- AI & ML

- Big Data

- Real-Time Solution

- Data Analytics

- Custom Software Development

Building a sophisticated AML AI software for efficient digital banking operations. Integrating ML algorithms for automated fraud detection with real-time transaction monitoring capabilities. Enabling data-driven predictive risk management while ensuring live compliance reporting to align with industry regulations.

client

NDA Protected

Switzerland

50 employees

Our client, an emerging digital bank, aims to deliver secure and accessible financial services through an intuitive mobile platform. Offering personal and business accounts, payments, loans, and investment options, the company strives to make banking more efficient through digitalization.

As its operational capacity grew, they started looking for anti-money laundering compliance software to strengthen security and maintain regulatory adherence.

request background

Anti-Money Laundering Solution as a Response to Regulatory Changes

The company realized that keeping up with security and regulatory standards is becoming more challenging as the financial sector evolves. With more transactions taking place daily and new financial risks emerging, it’s clear that smarter, automated solutions come as a must to protect both the bank and its customers.

As regulations tighten — especially around anti-money laundering — our client prioritized AML AI solution development as part of their business maturity strategy. They’re now exploring advanced technology to detect suspicious activity in real time, reduce manual compliance work, and ensure they meet ever-changing legal requirements.

Beyond compliance, the anti-money laundering solution for banking was supposed to also contribute to a better customer experience. Faster, more accurate security measures mean fewer transaction delays and a smoother banking process.

To embrace technological growth, the company approached Acropolium to leverage cutting-edge approaches with artificial intelligence, machine learning, and predictive analytics.

challenge

Anti-Money Laundering Solution to Deal with Workflow Vulnerability

Building a secure and efficient fraud detection system in a fast-growing digital bank comes with several key challenges. As the volume of transactions increased, so did the complexities of monitoring financial activities, ensuring compliance, and preventing financial crime.

One major hurdle was managing the rising number of transactions. Since bank operations expanded, manual tracking of fraudulent activity has become increasingly difficult and inefficient. The growing workload not only slowed down anomaly detection but also increased the risk of missing critical signs of fraud.

Another challenge of anti-money laundering tool development was centered around manual compliance processes, which were slow, resource-intensive, and costly. The compliance team struggled to keep pace with monitoring and reporting, leading to potential delays and higher operational expenses. Without automation, meeting the changing regulatory requirements became a significant burden.

Financial crime risks were also on the rise, with fraudsters developing more advanced tactics for money laundering and other illegal activities. The bank’s existing fraud detection measures, while effective to some extent, may not be enough to address emerging threats. Strengthening security was among the top priorities in protecting both the institution and customer data.

goals

- Automate fraud detection and compliance monitoring with the power of artificial intelligence to reduce manual oversight and track transactions with higher accuracy.

- Improve security and risk management with ML-driven analytics so the bank can identify threats before they cause financial losses.

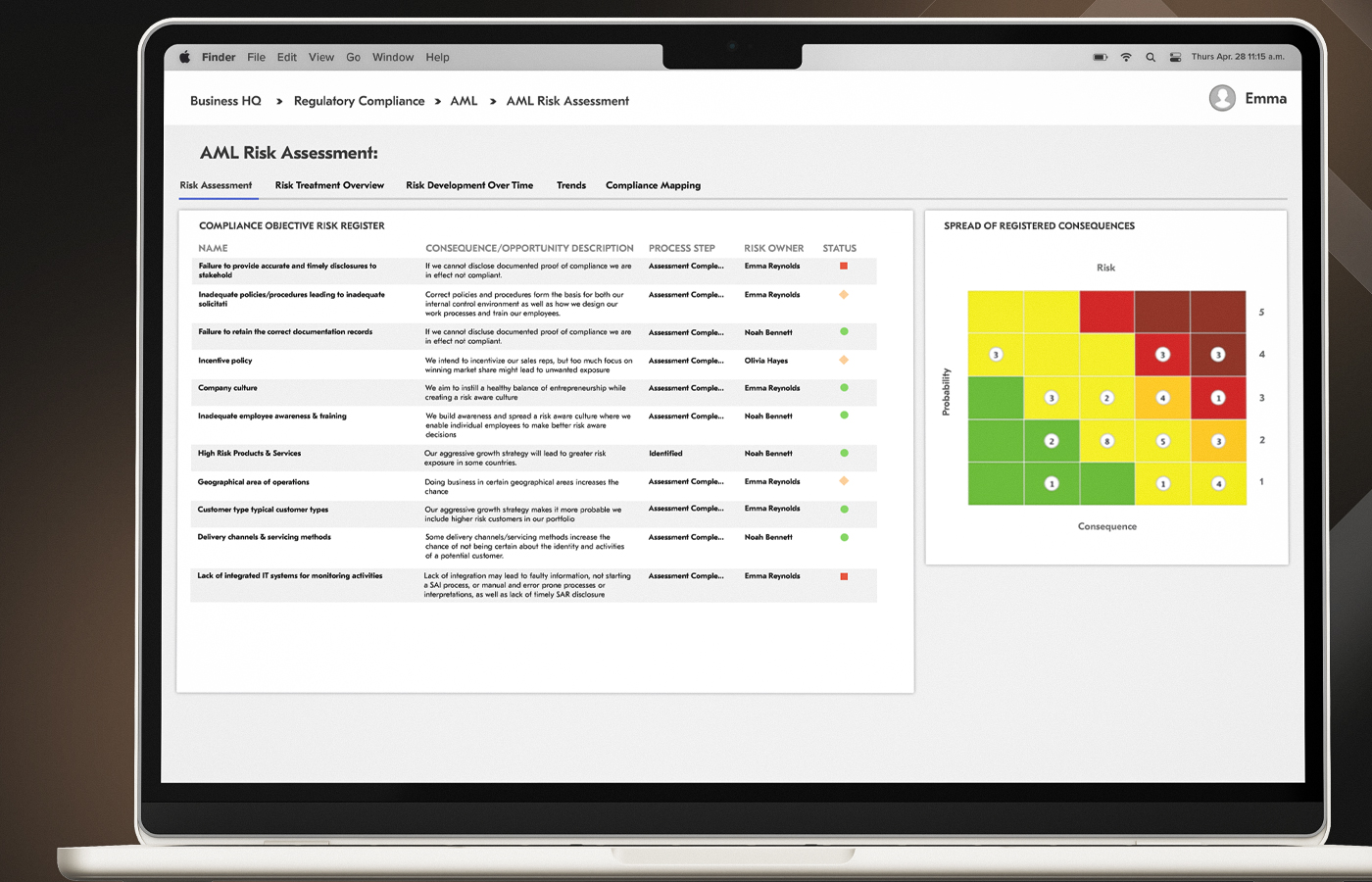

- Enhance regulatory compliance with anti-money laundering (AML) policies, the client needs a solution that can adapt automatically, generate compliance reports, and improve regulatory response times.

- Upgrade resource allocation by automating fraud detection and compliance processes.

- Cut costs by enabling staff to focus on high-priority cases.

solution

Automated Anti-Money Laundering Solution with Cutting-Edge Functionality

.NET Core, C#, ASP.NET Web API, Entity Framework Core, TensorFlow.NET, ML.NET, Apache Kafka, Apache Spark, Microsoft Azure, Kubernetes, Angular, PostgreSQL, Redis, Elasticsearch, RabbitMQ, Docker, Prometheus, Grafana

23 months

7 specialists

To realize the client’s objectives, we developed (AML) anti-money laundering software designed to enhance fraud detection, ensure compliance, and elevate operational efficiency.

We began with a discovery phase to understand the client’s specific challenges and regulatory requirements. Also, we analyzed the available anti-money laundering tools used by banks to pinpoint the best functionality features for our client.

This allowed us to design a tailored solution that meets industry standards and adapts to evolving risks.

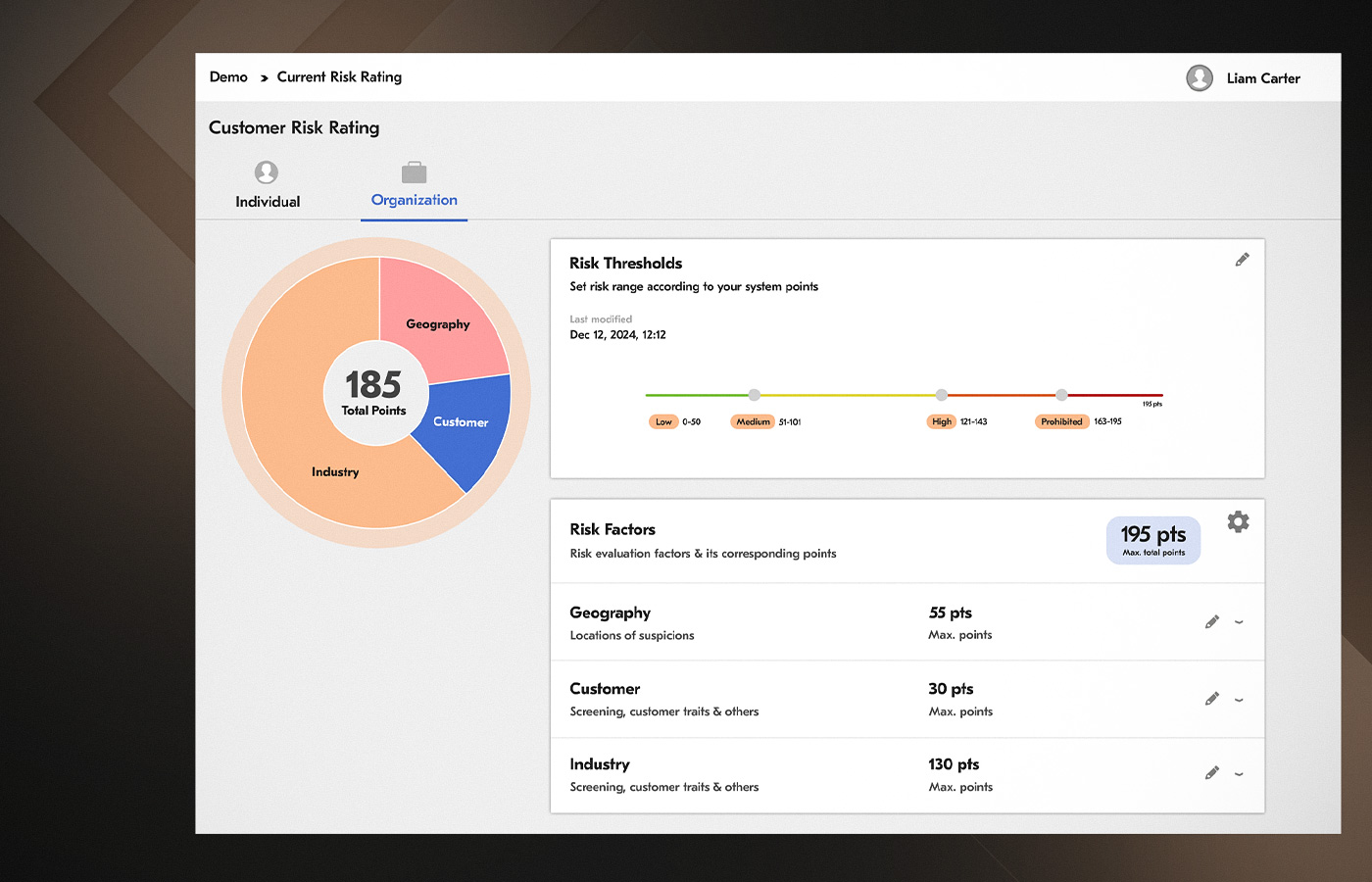

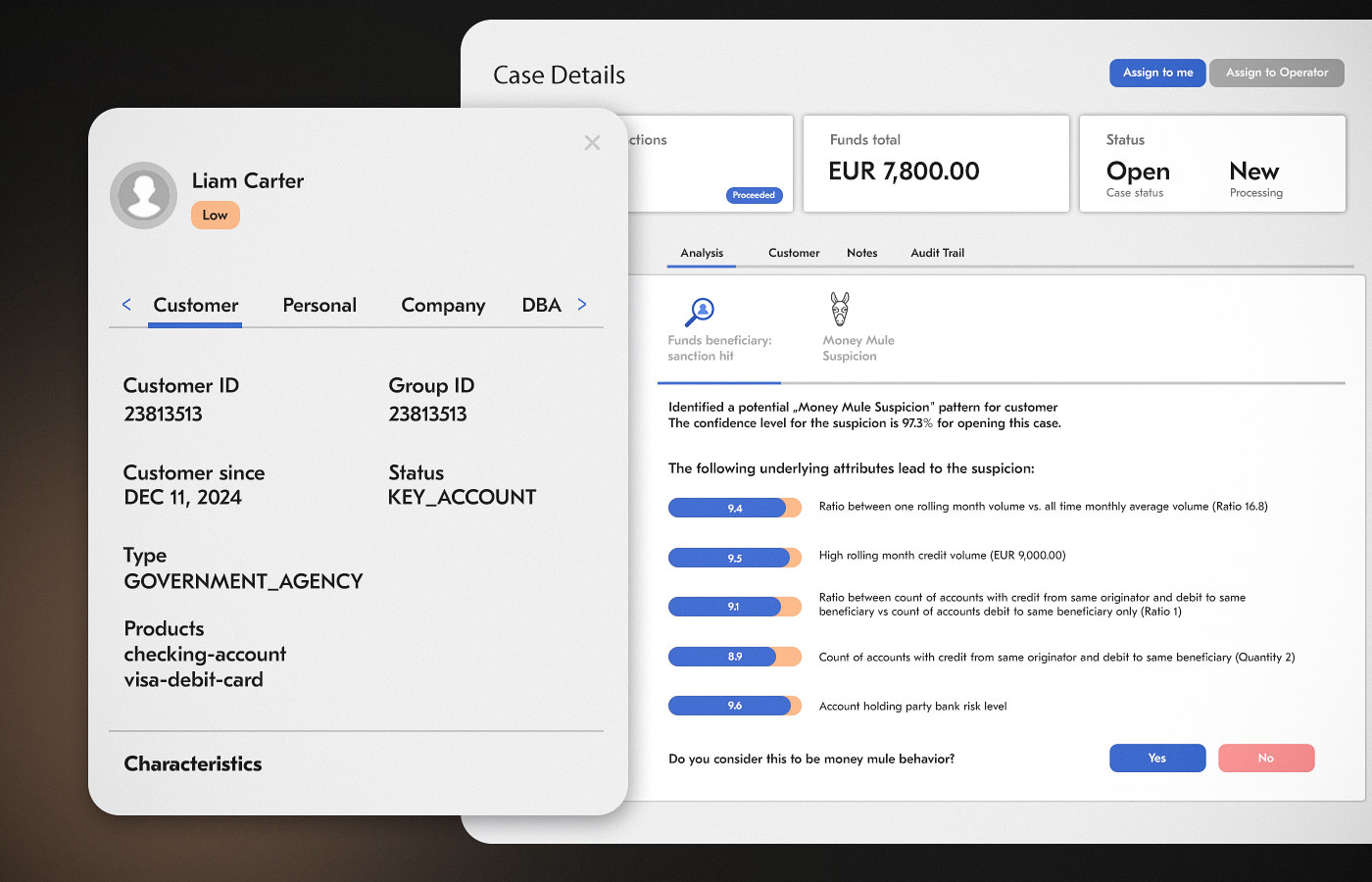

Our system used machine learning algorithms to analyze transaction patterns in real-time. It now detects anomalies, flags suspicious activities with high accuracy, and minimizes false positives. As a result, it reduced the need for extensive manual review.

Automating fraud detection accelerates the identification of financial crime risks and enhances overall security. The system continuously learns from new data, improving its ability to detect emerging threats over time.

For compliant operations, our developers integrated ML-powered risk assessment tools. They automatically generate reports, monitor compliance with AML regulations, and adapt to changes in regulatory policies without requiring manual updates.

The anti-money laundering tool optimizes resource allocation by reducing the workload on compliance teams. At the same time, automated workflows allow employees to focus on their top business tasks, which drives better productivity.

Wrapping up, Acropolium enriched the custom software with the following features:

- Real-time transaction monitoring to detect suspicious activities instantly.

- AI-driven fraud detection that minimizes false positives and enhances security.

- Automated compliance reporting to streamline regulatory processes.

- Adaptive machine learning algorithms that improve detection accuracy over time.

- Upgrade resource allocation to reduce manual workloads and improve efficiency.

outcome

Secure AI AML Software with Smart Anti-Fraud Monitoring

client feedback

Working with this team was absolutely hassle-free from day one. Their well-structured approach made sure the solution fit our needs perfectly. Our new AI AML software has taken our fraud assessment and regulatory activities to the next level. We truly appreciate Acropolium’s expertise and attention to our goals!