integrating AI-powered decisions with manual reviews where necessary helps maintain fairness.

Transparent processes, combined with ethical AI governance practices, can ensure equity and trust in financial decision-making.

Regulatory & Compliance Challenges

AI technology in finance must focus on data protection, financial transparency, and ethical use, which adds complexity to deployment. You must collaborate closely with legal and compliance teams to integrate AI within existing regulatory frameworks.

Adherence to GDPR and CCPA can’t be overlooked. Automated threat detection and behavioral analytics can enhance protection. Additionally, anonymizing data and securing explicit consent for its use further strengthen privacy safeguards.

High Implementation Costs & Integration Issues

Integrating AI into banking infrastructure presents financial and technical challenges. Legacy systems often lack compatibility with modern technologies, requiring costly upgrades. Also, AI deployment involves expenses for cloud computing, cybersecurity measures, and ongoing maintenance.

To manage expenses, you can adopt a phased AI implementation strategy, starting with modular AI solutions that integrate seamlessly with existing systems. Leveraging API-based integrations and cloud AI services can also lower upfront investment.

Why choose Acropolium?

Acropolium is a reliable tech partner with a strong track record in secure software development for the finance industry. We prioritize data protection, delivering AI-driven and finance-focused products that comply with GDPR and other industry regulations.

As an ISO-certified provider, we ensure top-tier quality across all projects — whether it’s building scalable platforms, modernizing legacy financial systems, or implementing AI-powered automation. From serverless solutions to advanced analytics, our expertise helps financial institutions stay secure, efficient, and ahead of competition.

Acropolium Case Studies

Over the past five years, we’ve delivered 11+ comprehensive products and provided over 32 fintech consultations to our clients. Here’s a recent success story showcasing how AI applications in finance elevates their operations.

AI-Powered Data Quality Monitoring Tool

A leading investment tools provider required a robust monitoring solution to ensure data integrity across extensive volumes of sensitive financial data. The goal was to implement AI-driven methods for real-time data quality monitoring, enabling accurate data collection and automated entry procedures while ensuring scalability and reliability.

Solution

We developed a scalable AI-powered data quality monitoring tool designed to handle massive financial datasets efficiently. Our solution integrated tracking dashboards and automated alerts for instant issue detection and resolution. Key developments included:

Standardized processes for real-time data profiling, ensuring continuous monitoring and data validation.

Machine learning algorithms to autonomously analyze incoming data, detect anomalies, and identify patterns.

Quick quality checks to proactively mitigate inaccuracies before they propagate within the system.

Customizable detection settings, allowing users to configure rules, filter data, and conduct backtesting for precision control.

Scalable architecture for seamless horizontal expansion without performance degradation.

Intuitive UI with interactive dashboards to simplify data quality assessment and issue resolution.

Results

200% scalability improvement, enabling seamless ingestion of up to 30 terabytes of data daily.

Live monitoring reduced issue identification and resolution time to less than one hour.

40% reduction in data errors, resulting in a final data quality rate of 95%.

30% faster data processing, decreasing the average time per terabyte from 12 hours to 8 hours.

By integrating AI-powered automation and scalable infrastructure, our solution enhanced data reliability and operational efficiency, empowering the client to maintain superior data integrity in financial analysis and decision-making.

AI-Powered Contract Management Platform

An international legal firm serving clients across multiple jurisdictions needed a more advanced AI-driven solution to streamline contract management. Their existing software automated drafting, reviewing, versioning, and monitoring but struggled with the growing complexity of modern contracts.

Solution

To enhance the platform’s capabilities, we focused on seamless integration with the firm’s existing systems while prioritizing data synchronization and security. To help the company embrace benefits of AI in finance, our developers:

Implemented charts, graphs, and interactive reporting features to present complex legal data in an intuitive format, empowering users with deeper insights.

Conducted in-depth assessments to ensure compatibility with legal and document management platforms, leveraging robust APIs for secure and efficient data transfer.

Strengthened data protection measures to safeguard sensitive legal information throughout processing and communication.

Integrated with financial and CRM systems to improve data availability and workflow efficiency.

Results

75% reduction in contract review times.

Greater accuracy in contract analysis, improving risk management and compliance.

Enhanced user experience, earning praise from the legal team.

Lower operational costs and reduced reliance on external legal services.

Final Thoughts

To stay ahead, companies must prioritize AI applications in finance beyond basic automation, integrating it into risk management, fraud detection, and predictive analytics. A clear AI strategy is essential — testing and refining Gen AI applications while addressing security, compliance, and intellectual property concerns.

Overcoming barriers like AI skills gaps, high costs, and data security risks requires proactive governance, modern IT infrastructure, and pilot initiatives to validate ROI.

At Acropolium, we help businesses embrace AI with tailored, subscription-based partnerships that align with their budget and goals. Our expertise ensures a seamless transition to AI-driven workflows in anything from logistics and finance to education and hospitality.

Contact us to see how you can amp up your efficiency and keep your business compliant, secure, and competitive.

![Cryptocurrency Exchange Software Development [2025 Guide]](/img/articles/why-you-need-custom-cryptocurrency-exchange-software-and-how-to-get-it-right/img01.jpg)

![Why Invest in Cryptocurrency Wallet Development [Guide]](/img/articles/investing-in-cryptocurrency-wallet-development-cost-and-benefits/img01.jpg)

![4 Benefits of Custom Accounting Software [+Case study]](/img/articles/custom-accounting-software/img01.jpg)

![Blockchain in Finance: [Use Cases Revolutionizing Finance in 2025]](/img/articles/blockchain-in-finance-use-cases/img01.jpg)