- Custom Software Development

- Blockchain

- Payment Systems

- Platform Development

Innovative and scalable solution for crypto exchange development with advanced trading capabilities. Building cryptocurrency exchange software with integrated crypto lending loans, robust matching engine, market making liquidity, comprehensive KYC AML compliance, secure custody cold storage, multi factor authentication, sophisticated wallet infrastructure hot and cold, diverse order types market limit stop, staking yield features, futures options spot trading, social trading gamification, and GDPR data protection.

client

NDA Protected

Malta

21 employees

Our client is a leading company in crypto exchange platform known for innovation and market insight. They provide diverse cryptocurrencies and advanced trading tools for global investors. The company operates in a highly regulated environment requiring sophisticated security measures and compliance frameworks.

Their platform serves thousands of active traders daily across multiple jurisdictions. They prioritize transparency, regulatory compliance, and user trust while maintaining cutting-edge technology standards in all operations.

request background

Cryptocurrency Exchange Software Development with Advanced Features and Robust Security

The client's vision was ambitious: create a next-generation platform for crypto exchange development meeting dynamic needs of traders worldwide. They wanted building more than another trading platform. The goal was becoming a leader in digital asset trading and setting new industry standards.

The cryptocurrency exchange software needed offering flawless trading experience based on advanced technology. Core requirements included high-performance matching engine processing thousands of transactions per second. The platform needed supporting diverse order types market limit stop for sophisticated trading strategies. Integration of futures options spot trading would serve different investor preferences.

Financial innovation demanded crypto lending loans capabilities. Users wanted earning yield on holdings through staking yield features. The system required robust market making liquidity ensuring tight spreads and deep order books. Wallet infrastructure hot and cold needed balancing accessibility with security.

Strict security measures were paramount. Multi factor authentication would protect user accounts. Custody cold storage solutions would secure the majority of digital assets. Comprehensive KYC AML compliance frameworks would meet regulatory requirements across jurisdictions. GDPR data protection measures would safeguard user privacy.

Scalability and performance would allow expanding the crypto exchange system as the cryptocurrency market grew. They recognized building a platform meeting growing user demand and trading volumes without compromising speed or reliability.

The company prioritized user engagement as critical success factor. They wanted fostering active community of traders and investors. Social trading gamification elements would facilitate user interaction and retention. The cryptocurrency exchange software needed features making trading engaging and rewarding.

challenge

Overcoming Industry-Specific Challenges in Crypto Exchange Development

Technology complexity. Building crypto exchange platform capable of handling complex requirements presented significant challenges. Optimizing the matching engine for microsecond-level performance was critical. Supporting diverse order types market limit stop required sophisticated logic. Integrating futures options spot trading added architectural complexity. Implementing crypto lending loans demanded careful risk management systems.

Security and custody concerns. The cryptocurrency exchange software required enterprise-grade security. Multi factor authentication alone wasn't sufficient. Custody cold storage solutions needed protecting majority of assets while maintaining operational efficiency. Wallet infrastructure hot and cold required careful balance between accessibility and security. Regular security audits and penetration testing were essential.

Regulatory compliance burden. Meeting KYC AML compliance across multiple jurisdictions was complex. Different countries had varying requirements for crypto exchange development. GDPR data protection added layers of complexity for European users. The platform needed flexible compliance frameworks adapting to regulatory changes. Audit trails and reporting capabilities were mandatory.

Scalability challenges. Supporting growing user base while maintaining flawless performance added complexity. The matching engine needed processing increasing order volumes. Market making liquidity required sophisticated algorithms. Load management and resource allocation demanded careful planning. System monitoring needed identifying bottlenecks proactively.

Liquidity and market depth. Providing market making liquidity was essential for successful crypto exchange platform. Thin order books discouraged traders. The platform needed attracting market makers and incentivizing liquidity provision. Integration with external liquidity sources was required. The matching engine had to handle complex order routing.

Feature integration complexity. Adding crypto lending loans required sophisticated risk assessment. Staking yield features needed secure smart contract integration. Futures options spot trading demanded complex position management. Social trading gamification required real-time data synchronization. Each feature increased cryptocurrency exchange software complexity.

User experience requirements. Meeting changing needs of cryptocurrency traders was paramount. The platform needed supporting beginners and experienced traders simultaneously. Diverse order types market limit stop had to remain intuitive. Wallet infrastructure hot and cold needed being user-friendly despite security complexity. Understanding market trends and user behavior was essential.

goals

- Build high-performance crypto exchange development platform with advanced matching engine processing thousands of transactions per second. Support diverse order types market limit stop enabling sophisticated trading strategies. Integrate futures options spot trading serving different investor preferences and risk profiles.

- Implement comprehensive crypto lending loans infrastructure with automated risk management. Deploy staking yield features enabling users to earn passive income. Establish robust market making liquidity mechanisms ensuring tight spreads and deep order books across all trading pairs.

- Deploy enterprise-grade security through multi factor authentication, custody cold storage, and advanced encryption. Build secure wallet infrastructure hot and cold balancing accessibility with asset protection. Implement regular security audits and penetration testing maintaining platform resilience.

- Ensure complete KYC AML compliance across all operating jurisdictions with automated verification workflows. Implement comprehensive GDPR data protection measures safeguarding user privacy. Build flexible compliance frameworks adapting to regulatory changes without disrupting operations.

- Create engaging user experience through social trading gamification elements fostering active community. Enable users to follow successful traders and share strategies. Implement leaderboards, achievements, and rewards encouraging participation and loyalty in the cryptocurrency exchange software.

- Design scalable architecture supporting growth in users and trading volumes. Optimize infrastructure for the crypto exchange platform handling peak loads. Implement efficient resource allocation and load balancing. Build monitoring systems identifying performance bottlenecks proactively.

solution

Crypto Exchange Software Development with Blockchain and Advanced Trading Features

Node.Js, GraphQL, Socket.io, Vue.Js, Nuxt.Js, PostgreSQL, JWT, AWS, Graphana, Docker, Kubernetes

20 months

5 specialists

Acropolium delivered comprehensive cryptocurrency exchange software overcoming all challenges successfully. Our crypto exchange development expertise enabled creating a next-generation trading platform with advanced features.

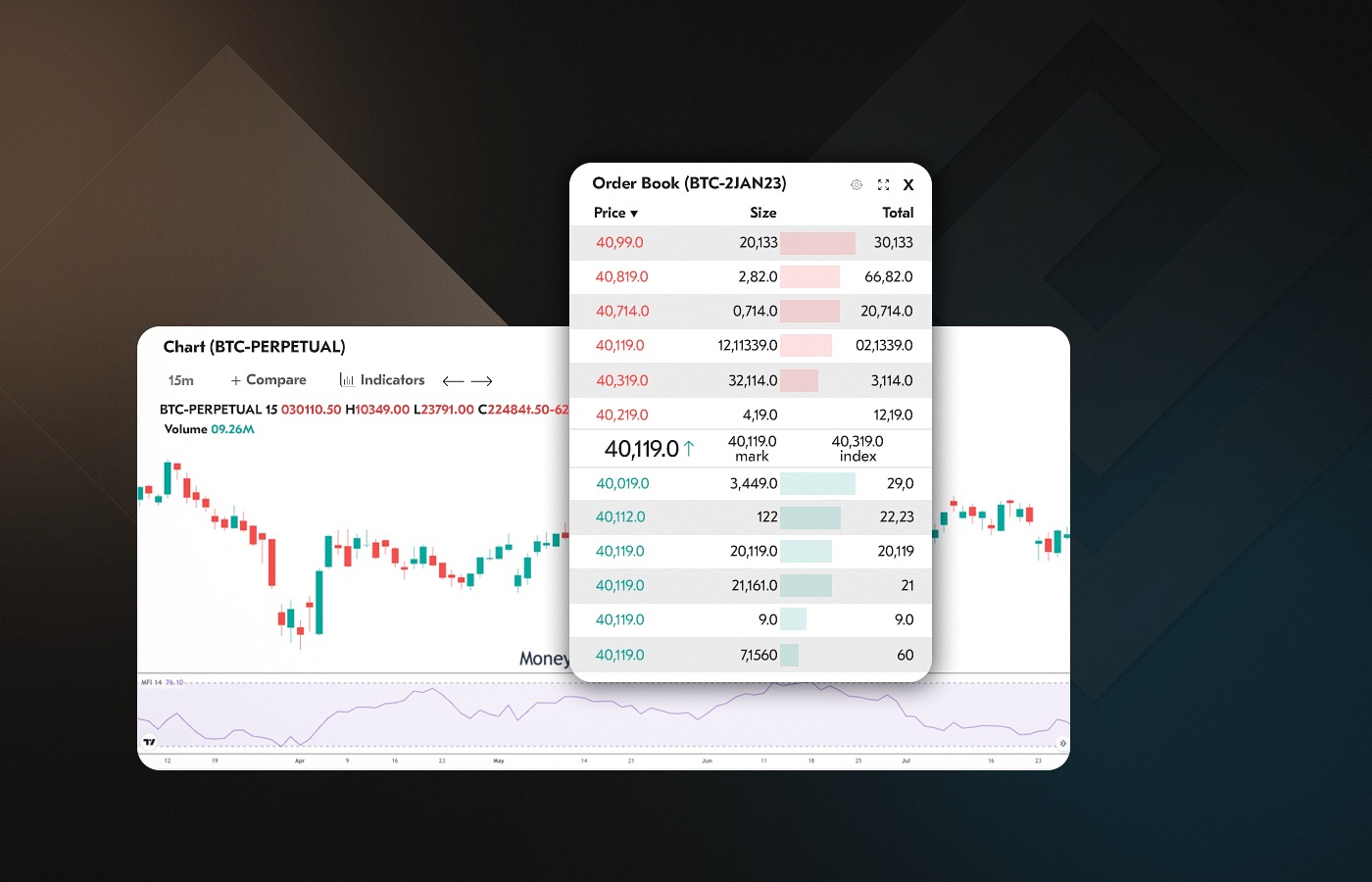

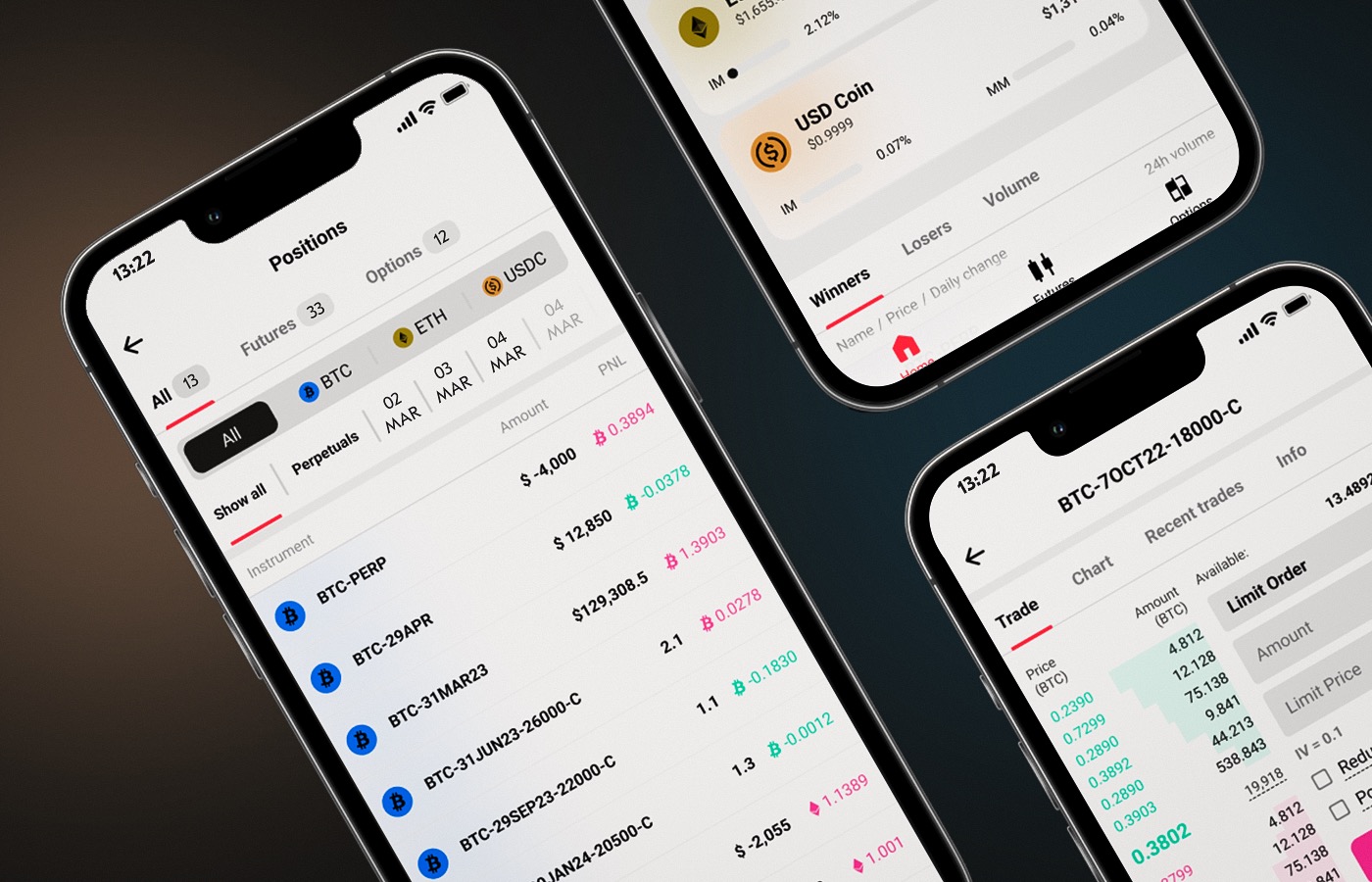

High-Performance Trading Engine. Built sophisticated matching engine processing orders with microsecond-level latency. The system supports diverse order types market limit stop including market, limit, stop-loss, and stop-limit orders. Real-time order matching ensures fair price discovery. The engine handles thousands of transactions per second without degradation. We integrated futures options spot trading providing comprehensive trading capabilities.

Lending and Yield Features. Implemented complete crypto lending loans infrastructure with automated risk assessment. Users lend digital assets earning competitive interest rates. Borrowers access liquidity using cryptocurrency collateral. Smart contracts automate loan terms and liquidations. We deployed staking yield features enabling passive income generation. Multiple staking options support different risk-reward profiles.

Liquidity Solutions. Established robust market making liquidity mechanisms attracting professional market makers. The cryptocurrency exchange software incentivizes liquidity provision through maker-taker fee structures. We integrated external liquidity aggregators ensuring deep order books. The matching engine routes orders optimally maximizing execution quality. Tight spreads enhance trading experience.

Security Infrastructure. Deployed multi factor authentication protecting user accounts through SMS, email, and authenticator apps. Implemented custody cold storage securing 95% of digital assets offline. Only operational balances remain in hot wallets. Built sophisticated wallet infrastructure hot and cold with automated fund transfers. Multi-signature requirements protect large transactions. Regular security audits verify system resilience.

Compliance Framework. Created comprehensive KYC AML compliance workflows automating user verification. The crypto exchange development platform integrates third-party identity verification services. Risk-based approaches tier verification levels. We implemented GDPR data protection measures including data encryption, access controls, and user consent management. Automated reporting tools simplify regulatory submissions.

Engagement Features. Integrated social trading gamification elements fostering active community. Users follow successful traders and copy their strategies. Real-time performance leaderboards encourage competition. Achievement systems reward trading milestones. We implemented chat features enabling trader interaction. Referral programs incentivize user acquisition.

- Matching Engine Optimization. Built high-performance matching engine using in-memory data structures. The engine processes order types market limit stop with microsecond latency. Advanced algorithms ensure fair matching and price-time priority. Load balancing distributes orders across multiple engine instances for crypto exchange solution scalability.

- Custody Architecture. Designed secure wallet infrastructure hot and cold using hierarchical deterministic wallets. Custody cold storage uses air-gapped servers in geographically distributed locations. Multi-signature schemes require multiple approvals for withdrawals. Automated risk assessment triggers manual review for large transactions in the cryptocurrency exchange software.

- Lending Risk Management. Implemented sophisticated risk models for crypto lending loans operations. Real-time collateral monitoring triggers automated liquidations preventing losses. Over-collateralization requirements protect lenders. Interest rates adjust dynamically based on supply and demand. Smart contracts enforce loan terms transparently.

- Trading Products. Integrated futures options spot trading with comprehensive position management. The matching engine handles complex order routing across different contract types. Margin calculations occur in real-time preventing over-leverage. Liquidation engines protect platform solvency during volatile markets.

- Liquidity Aggregation. Connected market making liquidity sources including professional market makers and external exchanges. The crypto exchange platform normalizes order book data across sources. Smart order routing finds best execution prices. API integrations enable algorithmic trading.

- Staking Infrastructure. Deployed secure staking yield features through validator node integration. Users delegate assets earning rewards proportional to stake. The cryptocurrency exchange software supports multiple proof-of-stake networks. Automated reward distribution occurs daily. Unbonding periods protect network security.

- Compliance Automation. Built flexible KYC AML compliance framework adapting to jurisdiction requirements. Machine learning algorithms flag suspicious transactions. GDPR data protection measures include data minimization and retention policies. Users control their personal data through privacy dashboards.

- User Interface. Created intuitive interface simplifying complex operations. Advanced traders access professional charting tools and diverse order types market limit stop. Beginners use simplified views with educational resources. Social trading gamification elements integrate naturally into user experience.

outcome

Cryptocurrency Exchange Platform Development for Higher User Engagement and Growth

- 43% increase in user base. The crypto exchange development platform onboarded over 41,000 new users in four months. Social trading gamification features drove organic growth. Comprehensive crypto lending loans and staking yield features attracted long-term investors. The cryptocurrency exchange software became preferred platform for diverse trading needs.

- 44% increase in daily trading volume. High-performance matching engine enabled professional traders. Diverse order types market limit stop supported sophisticated strategies. Market making liquidity ensured tight spreads. Integration of futures options spot trading attracted institutional participants. Trading volume growth exceeded industry benchmarks.

- 30% reduction in infrastructure costs. Migration to optimized cloud architecture improved efficiency. Kubernetes orchestration enabled better resource utilization. The crypto exchange development platform scaled automatically with demand. Cost per transaction decreased significantly while maintaining performance.

- Zero security breaches. Multi factor authentication and custody cold storage protected user assets. Robust wallet infrastructure hot and cold prevented unauthorized access. Regular security audits identified vulnerabilities proactively. The cryptocurrency exchange software maintained perfect security record.

- 100% regulatory compliance. Automated KYC AML compliance workflows met all jurisdictional requirements. GDPR data protection measures satisfied European regulators. Audit trails and reporting tools simplified regulatory submissions. The platform operated without compliance incidents.

client feedback

Thank you, guys, for delivering an exceptional crypto exchange platform for our business. Your team's expertise and dedication have truly transformed our trading operations. We appreciate your commitment to excellence and look forward to continued collaboration.