- SaaS

- Platform Development

- Software Development

- Bespoke software

- Custom Software Development

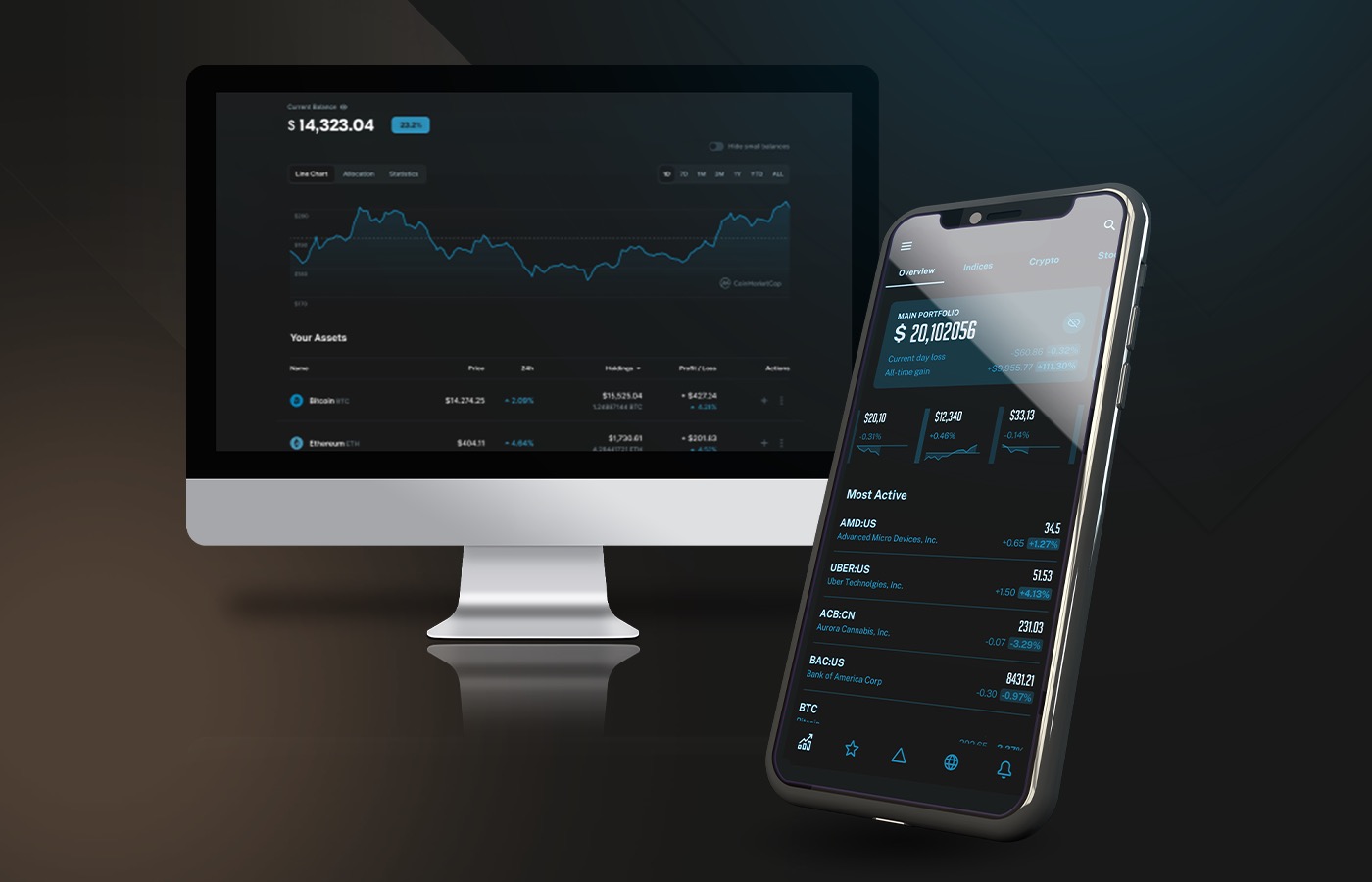

A cryptocurrency business providing a platform to access trading bots, invest in indices, and automate user portfolio management. The cryptocurrency robo-advisor software offers a customizable back-testing engine, revealing the most profitable index strategies and empowering customers to manage long-term investments effectively. The product also aims to help beginner users diversify their portfolios across various digital assets while discovering the basics of crypto investments.

client

NDA Protected

USA

10-50 employees

A cryptocurrency platform tailored for immediate access to verified trading strategies and investment portfolios.

request background

A complex, highly functional crypto platform that is easy and safe for crypto beginners

The client required a comprehensive product with a low cryptocurrency knowledge threshold, allowing users to navigate the industry’s main assets easily. The platform was supposed to be an advanced crypto robo-advisor, helping crypto-beginners unleash the power of digital investments.

Our partner wanted the SaaS crypto product to help users explore the platform and engage in a risk assessment questionnaire, revealing a moderate risk tolerance. The platform subsequently proposes a well-diversified portfolio of trading strategies, particularly on established cryptocurrencies.

The investors using the crypto robo-advisor software had to be able to allocate their capital to recommended portfolios. Through several months of usage, the portfolio had to steadily grow, closely mirroring the investor's risk profile. That way, the platform has to allow for entrusting its management to experienced traders.

challenge

Cryptocurrency software development ensuring regulatory compliance and platform reliability.

The cryptocurrency SaaS product required following specific regulatory compliance for each evolving cryptocurrency. The main challenge centered on staying in line with changing regulations based on user location, cryptocurrency choice, and activity positions. Our task was to ensure the cohesive operation of different regulatory variables.

As a cryptocurrency development company, we were to provide stability and continuous uptime despite the critical nature of financial transactions. Since the target user of our client doesn’t have expertise in crypto operations, we had to implement user-friendly pricing models.

Acropolium also used transaction processing best practices to provide simple navigation within the platform.

goals

- Development of a strategic marketplace, allowing users to explore and instantly implement trading options.

- Employment of a questionnaire-based risk-profiling tool, determining users’ risk tolerance and matching their profiles with suitable portfolios and trading options.

- Enable diversification within the crypto robo-advisor software, allowing users to allocate their investments across various cryptocurrencies.

- Implementation of multi-factor authentication and cold storage for cryptocurrencies, providing robust security measures to protect users' assets and data.

solution

Smooth payment processing, strong security measures, and user-friendly navigation — all wrapped into one crypto solution

Node.JS, React.JS, Firebase, AWS ECS, Elasticache, RDS, CodePipeline, Terraform, AWS Lambda

24 months

6 specialists

Acropolium delivered a set of crypto development services, following sophisticated security practices to build a cryptocurrency platform. To accommodate a range of risk preferences, we developed a risk profiling tool for this crypto robo-advisor.

Maintaining high user satisfaction and retention rates is a priority for such cryptocurrency development solutions. With the client’s user in mind, we also took care of feedback and performance measuring sections. Aiming for a low churn rate and positive user satisfaction scores, we added surveys and feedback measurables.

The platform offers instant access to trusted trading strategies and investment portfolios, simplifying the investment process. At the same time, the product focuses on diversification and risk management, catering to a broad spectrum of investors. As a result, the product serves as a practical solution for those looking to enter the crypto market without significant expertise.

- Acropolium integrated diversification as the main feature, where users could distribute their investments across various trading strategies. That way, we enabled the crypto robo-advisor users to reduce exposure to individual assets.

- For informed decision-making, our developers provided comprehensive performance metrics for each trading strategy and portfolio. The metrics include historical returns, risk assessments, and other pertinent data.

- The client’s main requirement was to ensure the platform's consistent performance. Thus, our team provided various scalable scenarios to swiftly resolve technical issues, minimizing downtimes.