Key Takeaways

- Fintech SaaS solutions present adaptability, affordability, and customer-focused features, serving as a valuable option for businesses and consumers.

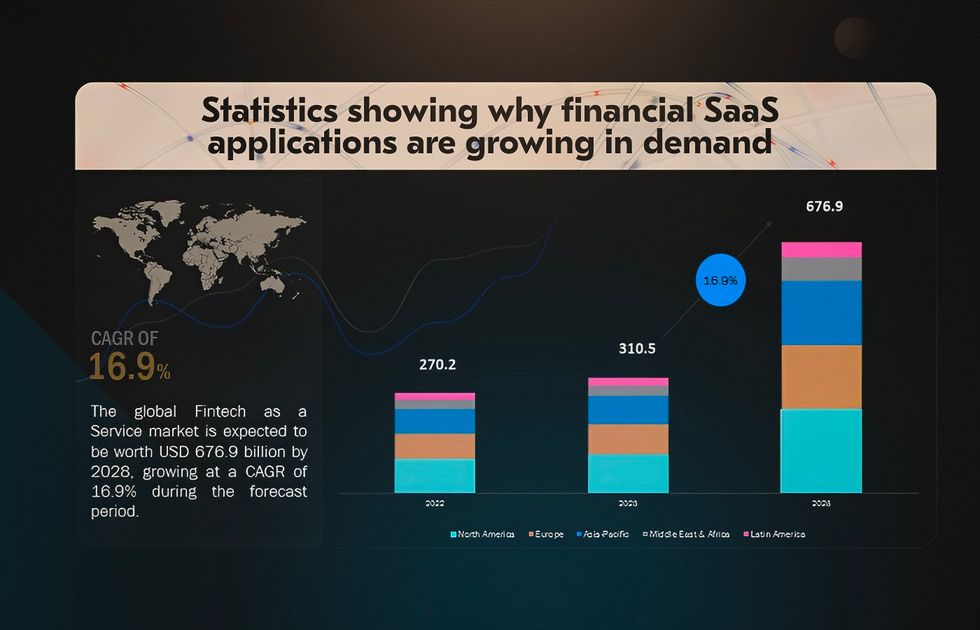

- The fintech-as-a-service market is set to grow from $10.5 billion in 2023 to $676.9 billion by 2028.

- Financial software custom development allows for tailored features and greater control to meet specific business needs and regulatory requirements.

Building a finance SaaS solution has become both a growth opportunity and a challenge in the finance and technology landscape. Fintech SaaS bridges the traditional financial industry and the tech-driven future, providing financial services through cloud-based platforms.

Software-as-a-service solutions revolutionize how financial institutions, businesses, and individuals manage their funds, investments, and transactions. From banking and accounting to insurance and cryptocurrency companies, businesses sharpen their competitive edge with the power of SaaS.

In this post, we will guide you through the fundamentals of building and choosing a suitable finance SaaS solution. Read on to discover real-life success stories and make an informed decision!

SaaS Fintech Market Size

The fintech-software-as-a-service market is estimated to expand substantially from $10.5 billion in 2023 to $676.9 billion by 2028. The forecasted 16% CAGR during the forecast period is based on the growing demand for convenient digital financial services among consumers.

Generally, businesses prefer SaaS solutions due to cost-effectiveness, where upfront hardware costs and ongoing maintenance expenses are eliminated. Additionally, SaaS providers handle maintenance and updates, ensuring the software remains current and reducing the burden on in-house IT teams.

Below, we’re exploring the basics of fintech SaaS, breaking down the features that make it irreplaceable for successful financial operations.

What is Fintech SaaS?

SaaS fintech refers to financial technology applications and solutions that are delivered and utilized over the internet as cloud-based services. Financial SaaS applications are hosted on remote servers and provided to users on a subscription or pay-as-you-go basis.

This gives the users easy access without software installation and maintenance on their local devices or infrastructure. Such a user-friendly and straightforward model is one of the reasons why user-centric financial businesses consider outsourcing SaaS development.

Fintech software is designed to offer various financial services, tools, and capabilities to businesses, financial institutions, and individuals. Some common examples of SaaS fintech solutions include:

- Payment Processing: Fintech SaaS software enables online payment processing, including credit cards, transfers, and various methods.

- Accounting and Financial Management: Such apps streamline financial transactions, expense tracking, reporting, and accounting processes.

- Wealth Management: SaaS tools help manage investments, create portfolios, and offer financial planning.

- Regulatory Compliance and Risk Management: SaaS financial management software ensures regulatory compliance, risk monitoring, and security for businesses.

- Trading and Investment Platforms: SaaS platforms provide access to financial markets for trading stocks, cryptocurrencies, and commodities. This is a common solution for crypto startups that outsource software development, striving to focus on investment attraction.

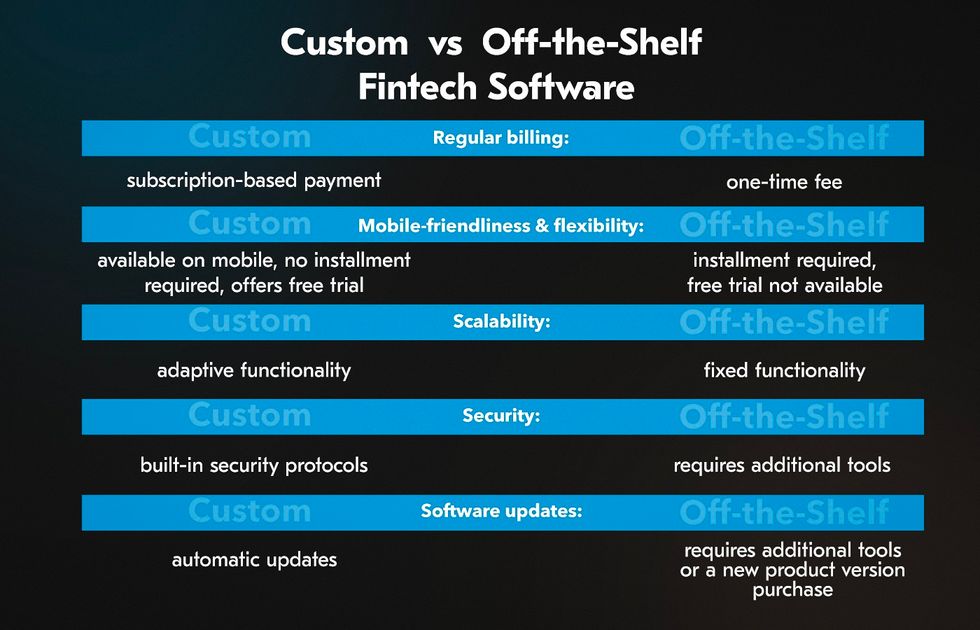

Custom SaaS Fintech Software vs. Off-the-Shelf Solutions

While both ready-made and tailored software have advantages, one must find the functionality to satisfy specific business objectives. Many companies choose between building custom financial software development and utilizing off-the-shelf solutions based on several factors:

- Regular billing. While off-the-shelf solutions require product installation at a one-time fee, tailored SaaS fintech software operates on a subscription basis.

- Mobile-friendliness & flexibility. Traditional software is usually available in one medium, whereas SaaS allows mobile usage. At the same time, SaaS offers the users free trials, which strengthens customer trust and increases customer satisfaction.

- Tailored features. Custom SaaS fintech software can be designed to match a company’s unique needs and requirements. Such customization allows businesses to streamline financial operations and align with their specific processes and objectives.

- Scalability. Custom SaaS solutions can be designed to scale with the growth of the business. SaaS scalability ensures that the software can adapt to evolving user demands, changes in transaction volume, and expanded service offerings.

- Enhanced security. Financial services require robust security measures. Custom SaaS fintech software can incorporate security features tailored to a company’s unique risk profile and compliance requirements. Users of off-the-shelf software, however, have to invest in additional security tools for a higher level of data protection.

- Automatic updates. In solutions requiring a subscription, users can get automatic updates without extra pay. With ready-made software, businesses either need to purchase an updated version or hire a dedicated team to integrate other tools.

Off-the-shelf fintech solutions are pre-built software applications that cater to a wide range of financial institutions or businesses. While they offer convenience, they may have limitations when compared to custom solutions.

Real-world Finance SaaS Examples & Comparison

Payment processing platforms like PayPal or Square are readily available for businesses. However, they may not fully accommodate a company’s specific payment workflows or branding. At this point, custom fintech SaaS solutions are preferable when a tailored experience and integration with unique systems are required.

In accounting, software like QuickBooks is suitable for many businesses but might lack certain features needed for specialized accounting practices or industry-specific requirements. Custom solutions can cater precisely to these needs.

Regarding trading platforms, generic fintech SaaS applications are available for individual investors. However, brokerage firms often require trading solutions with tailored features, high-frequency trading capabilities, and integration with market data sources.

Benefits of Custom SaaS Fintech Solutions

While off-the-shelf solutions offer convenience, custom software provides a strategic advantage that can be crucial in the highly competitive financial technology sector. Moreover, the flexibility of SaaS solutions makes this software benefit small and medium-sized businesses.

1. Customization and scalability.

Combining customization and scalability, tailored SaaS solutions empower businesses to adapt their fintech solutions precisely to current and future requirements. Thus, the software ensures efficient operations and optimal user experiences.

2. Compliance

Some businesses, especially in the financial sector, have particular regulatory and compliance requirements. Bespoke SaaS software can be built with these requirements in mind, reducing the risk of non-compliance and potential legal issues.

3. Integration.

Custom finance SaaS software can be designed to integrate with a company’s existing systems seamlessly. This way, it simplifies data management and sharing across the organization. Integration capabilities can lead to greater efficiency and a more unified approach to financial operations.

4. Cost-effectiveness.

While custom software development costs might imply higher upfront expenses, it can lead to cost savings in the long run. Off-the-shelf solutions may come with unnecessary features that require costly modifications to fit a company’s unique needs. Tailored software, in turn, is designed to satisfy specific needs at the outset.

5. Competitive advantage.

Custom solutions offer the opportunity to differentiate a company’s services and stand out in a competitive market. Businesses can sharpen their competitive edge by providing finance SaaS products specifically designed to address their customers’ pain points and unique needs.

6. Ownership and Control

With custom SaaS fintech software, the company retains full ownership and control over the software. That’s why companies outsource app development for fintech projects: it enables more direct influence over product building, maintenance, and updates.

Features to Consider in Custom SaaS Fintech Development

Despite requiring more upfront investment, custom solutions offer the advantage of tailoring features, security, and compliance measures to meet your precise requirements. Whether developing accounting software or crypto tools with unique functionality, paying attention to commonly required features is always wise.

When building a SaaS app with a web development vendor, make sure to consider the following features:

- Smooth payment processing

- User-friendly interface

- Robust security

- Personalization

Smooth Payment Processing

Your finance SaaS app should simplify financial tasks like money transfers, electronic payments, and balance tracking without compromising security.

User-Friendly Interface

A visually appealing, easy-to-navigate layout and a swift sign-in process exceed users’ expectations, enhancing your fintech application’s reputation and value.

Robust Security

An efficient authentication process is crucial to maintain a decent security level in finance SaaS software. Integrating strong expertise and the latest cybersecurity protocols is imperative to safeguard vital user data in your product.

Personalization

Users favor products tailored to their needs, allowing them to fine-tune their experience. Even minimal details like push notifications can evoke more trust for your application or platform.

Developing SaaS Fintech Software with Acropolium

With 20+ years of crafting unique software for various industries, Acropolium has an extensive portfolio of 137+ SaaS solutions. From accounting software SaaS platforms to cryptocurrency trading applications, we take a fundamental approach to realize business goals.

In our latest cooperation with a cryptocurrency company, we were asked for a user-friendly and highly functional crypto-adviser for beginners. The client required an easy-to-navigate, intuitive fintech platform, allowing users to invest in cryptocurrency effortlessly and securely. For this complex fintech SaaS project, our developers teamed up to:

- Develop a strategic marketplace for users to explore and instantly implement trading options.

- Employ a questionnaire-based risk-profiling tool to determine users’ risk tolerance and match their profiles with suitable portfolios and trading options.

- Enable diversification within the crypto robo-advisor software, allowing users to allocate their investments across various cryptocurrencies.

- Implementing multi-factor authentication and cold storage for cryptocurrencies to protect users’ assets and data.

In 24 months, our dedicated team built an all-encompassing product, increasing registrations by 250% and raising trading volumes by 119%.

Final Thoughts

SaaS solutions transform the way financial entities and businesses handle finances, investments, and transactions. Banking, accounting, insurance, and cryptocurrency firms elevate their competitiveness by embracing the potential of SaaS products.

With 7+ ultimate fintech solutions and 18+ consulting projects delivered in the last 4 years, Acropolium knows how to bring value.

As part of our customer-centric vision, we also value your budget, offering subscription-based cooperation to fit your requirements. Contact us to discuss a SaaS solution that will open up new opportunities for your fintech business!

![Microservices Architecture [Implementation Benefits]](/img/articles/microservices-architecture-implementation/img01.jpg)

![SaaS Migration Strategy: [Why Move to SaaS and How to Do It]](/img/articles/saas-business-model/img01.jpg)

![ᐉ SaaS Application Architecture: Best Practices [2025]](/img/articles/saas-app-architecture/img01.jpg)

![Single-Tenant vs. Multi-Tenant SaaS Architecture [What to Choose]](/img/articles/multi-tenant-vs-single-tenant/img01.jpg)

![ᐉ Biotech Software Development: Trends & Benefits [2025 Guide]](/img/articles/biotech-software-development/img01.jpg)