- With simple and secure online payments, businesses can build solid consumer trust, protecting their reputation and increasing customer satisfaction.

- According to a survey, 17% of online shoppers are likelier to leave the cart due to the complicated checkout process. This, in turn, might increase the cart abandonment rate and lead to revenue loss.

- 18% of shoppers abandon orders and payment entries if the website and its payment integrations don’t evoke trust.

If you go to an online marketplace like Amazon to buy, let’s say, shampoo, it will take only a few seconds to approve a transaction from an account with saved card details.

It looks like zero effort on the user end, but the tech side of processing online payments isn’t as simple. Businesses should know this other side to choose the most suitable payment processing software to keep the process secure and customers—happy.

This article is your all-in-one guide on how to find the best payment solution. We’ll explain how payment processing works, the types of payments worth having, how to create an online payment system, and what to know before adding it to your website. So, let’s start with the basics: what is payment processing?

What does payment processing mean?

If you look up a payment processing definition, you’ll see it’s a way for businesses to collect money for their products or services through payment processing software. For consistency and clarity, this article deals only with online payment processing, which happens whenever someone buys a product or service from a website.

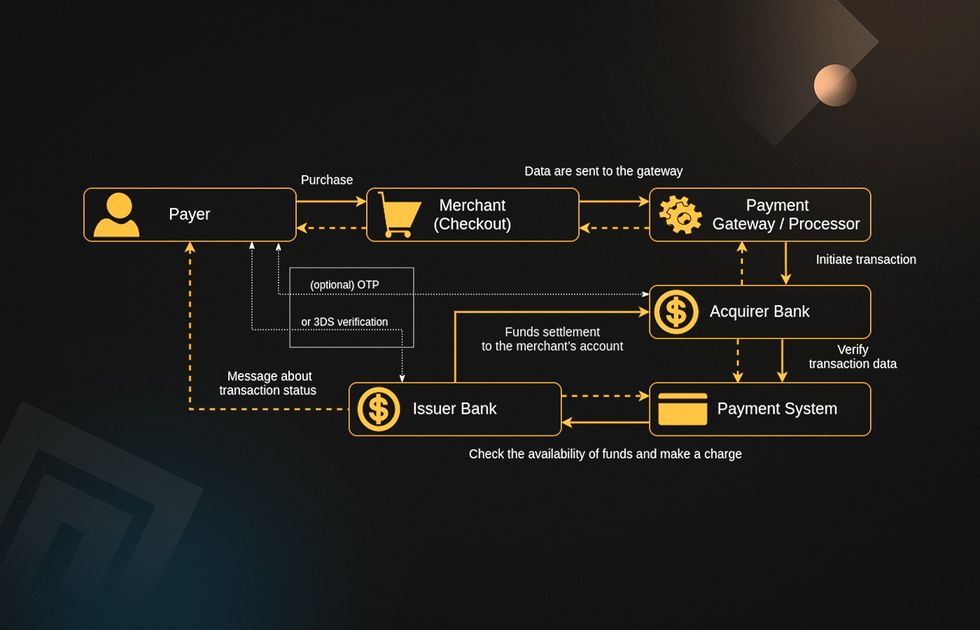

Online payment processes involve a few components and actors to complete the payment:

- Client: any website user willing to make a purchase

- Merchant/ business website or app: a digital store offering services or products

- Payment gateway: software that encrypts and transmits the payment data between the acquirer and issuer banks in the card-not-present (CNP) transactions

- Payment processor: a company authorized to process and verify the transactions between customers and merchants

- Acquirer bank: a bank where the merchant opened their business account

- Merchant account: a merchant’s business account used for collecting payments for services online

- Payment system: the whole system of institutions, tools, standards, and technologies enabling the transaction

- Issuer bank: a bank that issued the credit card to the client

Here’s what their interaction usually looks like.

Seems like too much for something that happens in a snap? Let’s dive a bit deeper and review the process of online payment in detail.

How does online payment work?

The payment process flow has two main stages: authorization and settlement.

The authorization stage starts when the client selects the product and presses the “Checkout” button. This is where they are redirected to the payment page to fill in the details, choose the payment type, and confirm the purchase.

When they hit “Place order,” the banking details go through the payment gateway to get encrypted and secured. Afterward, the payment processor communicates with the card issuer bank to confirm if the required funds are available.

The settlement stage starts after the merchant, processor, issuer, and acquirer bank algorithms authorize proceeding to transfer.

If there’s enough money and the purchase amount falls within bank limits set by a customer or their bank, the issuer’s bank or credit card system (Visa, MasterCard, etc.) transfers the required funds and any applicable fees from the customer’s account to the merchant’s one. The payment will be declined if there’s any issue with the money, transaction limits, or other settings.

The payment is officially completed once the funds are transferred.

While credit card payment is the most popular online payment type, it’s not the only one. What other options can be processed online with a similar online payment flow?

What types of payments can be processed?

Online payment processing software can process several most common payment methods, such as:

- Debit/credit cards (Visa, MasterCard, UnionPay, American Express)

- E-wallets (ApplePay, PayPal, Google Wallet)

- Crypto wallets (Coinbase, Electrum, Trust Wallet)

- Bank transfers

- E-checks

- Local payment methods

- Prepaid/gift cards

The method you go for should be beneficial to your clients and business. It should also demonstrate your knowledge of payment processing industry trends and the latest legal requirements. Let’s review the trends to consider when choosing the right solutions for processing online payments.

Payment processing industry trends

The option of paying online is a must for any business eager to build up its target audience and future-proof its market activity. Think about it: over 24% of retail customers worldwide will be paying online on e-commerce websites by 2026. And this trend will only grow. What else will shape the future of online payment?

- Remote card payment. According to the Federal Reserve Payment Study, card payment was the most popular cashless payment form in the US in 2018-2020. The study also shows that since 2020, remote card payments have increased significantly ($3.85 trillion), while in-person card payments have dropped ($3.20 trillion).

- E-checks. The same study suggests that check payments are falling out of favor. But it’s still an option your customers may want to use at checkout. Particularly if you’re in the B2B segment. The reason? Lower transaction costs than card payment and faster processing compared to paper checks.

- Mobile payments. In the US alone, the share of mobile payments is predicted to reach 50.2% in 2025. It’s a sign for businesses that they need to guarantee online checkout on their apps or mobile versions of their website.

- Digital identity for KYC purposes. The rise of website payment processing comes with an increase in digital fraud, so businesses must secure their payment processing against potential threats. Know your customer (KYC) policies help do it. According to Deloitte, in 2022 and beyond, businesses will invest more in digital identity initiatives to reduce identity theft risks when processing online payments.

- Next-gen technologies. The use of blockchain technologies will be on the rise as it’s a path toward further payment digitalization. According to Deloitte’s study mentioned above, blockchain technologies may be used as a faster, more reliable, and more transparent alternative to automated clearing houses and paper-based processes, especially cross-border ones.

All these trends and figures suggest that you should hurry up and equip your website with online payment solutions that would work best for your clients and business. Here are some sure-fire tips on how to do it.

How can you add electronic payment processing to your website?

To start accepting payments for your online sales locally or globally, you should power your website with online payment processing solutions. Here are four major ways how to set up payments on a website:

- API integration. Application programming interface (API) allows you to create custom payment interfaces based on the third-party payment processor’s infrastructure and functionality. This option saves time and money and empowers greater design and feature variety.

- Pre-built hosted checkout page. With a pre-hosted checkout page where clients get redirected after they hit “Checkout”, your customers are flexible in choosing their preferred payment method among dozens of supported ones. This low-code PCI DSS-certified solution helps you add a website payment solution fast without worrying about compliance issues.

- E-commerce platform plugins. If your e-commerce store already uses some features of WooCommerce, Shopify, Magento, Wix, or alike, you can simply install a website payment software plugin that you can find in their plugin stores. Some plugins can be also used with custom-built websites and function as third-party plugins. In this case, you must check the compliance and certifications required to run safe transactions.

- Digital invoicing. This feature is more popular with B2B online payment processing small business and medium enterprises deals, where closing is followed by sending invoices and bills. Adding digital invoicing as their online payment method, companies can issue invoices and statements with all the necessary details and get paid faster.

With so many options for how to set up an online payment system, it’s crucial to know what to look for to select the best fit. Scroll down to learn about a few must-haves for your payment software solutions.

Requirements for web payment processing software

The best solution for processing online payments matches not only the payment industry requirements but the customer’s expectations of usability, security, and flexibility. We put together a list of essentials your online payment software must have.

- PCI DSS certification of compliance. This certification confirms that a particular plugin/tool/platform complies with the Payment Card Industry Data Security Standard (PCI DSS), so it can be safely used for card processing.

- Relevant payment type processing. If you deal with B2B transactions and your payment system doesn’t offer invoicing and billing, chances are you will have to do it in a paper-based format, which is slow, less secure, and simply inconvenient. Make sure that the payment processor supports the payment options your clients value.

- Transparent fee policy. Each platform provider has its own transaction fee policy. An open and honest fee schedule will allow you to budget properly.

- Sensitive data encryption and secure sockets layer (SSL) certificates. According to the FBI report, identity theft and data breach were among the top cybercrimes in 2021. Data theft usually occurs during data transfer unless the information is encrypted. When you receive payments online, software must encrypt the data your clients type in to prevent data theft during transactions.

- Incident management policy. No solution is fully protected against security or functionality incidents. Still, it shall come with a robust risk management system and policies to alert about possible malfunctioning and mitigate the consequences if the incident does occur.

- Password security and access control policies. Single sign-on (SSO), two-factor authentication, ID authorization, and password enforcement—these are just a few most common practices used during the web payment process to ensure its safety. Select a solution that enforces them to foster the cybersafety culture among users and minimize the risk of fraud.

- User agreement template. These agreements describe how the user data is processed, stored, and used and collect their consent.

- Local laws compliance. Some regions and industries have unique policies on data privacy and security. For example, if your website serves EU residents, you must comply with the GDPR requirements by designing specific payment process steps and using tools that ensure them.

- System monitoring and logging policy. Real-time or planned system monitoring helps detect potentially dangerous issues and track users’ actions that led to incidents. Doing it early will reduce potential financial, data, and reputation damage.

We agree: that’s a lot to ask for a solution. Still, these requirements help you protect sensitive financial information and avoid losses, fines, and customer distrust.

Some solutions for accepting payments online come with the essentials built in. There’s also an option to create a custom payment processing system with a portfolio of features tailored for a certain industry, market, and users. They have their pros and cons, and that’s what we discuss in the next chapter.

How to choose the best payment processing software for your business

Quite a few factors impact the choice of online payment processing tools for your website: business needs, budget, desired launch time, technical specifications, availability of tech vendor, and so on. We’ll focus on the three most popular options on the market and describe why you should opt for them and what to keep in mind.

Paid ready-to-use payment processing solutions

Ready-to-use platforms top the list of the most popular website payment processing options. And we do need to give them credit. These out-of-the-box solutions like Square, Stripe Payments, or Braintree do not need much of the developer’s work to be set up and configured with your account.

Solutions like these offer plenty of developer’s resources and integration options, so you can pack your website with the most suitable ones. However, not every business will find it beneficial.

| Payment processing platform pros | Payment processing platform cons |

|---|---|

| - Low-code setup | - Design and branding options might be limited |

| - Critical compliance and certifications included | - Can be expensive if not bundled with other solutions |

| - Variety of pricing plans | - Not suitable for high-risk industries |

| - Developer toolkit and resources | |

| - Versatile payment gateway |

Open-source payment processing platforms

Open-source payment processing platforms like UniPAY or WooCommerce are go-to choices for startups and emerging small businesses. They offer basic functionality and access to source code that you can change to add the needed features.

However, these solutions don’t usually offer certified environments. This could be a problem since you will have to run external audits to ensure that your payment environment complies with the requirements.

| Open-source payment processing platform pros: | Open-source payment processing platform cons: |

|---|---|

| - Allow changes to source code | - Usually comes with no PCI DSS certification, so you will have to arrange a costly PCI audit |

| - All basic features needed for payment processing are available | - No acquirer bank integration ready |

| - No upfront payment necessary to use solution | - No ready-to-use mechanisms for onboarding, provisioning, and payment reconciliation |

Custom payment solutions

If the previous options don’t match your needs, creating a custom payment solution will be the way to go. Its major benefit is that you will get a tailored, feature-packed system fitting your company’s safety, functionality, and design requirements.

At the same time, this option requires a thorough project estimation, upfront investment, skilled developers, and a longer time to market.

| Custom payment solutions pros: | Custom payment solutions cons: |

|---|---|

| - Full integration with the existing architecture | High upfront payment |

| - Variety of design options | Need to hire tech partners |

| - Almost unlimited choice of tools and services | Slower time-to-market, compared to the ready-to-use solutions |

| - Custom development offers tailored features that might be unavailable in the ready-made solutions | |

| - Possibility to power it with various next-gen technologies (blockchain, AI, ML) |

At Acropolium, we gravitate toward processing online payments with custom-built solutions. Here’s what makes us think this way.

Why choose custom online payment solutions

While out-of-the-box solutions promise fast and easy installation, they do not fit every business. Usually, their clients are small and medium businesses from lightly regulated industries with moderate transaction flow.

But what if you’re an international enterprise offering high-risk goods or services globally in, let’s say, fintech or healthcare? This is where a custom credit card (and other payment) processing solution is a perfect option. See our arguments for developing a tailored payment solution.

- You can choose any development tools and solutions that comply with your requirements. Government policies, laws, and regulations will be the only limits the dev team will deal with. Development is fully flexible, which means that you can select what works better and costs less.

- You can do any signature design and provide the best UX. Having the freedom to do whatever design you want is a path toward greater brand awareness. It’s also essential to make the process as smooth as possible because for 17% of survey respondents, an overly complicated checkout can be a reason they abandon the cart (and you lose money.)

- You can ensure bank-grade safety. 18% of surveyed shoppers say they can walk away from entering payment details and placing an order if they don’t trust the site. Savvy shoppers check what the website looks like and whether it collects data processing consent from its users and offers SSL encryption. With custom website payments solutions, you are in charge of the process flow and safety measures. You can choose the most appropriate tools to gain and maintain your customer’s trust.

To build and integrate a custom solution that accepts payments online, you need to hire a team of professionals who will not only deliver the code but also connect the payment system to your website, ensure its maintenance, and provide the required documentation. A team like Acropolium. Why should you entrust our agency with your payment system? Here are a few reasons.

Why choose Acropolium?

Acropolium is an experienced tech vendor specializing in custom and pre-built software solutions for various industries. Our portfolio features custom-built payment and billing tools for HoReCa, transportation, logistics, healthcare, and others.

Our skilled, dedicated team offers a vast range of services, including IoT, backend and frontend development, web development and design, IT consulting, software modernization, cloud solutions, and others. All that makes us a reliable end-to-end tech partner to trust your project with.

Instead of following a traditional hourly rate, we work on the development-as-a-subscription base that offers all services and professionals needed to start your software—from development to QA. This model allows you to plan your budget smartly and saves you time since we assemble the needed team by ourselves.

Our portfolio

Acropolium’s team has finished numerous projects, and some of them involved either payment gateway integration or designing an online payment process tool.

For instance, in the case of chatbot software for a restaurant business, we had to develop a solution to help clients order, pay, and request delivery by using a chatbot. To save time and fit the budget, we integrated a pre-built, low-code solution equipped with all the necessary features.

Another example of payment integration is pharmacy kiosk software. The self-service pharmacy kiosks required a fast solution that would work seamlessly across terminals, allowing the clients to choose the medication, pay upfront, and either pick it up at the drug store or order home delivery.

We also developed a hotel chain management system based on the legacy system and moved it to the cloud—yes, we are friends with serverless technologies! The system included web and mobile apps powered with booking, payment, availability control, and other features.

On top of that, our portfolio includes a cryptocurrency trading platform, so we know how the cryptocurrency works, what needs to be done to accept crypto payments, and how to protect web payment processing from hackers.

Our expertise in these fields allows us to deliver bespoke software to help you get payments online quickly and securely and protect clients’ information along the way.

Final thoughts

Processing online payments requires a lot of activity and tools—not always visible to the website users but essential to ensure the process’s safety and quality. With a variety of payment processing platforms and instruments on the market, businesses can equip their online store with out-of-the-box, pre-built, or custom payment solutions and collect money for their services online.

Knowing how payments work is not enough to set up and run it successfully—you need in-depth tech expertise to arrange the tech side of the story. Acropolium offers you custom, subscription-based development that covers all project needs for a fixed monthly fee. Contact us today, and let’s discuss what it will take to get your online payment processed.

![4 Benefits of Custom Accounting Software [+Case study]](/img/articles/custom-accounting-software/img01.jpg)

![Blockchain in Finance: [Use Cases Revolutionizing Finance in 2025]](/img/articles/blockchain-in-finance-use-cases/img01.jpg)

![Why Invest in Cryptocurrency Wallet Development [2025 Guide]](/img/articles/investing-in-cryptocurrency-wallet-development-cost-and-benefits/img01.jpg)

![AI in Portfolio Management: Use Cases & Benefits [2025 Guide]](/img/articles/ai-for-portfolio-management-use-cases/img01.jpg)

![Top AI Applications in Finance for 2025: [Benefits & Success Stories]](/img/articles/artificial-intelligence-applications-in-finance/img01.jpg)