- Software Development

- Consulting (technology stack and cloud selection, architecture)

- Data Analytics

- Legacy System Modernization

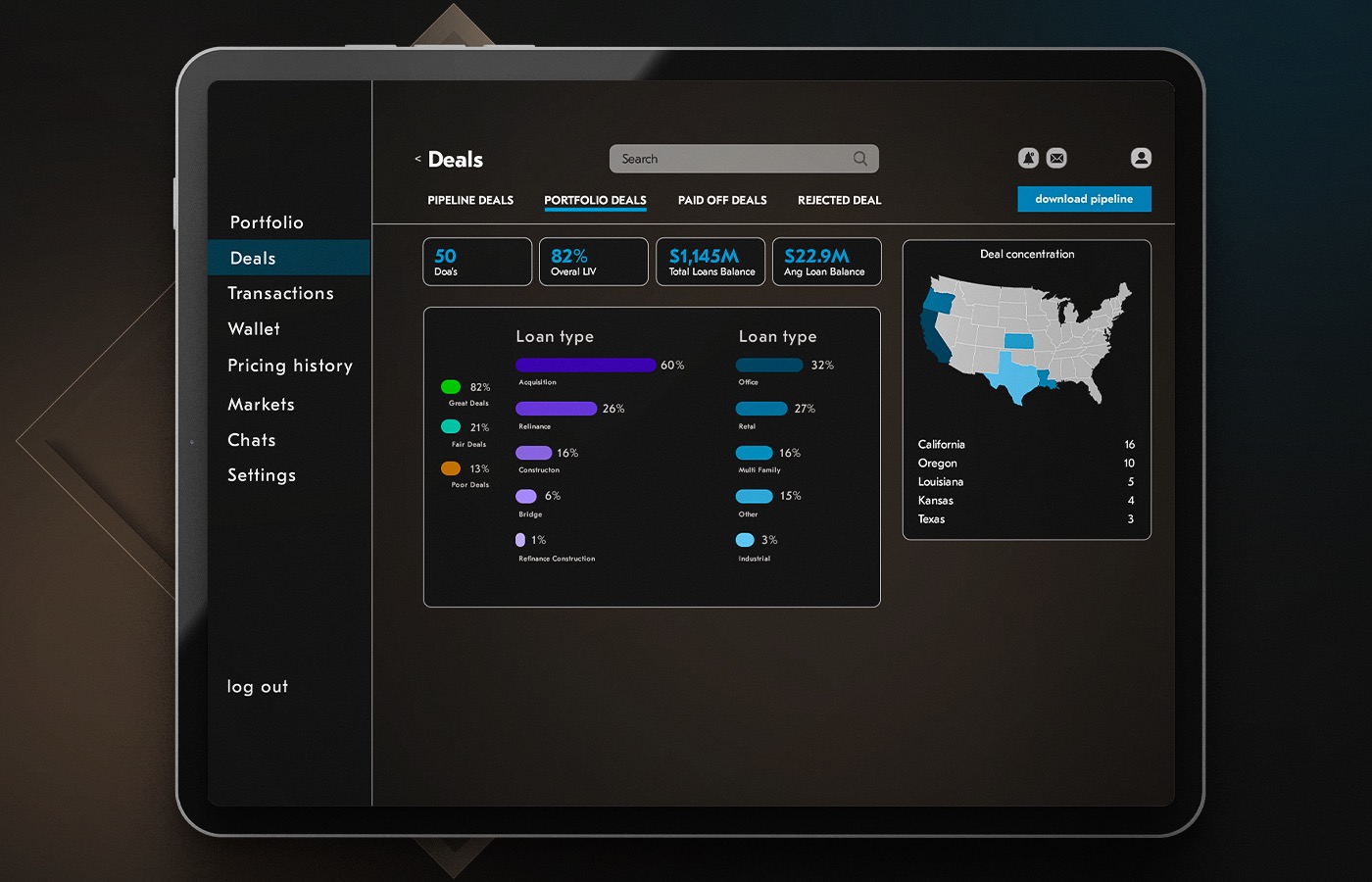

Building comprehensive investment portfolio management software with advanced project portfolio management tools. Creating intuitive real time visibility and dashboards for better project oversight. Developing resource allocation modules to enhance budget and personnel management. Implementing portfolio risk assessment and mitigation capabilities with scenario modelling and stress testing. Ensuring scalable architecture and Azure cloud deployment.

client

NDA Protected

Austria

74 employees

Our client is a financial services firm serving companies across international borders with operations spanning multiple continents. The firm offers diverse solutions to various customer segments, including individuals, businesses, and institutional clients. Key services include investment management, wealth advisory, insurance, and lending products.

They manage substantial assets under management and maintain a strong reputation for delivering personalized financial solutions. The company operates in a highly regulated environment requiring sophisticated tools for portfolio oversight, risk management, and client reporting.

request background

Portfolio Intelligence Tool for Advanced Project Management Capabilities

As the company expands operations, its project portfolio grows in size and complexity. Rising difficulty in portfolio management requires sophisticated investment portfolio management software. The firm needed modern project portfolio management strategies, ensuring successful execution and delivery.

Regulations, market and technology evolve at the speed of light in the financial industry. The company is working in this challenging environment where the external events influence project priorities and schedule. Portfolio assessment is a dynamic exercise with the need for flexibility and proactive scenario modelling and stress testing.

Delivering projects on time and within budget requires effective project portfolio management. The company needed adopting modern methodologies and tools. Real time visibility and dashboards would enable decision-makers to prioritize projects based on strategic importance and portfolio risk factors.

Leadership wanted portfolio intelligence capabilities providing comprehensive insights. They needed tracking KPIs and reporting metrics across all initiatives. Resource allocation optimization was essential.

challenge

Scalability, Resource Optimization, and Risk Management Challenges

Manual processes and inefficiencies. Project control was extremely dependent on human interaction and processes. Such reasons do not provide higher accuracy and faster execution. These resources can be used to more productive ends than simply scheduling, tasking, and checking up on whether the work has been done. Without the right investment portfolio management software, the firm had difficulty with coordination.

Limited decision-making tools. Existing processes did not have sufficient capabilities for effective portfolio risk analysis and control. Without scenario analysis and stress testing tools, proactive planning was impossible. Decision-makers were unable to compare outcomes or plan for contingencies.

Decentralized management approach. Projects were managed differently by different teams. It was a recipe for inconsistent and duplicated work. The challenge for the company was alignment of objectives and business targets. There was no consolidated project portfolio management, so prioritization was difficult. Inability to manage access on role basis and monitor logs for audit lead to security concern in compliance context.

Poor visibility and tracking. Lack of real-time visibility and dashboards prevented project sponsors from effectively tracking the health of projects. The company found it difficult to follow progress and spot problems early. You have KPIs and reporting scattered in different systems. Decisions about which resources to allocate were not based on data.

Scalability constraints. Without scalable architecture and Azure cloud infrastructure, the firm faced limitations taking on new projects. Legacy systems couldn't handle growing data volumes. The absence of proper integrations with ERP CRM BI platforms created data silos.

Inadequate risk management. The company lacked systematic portfolio risk assessment capabilities. Without scenario modelling and stress testing tools, they couldn't evaluate potential impacts. Portfolio intelligence for identifying and addressing risks was missing. Cost overruns and schedule delays occurred frequently.

goals

- Put in place centralised real time visibility and dashboarding on the understanding of your portfolio as a whole. Enable stakeholders to access key metrics, project statuses, and financial data instantly. Create customizable views supporting different user roles and requirements.

- Develop user-friendly investment portfolio control software with intuitive navigation and design. Develop end-to-end KPIs and reporting by monitoring all metrics of success. Make sure the platform is designed to help decision-makers move at pace with intelligent, clear data-visualization and real-time automation.

- Create advanced resource allocation module optimizing budget and personnel distribution. Implement intelligent algorithms considering project priorities, skill sets, and timelines. Enable automated processes minimizing conflicts and maximizing utilization of available resources.

- Design scalable architecture and Azure cloud infrastructure supporting growth. Ensure the investment portfolio management software handles increasing numbers of projects, users, and data volumes. Build flexible systems allowing future enhancements without disrupting existing functionalities.

- Include the ability to perform scenario modelling and stress testing for sophisticated risk assessment and mitigations in your portfolio. Use analytics to flag and rank risk exposures, throughout the portfolio. Allow stakeholders to take corrective action against portfolio risk.

- Develop solid integrations with ERP CRM BI systems for smooth data exchange. Add role-based access control and audit logs for security and compliance. Integrate with existing enterprise tools and ensure data quality of PPM.

solution

Investment Analysis and Portfolio Management Software with Intuitive Interface and Process Automation

.NET 6, Angular 13, Material Angular 12.2.13, Azure services (Frontdoor, App Services, App Configuration, Blob storage etc)

14 months

5 specialists

Our developers successfully addressed challenges and delivered efficient investment portfolio management software with advanced portfolio intelligence capabilities.

The solution required creating centralized real time visibility and dashboards with simple navigation and intuitive design. Key metrics, project status and financial information are now readily available to all stakeholders. Scalable, customizable and updates in real-time to keep track of your project's progress and make decisions as soon they are required. Performance portfolio and reportings tools allow for complete transparency on how you are doing.

We integrated an advanced resource allocation module considering project priorities, skill sets, and timelines. The module optimizes resource utilization through automated processes and intelligent algorithms. It mitigates conflicts and minimizes wastage across the project portfolio management ecosystem.

The investment portfolio management software was designed with scalable architecture and Azure cloud infrastructure. The architecture is flexible and adaptable, scaling seamlessly to support growing numbers of projects, users, and data volumes. This ensures the platform remains responsive and efficient as operations expand.

We embedded robust portfolio risk assessment and mitigation capabilities within the tool. They employ advanced analytics and algorithms for scenario modelling and stress testing. Stakeholders can identify, assess, and prioritize risks across the portfolio. They track portfolio risk exposure, evaluate potential impacts, and develop proactive strategies.

- Portfolio Intelligence Platform. Built comprehensive investment portfolio management software with scalable architecture and Azure cloud deployment. The platform provides complete portfolio intelligence through integrated analytics and visualization tools.

- Real-Time Dashboards. Created intuitive real time visibility and dashboards with customizable views. Users monitor project health, track KPIs and reporting metrics, and access financial data instantly. The interface supports different stakeholder needs through role-specific views.

- Resource Optimization. Developed intelligent resource allocation algorithms balancing competing priorities. The project portfolio management system optimizes budget and workforce distribution automatically. Visualization tools help managers understand resource utilization patterns.

- Risk Management Tools. Implemented advanced portfolio assessment using scenario modelling and stress testing capabilities. The system identifies potential issues early and recommends mitigation strategies. Analytics help stakeholders prepare for various outcomes.

- Enterprise Integration. Established seamless integrations with ERP CRM BI systems ensuring data consistency. The investment portfolio management software synchronizes with existing tools automatically. APIs enable bidirectional data flow across platforms.

- Security and Compliance. Deployed role based access control and audit logs protecting sensitive information. The system tracks all user actions maintaining complete transparency. Security measures meet industry standards and regulatory requirements.

outcome

Wealth Portfolio Management Software for Better Project Visibility and Risk Mitigation

- 30% improved visibility. Real time visibility and dashboards enhanced tracking of project statuses and timelines. Stakeholders access portfolio intelligence instantly. The investment portfolio management software provides comprehensive oversight across all initiatives.

- 25% increase in centralized access. All financial metrics now available through unified KPIs and reporting interface. Integrations with ERP CRM BI systems eliminated data silos. Teams work with consistent information reducing errors.

- 30% faster monitoring. Real-time portfolio tracking through advanced investment portfolio management software reduced monitoring time significantly. Real time visibility and dashboards enable quick identification of issues and trends.

- 17% workforce efficiency gain. Optimized resource allocation improved overall productivity. The project portfolio management system balances workloads effectively. Automated processes free staff for strategic activities.

- 25% better strategic decisions. Enhanced portfolio intelligence and KPIs and reporting increased decision accuracy. Scenario modelling and stress testing capabilities enable evaluation of different approaches. Leaders make informed choices based on comprehensive data.

- 80% proactive risk identification. Advanced portfolio risk assessment tools identify potential issues early. Scenario modelling and stress testing capabilities help prepare mitigation strategies. The system reduced unexpected problems significantly.