Key Takeaways

- Custom hotel accounting software automates financial processes, replacing spreadsheets with centralized, real-time systems that reduce errors and improve decision-making.

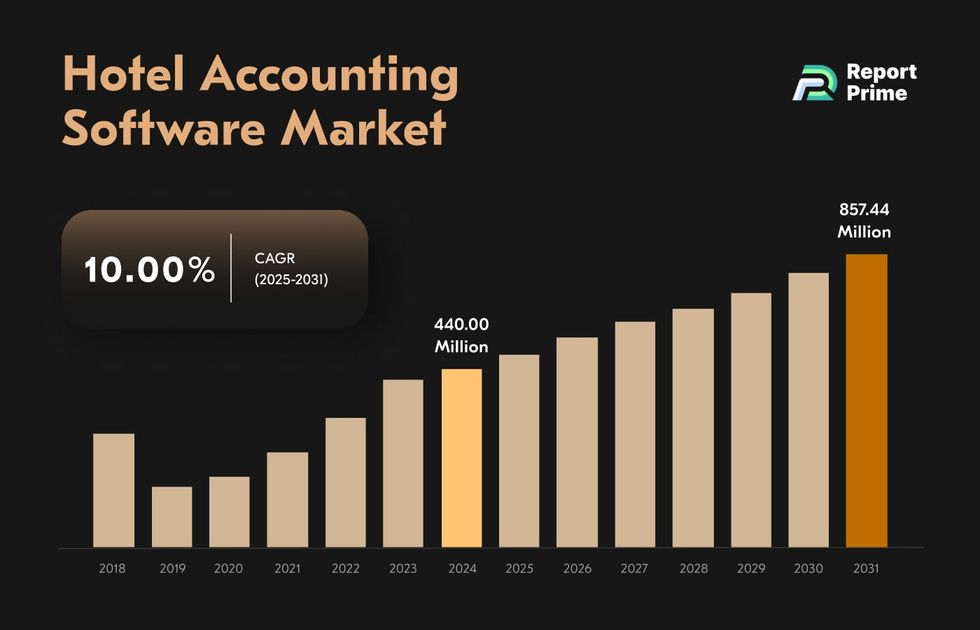

- The global hospitality accounting software market is booming, expected to nearly double by 2031, driven by the need for automation and financial accuracy.

- Custom systems offer seamless integration with PMS, POS, and booking engines, creating unified workflows and financial visibility across departments.

- Businesses benefit from reduced reliance on third-party accountants, faster approvals, and long-term cost efficiency, making custom software an investment in profitability.

Hotels depend on streamlined and automated processes to operate efficiently. Although accounting happens behind the scenes, it directly impacts profitability and long-term stability. Purpose-built hotel accounting software simplifies financial management by automating routine work and delivering reliable, data-based insights. When clear financial procedures are established, hotels can maintain transparency, accuracy, and compliance with industry standards.

Using insights from our 13-year experience in hospitality software development, we’ll break down the basics of hotel accounting systems. Let’s explore the top features of custom solutions for hotels and help you navigate potential challenges.

What Is Custom Hotel Accounting Software?

Hotel accounting software helps hospitality businesses manage their finances more efficiently by automating and streamlining bookkeeping tasks. It replaces manual spreadsheets with a centralized system that pulls data from sources like bank accounts, POS systems, and subledgers, keeping records accurate and relevant.

It also helps with the bigger picture. With clear, real-time insights, it’s easier to make smart decisions, manage your cash flow, and avoid problems like missed payments or tax issues. Plus, many systems come with handy hotel-focused features like payroll tools, automated invoicing, and dynamic pricing data synchronization.

Since such functionality is especially helpful when you’re dealing with lots of guest bills and extra services, the hospitality accounting software market is growing steadily. Projected to hit $857.44 million in 2031 from $440.00 million in 2024 it will be expanding at a CAGR of 10.00%.

Common Challenges in Hotel Accounting

As your hospitality business grows, your approach to managing finances and operations in general naturally evolves. With 86% of hotel brands using smart hospitality solutions with more structure and resources, growing hospitality businesses need to upgrade how they handle accounting.

What may have worked fine at a small scale, like basic spreadsheets or ad-hoc processes, can quickly become inefficient and error-prone as things expand. The bigger your operation, the more you need reliable hotel accounting systems in place to keep everything running smoothly and deal with common field-related challenges.

Multi-department & Multi-location Complexity

As operations spread across departments and even locations, tracking income and expenses gets trickier. IoT devices add another layer, constantly generating data from guest rooms, kitchens, and maintenance systems. Without a centralized system, it’s hard to stay on top of it all.

Manual Reconciliations and Human Errors

When you’re reconciling accounts and transferring data between systems manually, it’s only a matter of time before something slips. Software for hotel accounting offers automation that takes the load off your plate, reducing errors and freeing your team to focus on strategy instead of spreadsheets.

Compliance with Local Tax Regulations

Each region comes with its own tax rules, and complying with all regulations is a full-time job. Without proper tools and processes, it’s easy to miss deadlines or misreport data, which can lead to fines or audits.

Integration Issues with PMS, POS & Booking Engines

If your hotel accounting software doesn’t sync with your property management system, point-of-sale terminals, or booking platforms, your data gets fragmented. That not only slows down operations but also creates friction in the guest experience, from billing delays to double charges.

Real-time Financial Reporting Gaps

Delayed reports mean missed opportunities. The lack of instant, live insights into your financials, it’s harder to catch overspending, optimize pricing, or forecast accurately. Having up-to-date reports helps you make smarter, faster business decisions.

Why Choose Custom Accounting Software for Hotels over Off-the-Shelf Solutions

Generic hotel accounting systems might cover the basics, but they often fall short when it comes to the unique demands of running a hotel. Whether you’re managing a boutique inn or a large hotel chain, choosing software that’s built for your specific hotel goals can make a huge difference.

Here are a few reasons why hotel-specific accounting tools are worth the investment.

Tailored to Your Business Model

Not all hotels operate the same way. A boutique property might focus on personalized service and local charm, while a chain hotel deals with standardization, multiple locations, and centralized reporting. Custom accounting software for hotels takes these differences into account.

The most profitable companies, managing multiple properties, take advantage of modern apps to handle complex, multi-property financials. Such tools offer consolidated reporting and integration via open APIs with property management systems, streamlining both financial oversight and daily operations across departments.

Seamless Integration with Your Hotel Systems

Running a hotel means juggling systems: PMS, POS, booking engines, housekeeping software, and more. Tailored hotel accounting software is designed to plug into these tools without extra hassle, pulling data in automatically and reducing double entry.

Silver Hotel Group adopted Amadeus Sales & Catering, integrating their sales and catering data across 21 properties. This centralized approach allowed for live access to accounts and data, enhancing operational efficiency.

Automated Workflows and Approval Chains

When your hotel grows, so does the paperwork. Automating approvals for expenses, vendor payments, or payroll keeps things moving and helps you avoid delays.

A hotel featured in a Powder Bookkeeping case study faced challenges with manual financial processes. By transitioning to QuickBooks Online, they automated accounts payable workflows and approval processes, reducing errors and improving efficiency.

Enhanced Reporting for Occupancy-based Forecasting

Unlike other businesses, your revenue fluctuates with occupancy rates. Hotel-specific accounting tools understand this and let you forecast with those changes in mind, helping you plan ahead for slow seasons or peak demand.

Rain Maker Hospitality implemented HIA’s cloud-based solution, gaining access to advanced reporting dashboards. The accounting software for hotels helped the company foster accurate forecasting of future revenue and expenses, allowing for data-driven decisions to drive growth and profitability.

Long-term Cost Efficiency & Ownership

While industry-specific solutions may have a higher upfront cost, it pays off in the long run. Fewer errors, better insights, and less reliance on external accounting help all translate to real savings.

Not only will you have the ability to fully design the functionality of your hospitality accounting software, but you will also be the only owner of the product. Since the software will be working exclusively for you, it will scale up or down according to your business growth.

Key Features of Custom Software for Hotel Accounting

Before developing custom accounting software, it’s crucial to define and understand the fundamental features it must include. Skipping this step or relying on assumptions can lead to a solution that lacks the functionality needed to handle real operational demands.

Real-time Revenue and Expense Tracking

Custom software gives you a live look at your cash flow across departments — front desk, F&B, housekeeping, spa services, and more. Real-time tracking helps spot overspending early and supports better, faster decision-making. If powered by AI, your hotel accounting software can also identify unusual spending patterns or forecast future expenses based on trends, adding a layer of intelligence to your financial oversight.

Dynamic Dashboards & Financial Analytics

With interactive dashboards, you can monitor KPIs like RevPAR, occupancy rates, or labor costs in one place. Custom reporting tools also let you break down data by property, season, or department, which is perfect for multi-location operators or boutique hotels with diverse revenue streams.

Automated Billing, Invoicing & Payment Gateways

Integrated payment gateways make transactions smoother for both guests and back office teams while keeping everything synced with your books. AI-powered validation within hospitality accounting solutions helps flag duplicate invoices or inconsistencies automatically, improving financial accuracy and reducing fraud risks.

Payroll & Tax Compliance Modules

Custom solutions should handle complex scheduling, gratuities, shift differentials, and seasonal staffing changes. Plus, there must be built-in tax compliance tools to ensure you’re up to date with local, regional, and national regulations.

Integration with PMS, CRM, & Inventory

Custom accounting software for hotels should connect with robust APIs to directly interact with your current assets. That means fewer data silos, better accuracy, and more seamless operations, from room charges to minibar stock to loyalty programs.

Role-based Access Control & Audit Trails

Role-based access allows your finance team, general manager, and supervisors to only see what they need to. Detailed audit trails also keep track of who did what, helping you stay compliant and prevent fraud. Cybersecurity protocols such as multi-factor authentication and encryption help protect sensitive financial data from breaches or unauthorized access.

Business Benefits of Custom Hotel Accounting Software

Financial precision is about making smart, timely decisions that directly impact profitability. Off-the-shelf accounting tools can only go so far. Custom accounting software for hotels serves as the financial backbone that the facilities need to scale, optimize operations, and remain competitive.

Improved financial accuracy and transparency. Tailored solutions reduce the risk of human error by automating data collection, reconciliation, and reporting. With a single source of truth across departments, your leadership team can trust the numbers and act with confidence.

Reduced manual labor and accounting costs. Automation deals with routine tasks like data entry, invoice matching, and payroll processing. This not only saves hours of staff time but also frees up your finance team to focus on strategic work, cutting down the need for external accounting help.

Faster decision-making through data-driven insights. With all financial data centralized and in real time, you can promptly identify trends, spot inefficiencies, and respond to changes on the fly. Big data enables deeper forecasting and smarter revenue strategies, notably when it’s integrated into your accounting stack.

Improved cash flow and profitability tracking. Bespoke software for hotel accounting helps understand exactly where money is coming from and where it’s going. Be it adjusting room pricing, controlling food costs, or rethinking vendor contracts, clearer visibility into financial flows helps you take proactive steps to maximize margins.

Compliance and audit readiness. Integrated tax rules, documentation logs, and audit trails prepare your hotel for regulatory checks and financial audits. This reduces risk, improves transparency with stakeholders, and builds long-term credibility with investors and partners.

Why choose Acropolium?

At Acropolium, we bring deep hospitality software and accounting expertise to every project, designing intelligent, future-proof systems that solve real operational pain points.

From revenue management to financial automation, we develop unique solutions that align with each hotel’s goals, scale, and tech ecosystem. Our dedicated teams focus on creating a unified digital backbone for smarter hotel operations.

Acropolium Case Studies

When delivering software, we build measurable results that soon turn into success cases for our clients.

AI-Powered Revenue & Pricing System for a Hotel Chain

A prominent hotel group operating both city-based and resort properties was struggling with outdated, manual pricing processes. Without automation or accurate demand forecasting, they faced inconsistent room rates across locations, lost revenue opportunities, and reactive pricing.

Solution

The client approached us to modernize their revenue management with a custom-built, AI-driven pricing platform. The software for hotel accounting and pricing needed to deliver real-time insights, automate rate changes, and integrate seamlessly with their tools while adapting to each property’s unique profile.

Our solution combined deep data analytics, automation, and smart integration:

- Real-time pricing optimization based on market demand, booking patterns, competitor rates, and event calendars — automatically applied across properties to maintain revenue integrity and reduce accounting errors.

- Enhanced occupancy projections enabled strategic pricing decisions weeks in advance, reducing reliance on reactive rate changes and minimizing revenue leakage.

- Unified rate control of the hotel accounting software allowed oversight across the entire chain, while property-specific rules accounted for geographic, seasonal, and audience differences.

- Full connectivity with their internal tools ensured consistent financial data, streamlined reporting, and efficient reconciliation.

- Data-driven suggestions based on guest behavior increased revenue from services like spa bookings, dining packages, and late check-outs, which were automatically reflected in the financial systems.

Results

- 15% increase in overall revenue through automated pricing adjustments and better forecasting

- 12% boost in occupancy rates across both urban and resort properties

- 30% reduction in manual pricing workload, freeing up teams to concentrate on strategic growth and improving financial accuracy

Final Thoughts

As hospitality operations grow more complex, many providers struggle with disjointed systems, inefficient processes, and rising financial risk. Custom software for hotel accounting has become a practical requirement for organizations aiming to maintain control, accuracy, and operational clarity.

With the challenges concerning tech adoption, it’s vital to have a partner who can guide you through the ins and outs of modernizing accounting operations.

To ensure sustainable growth and expense control, Acropolium provides a subscription-based model that includes ongoing updates, proactive maintenance, and scalable enhancements. This way, you can evolve technologically without the uncertainty of variable development costs.

![Hotel Revenue Management Software [2025 Guide]](/img/articles/hotel-revenue-management-software/img01.jpg)

![ML & AI in Hospitality & Travel [7 Use Cases Included]](/img/articles/ai-and-ml-in-travel/img01.jpg)