- Legacy System Modernization

- AI & ML

- Automation

- Real-Time Solution

- Cloud Solutions

- Platform Development

Advanced AI fraud detection in banking with comprehensive fraud prevention capabilities. AI-driven modernization of legacy systems creates unified, real time transaction monitoring across accounts, payments, lending, and cryptocurrency trading. Our solution features real time scoring, rules, and ML hybrid engines, sophisticated behavioural analytics, intelligent anomaly detection, automated risk scoring, case management workflows, model explainability, strict regulatory compliance, seamless AML and KYC integration, PSD2 and GDPR adherence, advanced alert workflows, and false positives reduction for heightened security and operational efficiency.

client

NDA Protected

Sweden

50-100 employees

Fully digital virtual bank providing a full suite of online financial products such as current accounts, instant payments, digital lending and cryptocurrency trading products. It leverages the power of cutting edge AI fraud detection in banking and embedded finance to provide smooth, secure, scalable banking experiences. As the firm attempts to handle higher transaction volumes containing greater amount of confidential customer detail, it is besieged with increasingly severe attacks on data.

To safeguard against digital threats and ensure fraud detection and prevention, the company needed to adopt advanced transaction monitoring, behavioural analytics, real time scoring, comprehensive case management, and strict regulatory compliance including AML and KYC verification plus PSD2 and GDPR requirements.

request background

Digital Bank Fraud Prevention Software

Errors, however, do occur, and they can be exacerbated by fraud prevention challenges created as transaction volumes spiked and threats escalated at a breakneck speed — from identity theft and account takeovers to complex payment scams. The current platforms did not offer sophisticated anomaly detection, behavioral analytics, and real time scoring for today’s security attacking environment.

To safeguard assets, ensure regulatory compliance, and maintain customer trust, the client sought a comprehensive AI fraud detection in banking solution. The platform had to deliver real time transaction monitoring, intelligent risk scoring, rules, and ML hybrid processing, advanced case management workflows, and seamless integration with existing systems.

The answer needed to present analytical alert paths, streamlining operations by reducing false positives, and staying within AML/KYC compliance. For the platform, model explainability was necessary for audit transparency and end-to-end PSD2 and GDPR compliance, while maintaining a scalable architecture capable of handling exponentially growing numbers of transactions without performance loss or latency.

challenge

Automated, Compliant & Scalable AI Fraud Detection in Banking System

As the bank grew quickly and transaction size rocketed, it saw dramatic increases in high-grade fraud activity, from identity theft to account takeovers (ATO) and more sophisticated payment scams. Old-school rule-based systems were left behind: fraudulent transactions remained undetected, and they interfered too late to stop loss.

But without advanced behavioural analytics and anomaly detection, the bank couldn’t spot subtle patterns that would have shown it was under threat. There was no real time scoring and the system operated with batched transactions, a timeframe that introduced dangerous lags. Because there were no rules and because of the ML-hybrid architecture, the system was unable to use both hard-coded determinstic rules along with machine-learning flexibility.

Operational inefficiencies plagued existing workflows. Without adequate case management systems, fraud analysts were cobbling together manual tracking of investigations across multiple tools. Bad alerting systems were producing way too many false alerts, and reducing false positives is fast becoming an operational imperative. The inability to explain the model meant detectives did not know why transactions were being flagged, and had actually hampered their investigations.

There are plenty more - so many," and that "we're wrangling with good old-fashioned AML and KYC stuff in both Sweden and in the EU. The AI fraud detection in banking solution needed to strike a balance between exacting compliance checks and real time threat interception. A whole ecosystem that needed to be the embodiment of PSD2 and GDPR was something of an imperative too.

Preserving that trust was crucial, any negative or service interruption would risk undoing confidence in the digital-only model of banking. What already existed in the transaction monitoring environment was becoming severely hampered by a lack of flexibility to react dynamically to new fraud patterns, but not at the expense of losing performance.

Scalability concerns loomed large. The architecture must support millions of transactions per day and provide real time sub-second scoring and risk scoring. Without behavioural analytics and continuous anomaly detection, the bank was still exposed to new attack vectors. These twin challenges underscored the importance of a more sophisticated and scalable fraud prevention solution, one that would offer end-to-end case management and alert workflow as well.

goals

- Improve fraud protection through advanced AI fraud detection in banking with intelligent anomaly detection that identifies suspicious behavior with real time scoring to minimize financial losses and safeguard the customer assets.

- Enable scaling and an empowered rules/ML hybrid model to address increasing transaction load with low latency, powerful transaction monitoring, advanced behavioral analytics, coupled with dynamic risk scoring across every banking channel.

- Comply with all regulations, carry out embedded AML and KYC checks, achieve full PSD2 and GDPR compliance, automate case management, relieve the burden of audit reporting to meet regulators' mandates, and reduce compliance risks.

- Increase customer confidence with fewer false positives while keeping service frictionless, escalating security through intelligent alerting workflows and model transparency for investigative clarity.

- AI-powered case management and state-of-the-art alert workflow technology, advanced behavioural analytics, and real time scoring engine(s) with a full set of risk scoring to enable efficient investigation and response workflows.

solution

Fraud Prevention Systems Used by Banks: Best Practices Implemented

.NET Core, C#, ASP.NET Web API, Entity Framework Core, TensorFlow.NET, ML.NET, Apache Kafka, Apache Spark, PostgreSQL, Redis, Azure Kubernetes Service, Azure Monitor, Docker, RESTful APIs, Prometheus, Grafana, Keycloak

Ongoing

9 specialists

We designed and built a unified AI fraud detection platform integrating cutting-edge AI and machine learning models to preemptively identify fraudulent activities across all channels. The rules and ML hybrid architecture combine deterministic business rules with adaptive machine learning for comprehensive fraud prevention.

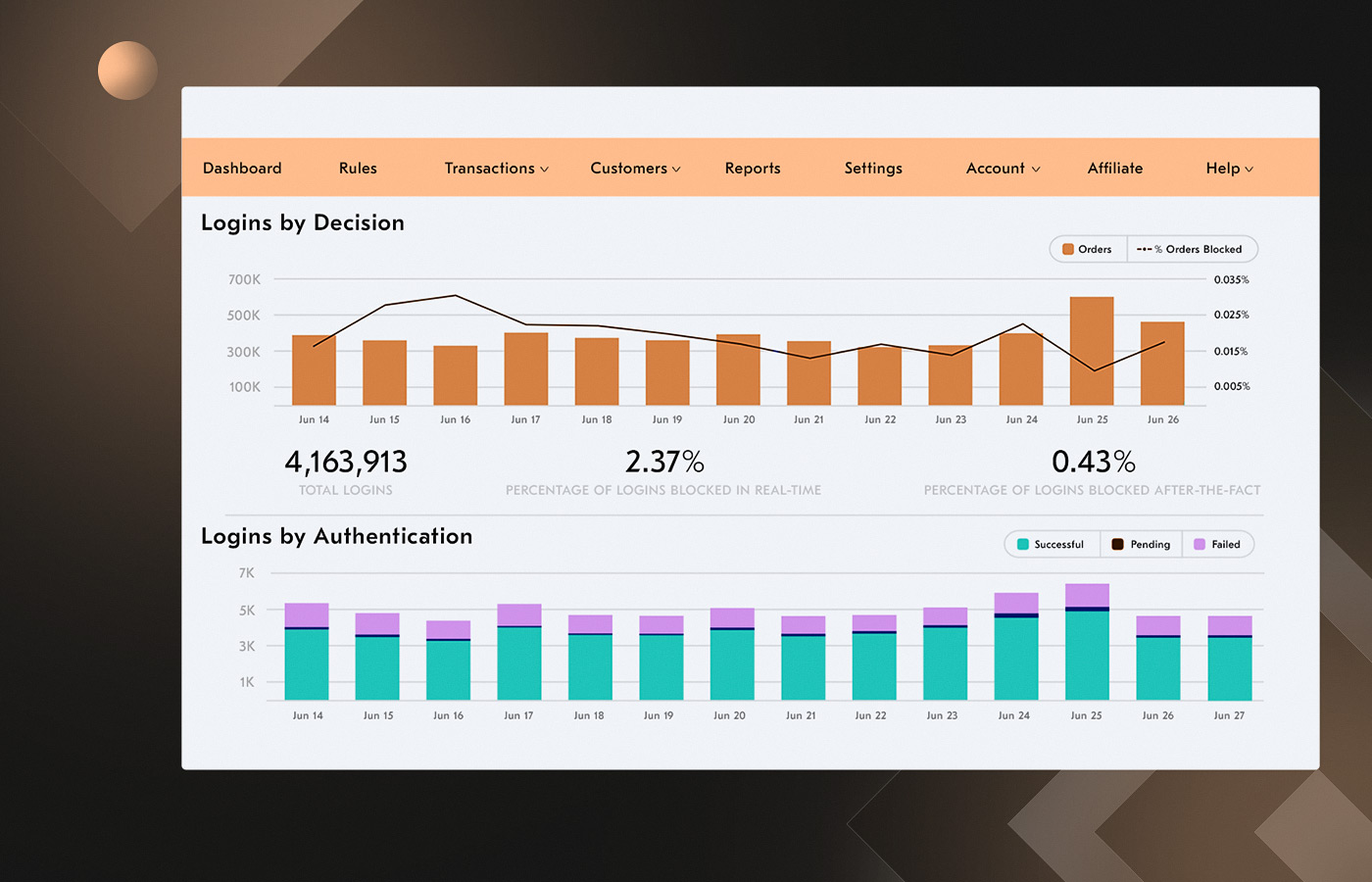

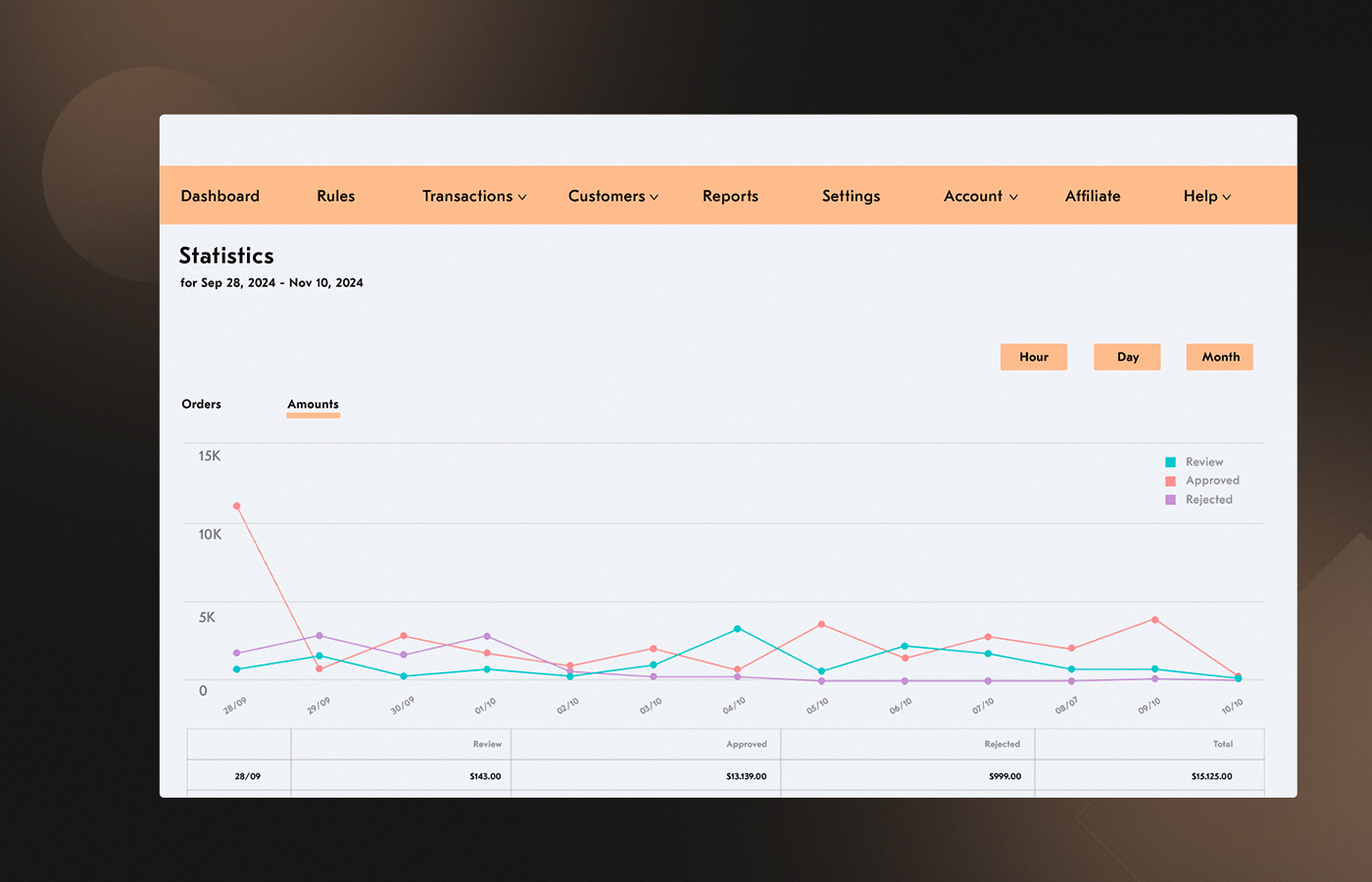

We leveraged a distributed architecture, ingesting, processing, and analyzing transactional data through advanced transaction monitoring, ensuring immediate response to emerging threats. The real time scoring engine processes millions of events per hour with sub-second latency, delivering instant risk scoring and anomaly detection capabilities.

With a horizontally scalable data pipeline, the system can handle spikes in the volume of transactions without corresponding peaks in latency. Workflows for regulatory compliance, such as AML (Anti-Money Laundering) and KYC, initiated automatic checks directly within this pipeline to ensure a continuously auditable process. Full PSD2 and GDPR compliance guarantees regulatory fit within all European zones.

The platform's advanced behavioural analytics engine is based on multi-dimensional user behaviour patterns, contextual transaction properties, and historical behaviours. Advanced model explainability capabilities offer visibility into decision-making that is critical to case management and audit needs.

Intelligent alert workflows dramatically improve operational efficiency through false positives reduction, using smart filtering and prioritization. The comprehensive case management system provides fraud analysts with unified investigation tools, automated escalation, and collaborative workflows.

- Supervised and unsupervised ML models in rules and ML hybrid architecture trained on historical and real time transaction data for AI fraud detection in banking, detecting both known and novel prevention patterns through continuous learning.

- Behavioural analytics engine with dynamic risk scoring based on multi-dimensional user behavior analysis, contextual transaction attributes, and sophisticated anomaly detection algorithms providing real time scoring capabilities.

- Event monitoring pipeline for low-latency transaction monitoring with Apache Kafka, Spark Streaming that processes millions of events hourly in sub-seconds to alert immediately and prevent fraudulent activities.

- AML and KYC screening, PSD2 and GDPR verification, perpendicular integration into transaction workflows with regulatory compliant automation modules, automatic suspicious activities’ detection with full audit trails.

- API-first integration Surface RESTful end-points to make it easy to connect with core banking systems, payment gateways, and third-party analytics engines that support extensive AI fraud detection in banking networks.

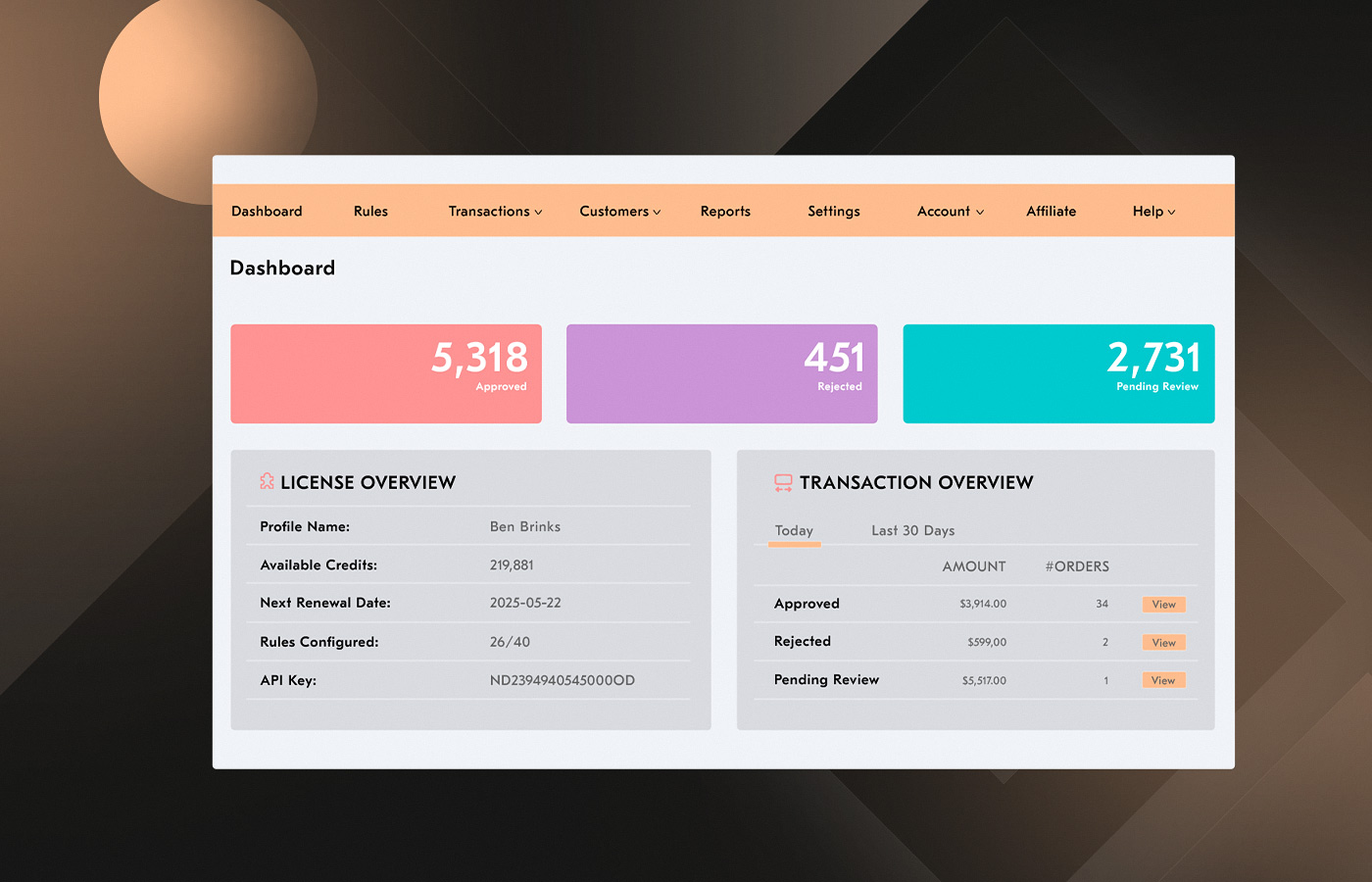

- Powerful Case Management Dashboard: real time transaction monitoring, complex alert workflows, automatic incident escalation, and collaborative investigation capability for security analysts.

- A model explainability framework that provides clear views into why scores were assigned to risk conditions for investigation in case management and compliance for audits.

- Intelligent alert workflows with false positives reduction mechanisms using smart filtering, risk-based prioritization, and automated validation reducing analyst workload while maintaining fraud prevention effectiveness.

- Scalable cloud infrastructure deployed on Azure Kubernetes Service with autoscaling, high availability, and disaster recovery configurations supporting growing transaction monitoring demands.

- Continuous model retraining implementing feedback loops and automated retraining pipelines to refine real time scoring accuracy and adapt anomaly detection to evolving threat landscapes.

outcome

Banking Fraud Prevention Software with High-End Data Protection Development Solutions

- 40% Reduction in Fraudulent Transactions through proactive anomaly detection, sophisticated behavioural analytics, advanced real time scoring, and comprehensive AI fraud detection in banking capabilities.

- 30% Increase in Operational Efficiency by automating case management, streamlining alert workflows, reducing manual investigations through false positives reduction, and optimizing fraud prevention processes.

- 25% Decrease in Compliance Costs via embedded AML and KYC checks, automated PSD2 and GDPR verification, streamlined audit reporting, and comprehensive regulatory compliance through intelligent transaction monitoring and risk scoring automation with model explainability for regulatory transparency.

client feedback

They’re so on top of their game with AI and real-time inefficiency detection. The new system is extremely fast and simple to use, and it has already helped us significantly reduce fraud. We feel a lot more in control now, and our customers definitely feel safer.