Key Takeaways

- Upgrading a banking legacy application enhances technology, security, efficiency, customer experience, and long-term strategic value.

- Modernization may present challenges, including high costs and disruptions to Business as Usual (BAU). Other possible issues include complex data migration, employee buy-in, and ensuring regulatory compliance during the transition.

- When upgrading your legacy banking system, add advanced self-service capabilities, APIs, instant payments, and cloud computing. Also, consider biometric technology, chatbots, AI-driven process automation, microservices, and big data analytics.

More and more fintech companies are disrupting the marketplace with innovations that leave banks struggling to catch up. Legacy core banking systems can’t please clients with fast and convenient transactions. And modern clients are used to getting instant results, or else they switch.

At Acropolium, we can breathe life into your legacy system with the same fintech software development solutions that have made modern fintech platforms a frontrunner in the industry.

In this article, we’ll get into the details of banking legacy modernization with all the benefits, challenges, and crucial features to include. But first things first: what is a legacy system in banking?

What Are Banking Legacy Systems?

Bank legacy systems refer to the outdated software and hardware infrastructure many traditional banks still rely on. They use it to manage their core operations, such as processing transactions, managing accounts, and handling customer data.

A bank could have developed such a system decades ago. Thus, it has become increasingly difficult to maintain and upgrade due to its age, complexity, and lack of compatibility with modern technologies. For example, COBOL, which holds the 28th position among programming languages globally, still remains relevant for core banking and transactions.

Legacy systems continue challenging traditional banks, driving global spending on outdated payment technologies from $36.7 billion in 2022 to an anticipated $57.1 billion by 2028.

This rising expenditure on legacy systems strains technology budgets, increases technical debt, and stifles innovation in the financial sector. The cost of maintaining legacy technology is growing by 7.8% annually. Delaying migration to modern systems increases these expenses further. At the same time, it potentially leads to missed opportunities, such as a 42% increase in payments revenue.

Why Banks Shouldn’t Ignore Upgrading Legacy Banking Systems

Banks are slow to adapt to new technological developments, mainly because of strict regulations and outdated core platforms. Although they continue to serve their purpose, these legacy banking platforms fail to keep up with clients’ needs for speed and advanced functionality.

With dozens of use cases of artificial intelligence (AI), machine learning, big data, and the internet of things (IoT) transforming the consumer landscape, banks need to catch up with technological developments to satisfy an increasingly demanding client base.

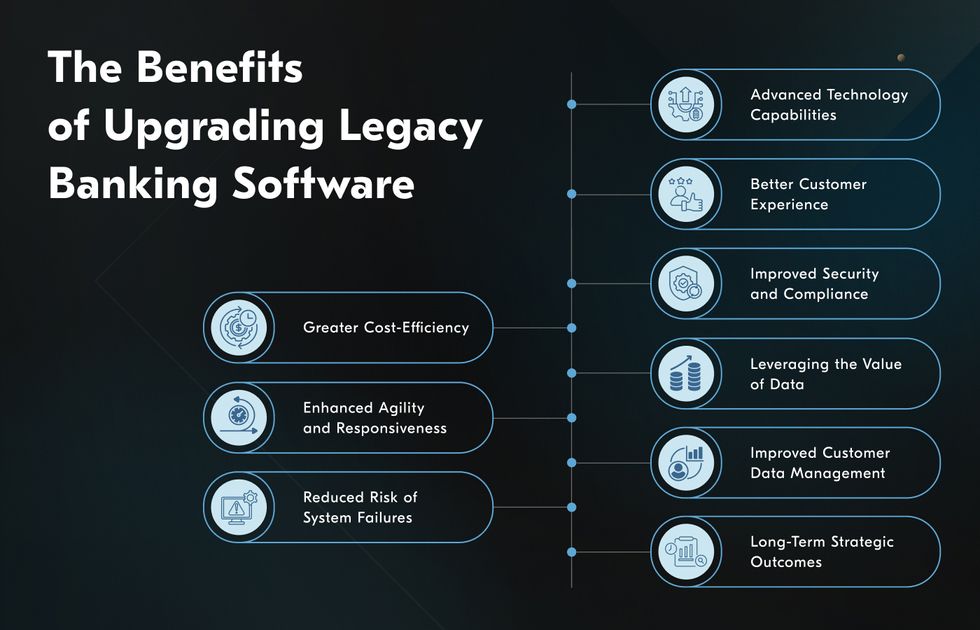

The Benefits of Upgrading Legacy Banking Software

Although expensive and time-consuming, modernizing legacy systems in banking is a worthwhile undertaking. Here are the benefits that await your banking institution.

Advanced Technology Capabilities

Modernized systems support contemporary APIs, enabling seamless integration with third-party applications and services. As a result, banking software leverages emerging technologies like blockchain, cloud computing, artificial intelligence (AI), robotic process automation (RPA), and data analytics.

Better Customer Experience

Advanced software paves the way for features that elevate service levels and web development. It also spares users the frustrating slowdowns and crashes they commonly experience with outdated systems.

Improved Security and Compliance

Unable to keep up with the latest upgrades and security patches, legacy systems are more susceptible to cyberattacks and data breaches. Upgrading the software allows banks to keep up with today’s security standards and regulations.

Greater Cost-Efficiency

A significant legacy financial system replacement may require hefty investments, but it comes with improved efficiency and productivity that can help offset the budget. It’s also easier and cheaper to maintain and modify in the long run.

Leveraging the Value of Data

Paving the way for sophisticated data analytics, a modernized banking system allows financial institutions to meet their business goals, recognize any room for improvement, and capture opportunities. It provides actionable insights that improve decision-making.

Enhanced Agility and Responsiveness

Upgrading legacy systems boosts a bank’s agility, supporting rapid adaptation to market changes, regulations, and customer demands. Modern platforms enable quick deployment of new products and services. With their help, banks respond swiftly to new opportunities or challenges.

Improved Customer Data Management

Modernized systems centralize customer data, improving accuracy and accessibility. Such consolidation enhances decision-making, supports personalized services, and enables targeted marketing. As a result, it increases client satisfaction.

Reduced Risk of System Failures

Modern systems minimize crashes and downtime to reduce the risk of operational disruptions. They often include disaster recovery features, ensuring quick data restoration and maintaining continuous operations.

Long-Term Strategic Outcomes

With legacy system upgrades, banks offer faster, more reliable services and quickly adapt to market changes, gaining an edge over competitors. Modernization creates a flexible technology foundation that easily integrates future advancements and attracts top tech talent.

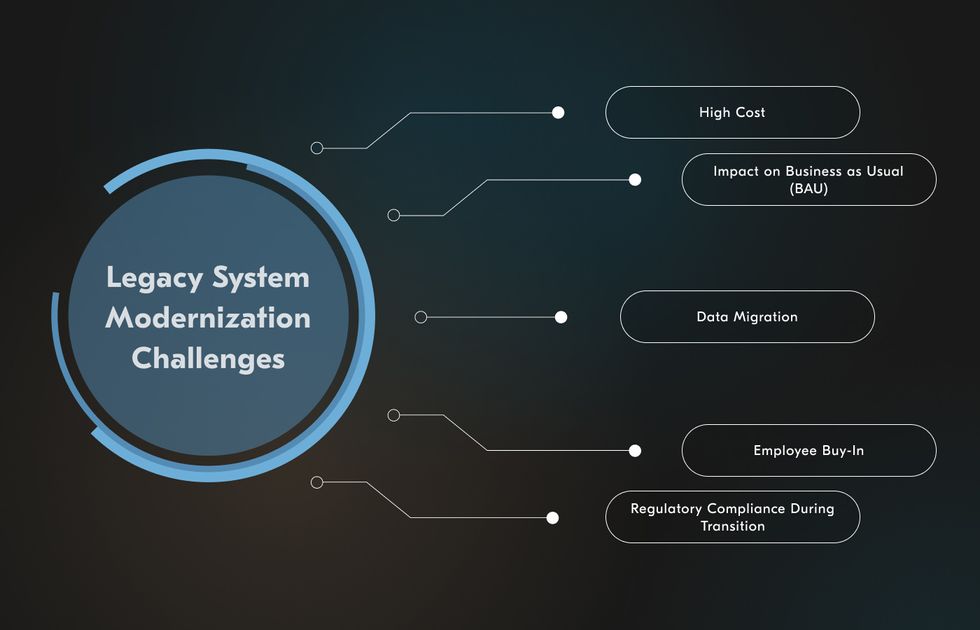

Challenges Your Business Will Face While Modernizing Financial Legacy Systems

Prepare for the following challenges before setting out to redesign legacy platforms in banking.

High Cost

Modernizing legacy financial systems is costly due to licenses, hardware, data migration, and implementation. To avoid extra expenses, explore complex dependencies when updating core platforms for compatibility with new technology.

Upgrade core processes first to address the challenge. This approach is less costly and disruptive than full-scale modernization. Also, consider future integration of solutions and APIs when planning.

Impact on Business as Usual (BAU)

Banks can’t afford system downtimes, especially lengthy ones. It’s best to modernize the system in chunks to guarantee continued service. Carefully plan the timing and scope of the software upgrade to minimize their impact on business-critical processes.

Data Migration

Data loss can be debilitating for financial institutions. And because the legacy infrastructure in banking stores data that run into terabytes, data migration can be particularly challenging. Creating an actionable legacy data migration plan will help ensure smooth data transfer and keep you prepared for contingencies.

Employee Buy-In

People tend to get comfortable with legacy systems, so get ready to deal with resistance to change. A comprehensive change management system will help you confront the challenge. Make sure it includes a communication plan that adequately conveys the benefits of the upgraded system and helps ensure employee buy-in. No amount of challenges should keep you from taking the next step to bolstering the competitiveness of your banking system. To implement the upgrade, you’ll have to undertake common processes.

Regulatory Compliance During Transition

During the transition, it’s crucial to ensure that old and new systems comply with data protection laws and anti-money laundering requirements. Carefully manage data migration to maintain accuracy and security. Besides, avoid disruptions affecting audit and reporting compliance.

The Process of Banking Legacy Software Modernization

The general process of modernizing a banking legacy system involves the following steps.

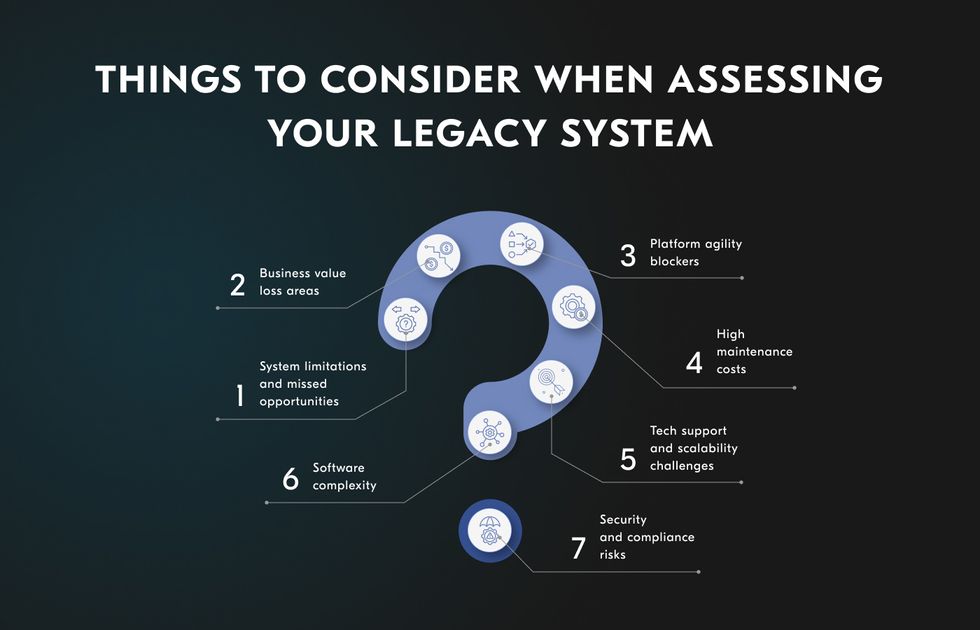

Assess Your Legacy System

To ensure your modernization efforts are on point, you need to assess your legacy system’s shortcomings. Take note of the areas that are keeping it from making the most out of current market opportunities. You can carry out your evaluation by answering the following questions.

- Which business opportunities are you unable to capture because of your system’s limitations?

- In which areas are you losing business value?

- Which part of the platform prevents agility?

- Does your legacy system come with unreasonably high maintenance costs?

- Will you be able to sustain its tech support and scalability?

- Is your software unnecessarily complex?

- Is your system compromising security or compliance in any way?

Explore Your Modernization Options

Now you can explore available legacy modernization options. Pick those that can address the issues you’ve identified during the evaluation:

- Retaining current functions but transforming them into features that are accessible to APIs

- Moving the components to a new infrastructure without changing the code

- Shifting to a new platform while retaining the core functionality and making only minor changes to the code

- Rewriting the legacy system’s code

- Modifying the system’s architecture

- Building new software from scratch, completely eliminating the old technology

- Building new core platforms that reflect modern enterprise mobile solutions and serve your current business goals

It’s a good idea to invite a certified software vendor with experience in financial app development to join you during this stage.

Pick Out the Most Suitable Approach

To select the best approach for modernizing your legacy system, you’ll have to weigh your options. You may choose to make minor modifications to your old system that will keep it running smoothly or decide to carry out an overhaul that may be costly at the moment but cost-effective in the long run.

New Tech Blocks to Add to Your Banking System

Here’s a list of quality components and features that should be included in your modernized banking system.

Advanced Self-Service Capabilities

In this digital age, consumers expect to accomplish what they need without visiting a physical branch. Self-service digital banking solutions are no longer confined to basic services like checking account balances and transferring money.

Banks can now provide the following services online:

- Account opening

- Self-registration

- Loan origination

- Purchasing insurance coverage

These self-service capabilities are made possible by technologies like real-time ID verification, facial and fingerprint biometrics, real-time credit bureau checks, device verification, and eSignatures.

APIs

To thrive in the modern world, a bank must be able to be a part of digital ecosystems. That is, it must have the capacity to integrate products and services from third-party applications. And APIs are just the solution for this since they enable software and apps to share data and communicate with each other.

For instance, core banking platforms can integrate an API that allows them to receive money transfer requests from card systems, digital payment systems, mobile wallets, and other third-party financial services.

Instant Payments

Consumers expect digital banking to work without delay. To stay competitive, banks must deliver. Instant payment solutions or electronic retail payments make this possible with real-time, effortless processing of transactions. Consumers no longer have to wait for one to three business days for a transfer to push through.

Banks can connect with real-time payment networks to integrate instant payment solutions by working with technology providers like Sherpa Technologies, Fiserv, and PayFi.

Cloud Computing

With cloud computing allowing institutions to store data and applications in remote servers, banks can develop products and scale web app services at a faster rate without shelling out huge investments.

Established cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform provide a range of services that allow banks to quickly innovate, meet client demands, and keep up with fintech technological trends.

Biometric Technology

Clients expect banks to provide the highest level of security for their personal information. Financial institutions take it to the next level with biometric technology, which offers a balance of convenience and security. Now, clients can use their voice, fingerprints, or irises to verify their identity and access their accounts.

Compared to passwords or PINs, these biometric identifiers are easier to use and harder to hack. Financial institutions can use them for mobile banking, digital onboarding, and know your customer (KYC) processes.

Chatbots

These days, clients are quick to leave reviews online about their bad banking experience. To avoid any reputational damage, banks must stay on their toes. One way or another, they must instantly respond to customer queries and issues. Capable of simulating online conversations with people, chatbots can stay available for clients 24/7.

Enterprise chatbots can respond to queries in real-time, offer personalized service, and assist clients with their banking tasks.

Process Automation with AI and Machine Learning

Automation takes operational efficiency to the next level with a rate of speed and accuracy that’s beyond human capacity. Powered by artificial intelligence and machine learning, it allows banks to greatly reduce costs, enhance customer experience, and increase agility.

Automation plays a vital role in banking processes, such as account opening, client onboarding, repeatable payments, automatic report generation, and mortgage lending.

Microservices

Banking systems no longer have to rely on a monolithic architecture that covers all functions. They can opt for microservices, which divide systems into standalone services that function independently but meld together into a well-oiled machine.

While a buggy code in a monolithic architecture can affect the entire operation, a malfunctioning microservice won’t completely handicap the rest of the system. The latter does a better job of ensuring business continuity.

Big Data and Advanced Analytics

Banks are some of the most data-intensive institutions, and they should use this to their advantage. Banks can leverage big data with analytics that provide actionable insights and improve decision-making. The wealth of information also enables them to provide personalized financial services to clients.

Data can come from a variety of sources, including online transactions, accounts on digital banking channels, ATM withdrawals, biometric authentication, and KYC databases.

Acropolium’s Experience

At Acropolium, we’ve spent 21 years building complex software solutions for organizations from various industries. Our extensive experience in delivering successful fintech projects has solidified our ability to provide you with the services you need to rev up your banking system.

You may opt for IT outsourcing or in-house software modernization. We can put together a dedicated team with the tech stack combining advanced front-end and back-end frameworks necessary to give your legacy system an overhaul. Alternatively, call for our strategic consulting and deep system audit.

We specialize in building and upgrading fintech systems (single-tenant or multi-tenant) with cutting-edge solutions, such as business process automation, cloud computing, chatbots, big data, artificial intelligence, machine learning, and blockchain security.

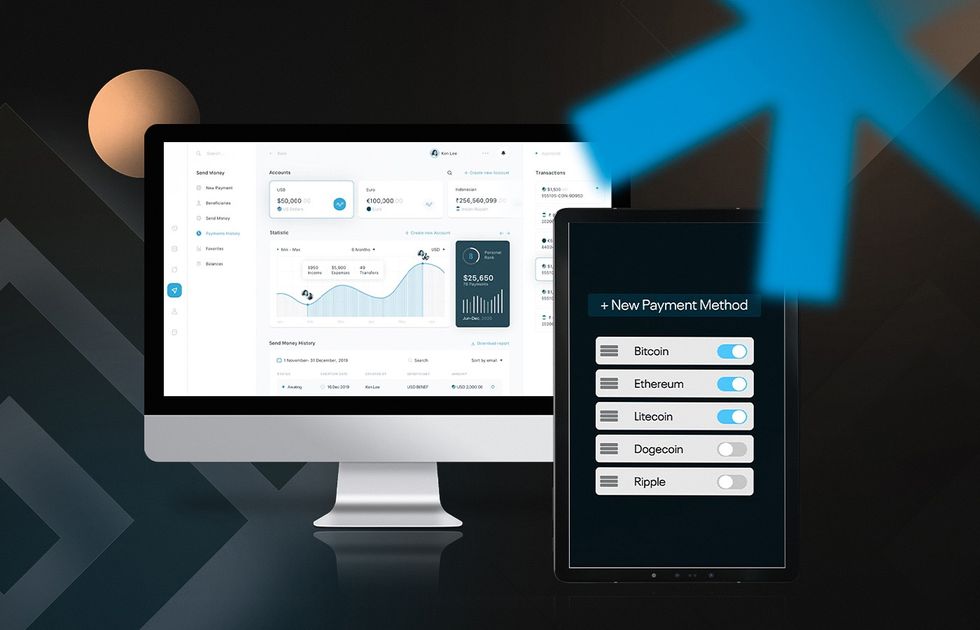

Let’s overview a modernized legacy banking system example and a development case study:

Digital Payment System Upgrade

A leading real-time payments system operating in over 30 countries faced the challenge of connecting distributed systems and enhancing security. To address these needs, we developed a unified modern architecture using Azure cloud services, an in-house ML-based anti-fraud tool, and payment processing for popular cryptocurrencies.

- These enhancements led to significant improvements:

- The system now supports approximately 5,000 corporate clients.

- Customer engagement increased by 28%.

- The user base for digital payment software grew by 36%.

- The proprietary anti-fraud system successfully detects over 96% of fraud.

SaaS Accounting Software Solution Development

A company specializing in accounting aimed to develop reliable and secure automation software with multi-tenant SaaS architecture. The project focused on integrating various payment methods, including Stripe. Also, it provides customizable reports and templates for invoices and reports.

We developed SaaS MVP software in five months, featuring a user-friendly setup with multi-tenancy capabilities and comprehensive transaction tracking. The platform achieved notable success, with a 30% conversion rate from free demos to paid plans.

Final Thoughts

In this digital age, no business can afford to sit on its laurels when it comes to technological advancements. It’s not any different for banks. These institutions need to catch up with the changing world to meet client demands and continue to thrive. Modernizing legacy systems can bring banks the agility they need to stay ahead of innovations.

Ready to explore your options? Reach out to us at Acropolium to get your scalable SaaS banking solution at a reasonable price.

![Migrating from Monolith to Microservices: [Strategy & 2025 Guide]](/img/articles/migrating-monolith-to-microservices/img01.jpg)